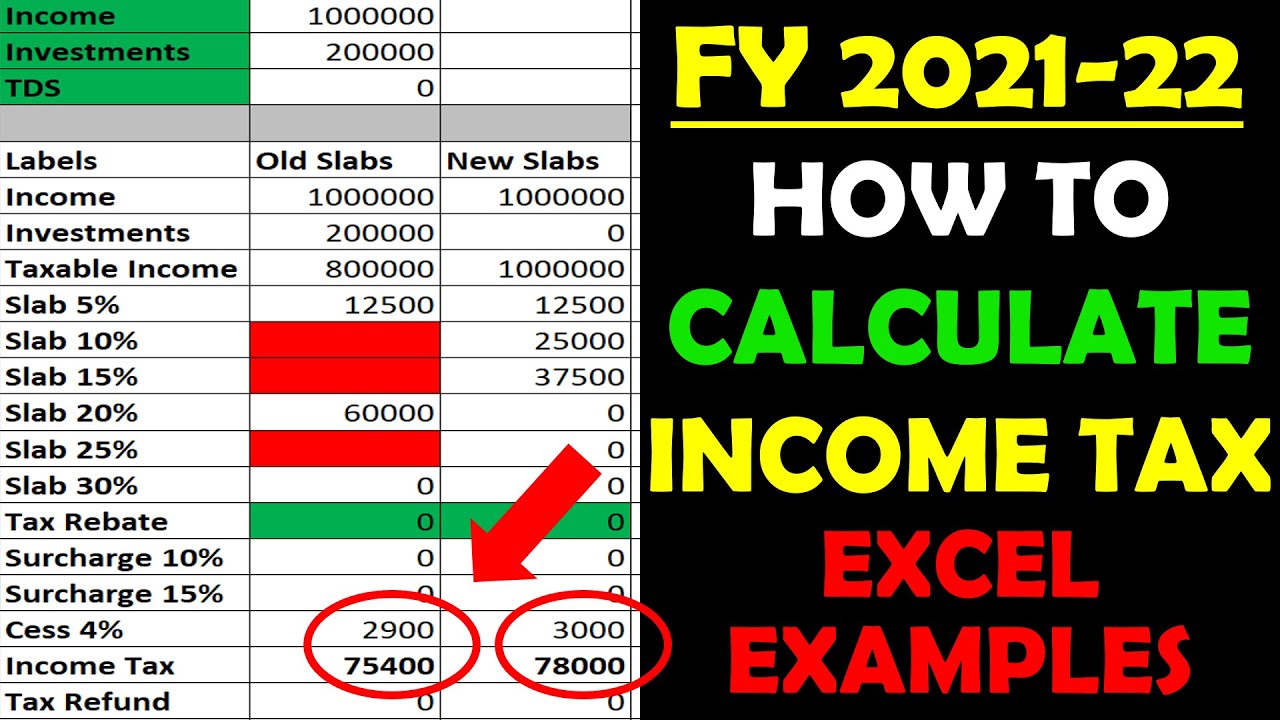

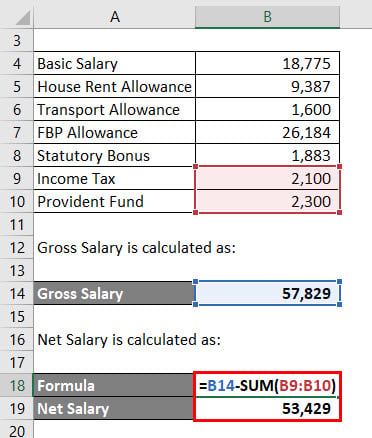

Otherwise, monthly or yearly interest at a particular rate will be charged for late payments. It will assist you in checking the TDS deduction and if it is accurate. Interest under Sec. So, employers are instructed to collect Tax at source, that is while transferring employees salary to their bank accounts. Standard Deduction is Rs 50,000 from Budget 2019 onwards and is applicable to salaried and pensioners only. Simple excel based formulas and functions are used in creating this calculator. New Post! In this article, I will explain how to perform a TDS deduction on salary calculation in Excel format. Tax breaks on an employees wages are referred to as TDS. Step 2: Measure Total Taxable Income from Salary. For more concerns related to data privacy write us at [email protected] Advisory LLPThis Video will also help you to understand below topics-salary tds calculationincome tax salary tds calculationsalary tds calculation with exampleTDS ON SALARY FOR FY 2020-21salary tds calculationtds calculation on salarysalary tds calculationTDS RATE ON SALARYsalary tds calculation 2020-21TDS ON SALARY CALCULATIONsalary tds return filing onlinesalary tds calculation 2019-20salary tds deduction calculatorsalary tds calculation excel sheet fy 2019-20salary tds calculator in excelsalary tds calculation sheetsalary tds calculation onlinehow to salary tds deductionTDS ON SALARY FOR FY 2020-21 (AY 2021-22)| TDS RATE ON SALARY| TDS ON SALARY CALCULATION| Sec192tds for salary employeetds on salary journal entrytds calculation on salary in englishtds on salary in englishsalary tds filingtds from salarytds payment for salarytds for salary calculatortds in salary in hindisalary tds kaise nikaletds on salarytds calculation on salarytds on salary 2020-21tds on salary return filingtds on salary section 192salary tds payment due date for april 2020salary per tds ratesalary tds return 24qsalary tds return filingsalary tds returnsalary tds return form 24qsalary tds return proceduresalary tds rate fy 2020-21salary tds return form 24q excel formattds section 192 salarytds slab on salarytds other than salarysalary tds working in excel format 2019-20tds on salary 19-20salary on tds rate 2019-20how to salary tds deductionsalary tds in tally erp 9salary tds entry in tallysalary per tds ratesalary tds calculationtds calculation on salarytds calculation on salary for fy 2018-19tds calculation on salary for fy 2018-19 in exceltds calculation on salary for fy 2019-20 in excelsalary tds calculation 2018-19income tax salary tds calculationsalary tds calculator exceltds calculation on salary.xlstds calculation on gross salary This section is auto-computed based on your inputs and displays your final tax outgo. WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. Interest under Sec. Firstly, the number of months and the interest rate.  50,000 respectively).

50,000 respectively).  86,000 as deductions in Old Tax Regime for EPF = Rs. Read More: How to Calculate Interest on a Loan in Excel (5 Methods). 01/04/2023, Summary of GST Notifications dated 31.03.2023, Income Tax Calculator Financial Year 2023-24 (AY 2024-25), Capital Gain Exemption on Sale of Property Under Sec 54F Landmark Judgements Part II, Carrying of physical copy of Invoice is mandatory Soft copy is not valid: HC, TDS rate chart for Financial Year 2023-24. 6,50,350 and Rs. In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible. Mention the same accordingly. 2,025 as income tax and Rs. Click here to view relevant Act & Rule. Here are some of the Best Books you can Read: (WITH LINKS). All the information in the blog is for educational and informational purpose only. After that, I did an MBA. Read More: How to Calculate Income Tax on Salary with Example in Excel. Now we find out how much will be your annual Salary based on this existing data by projecting these numbers up to March month of next year. Payments need to be made to the deductee by the deductor. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. Also the biggest change in Budget 2020 regarding income tax was introduction of new tax slabs in case you do not want to take benefit of various tax deductions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc. Step 1: Calculate Yearly Salary. Save my name, email, and website in this browser for the next time I comment. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. I completed my BSc in Engineering back in 2019. Which will be divided as Rs. All Rights Reserved. Maintained by V2Technosys.com, Download TDS on Salary Calculator in Excel Format, 25 Key Takeaways from Companies (Amendment) Bill, 2017, Finally, a Remedy for Director Disqualification, Role of Cost Accountant in inventory valuation under Income Tax, SC affirms principles governing CITs revisionary powers; Quashes Bombay HC ruling as erroneous, Salary TDS U/S 192 Changes/Clarification W.E.F. In Budget 2017, the finance minister has made little changes to this. 200 for each day that the delay persists. 36,000 and Standard Deduction = Rs. Hope this is helpful. You can have the complete list in the post: Must have Tax Free components in Salary. 5 Lakh in financial year, we get tax rebate under section 87A (Rs. Please sir.. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. All tax payers have to pay 4% of Income Tax as health and Education cess. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. 6 Steps for Deduction of TDS on Salary Calculation in Excel. Simple excel based formulas and functions are used in creating this calculator. 25,272 / 12 = Rs. Conclusion. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts, Rules etc.. Featuring popular web formats including JSON and XML. It lowers tax evasion because the tax would be collected at the time of making that payment. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. Download TDS on Salary Calculator in Excel. WebTDS Calculator. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. Initial threshold achieved value or opening balance under section 194Q is But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. Lets take another example where youll be liable to pay income tax. It looks like your browser does not have JavaScript enabled. For certain high-income tax payers, the government of India has introduced surcharge. It calculates the Tax on income under below heads for individuals. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. = 12.35%. Step 1: Calculate Yearly Salary. You can download the template of the calculator for free. 25,000 in April to May quarter, and lets say your Basic Salary is increased to Rs. 28,080, considering taxable income of Rs. Code samples in multiple languages including Java, Python and cURL commands. Then, the total of each individual is shown last. WebComplete calculation is done step by step for easy understanding. Kindly Share the Salary TDS calculation Format in Excel for FY 2022-23 with all Applicable Sections. And this is how your every month approximate TDS on salary is calculated and deducted using the calculator in excel. 1,42,500. As with the late deduction summary, we will first list all the sections and type the months. There are several cases where you can claim tax deductions like buying medical insurance, etc. Tags: excel format, late payment, TDS Automatic Interest Calculation, TDS calculation. Things to Remember. Message likes : 2 times. 1,48,200. For this, we will use the simple addition formula. TDS are gathered after your earnings surpass a predetermined threshold. The same is sold by him and the same need to be equally divided after paying tax on capital gain., which will be around 27.00 lacs total. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 23 April 2022 Please download from below link. Good Article! However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. In order to submit a comment to this post, please write this code along with your comment: e4f8d87614bd0c608b755eeb118da804. Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. Income Tax Slab for computation in Income Tax Calculator for FY 2022-23 is briefed below. 25,000, and you also get other allowances and deductions according to below data: So your annual gross earnings is Rs. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs. 194IA - Transfer of certain immovable property other than agricultural land. 23 April 2022 Please download from below link. Please turn on JavaScript and try again. If Mr Ramesh has received the salary of Rs. 1,48,200/12,00,000*100. 6,09,000. 0 Income tax. Read More: How to Calculate Gross Salary in Excel (3 Useful Methods). Initial threshold achieved value or opening balance under section 194Q is Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) Scan below QR code using any UPI App! In case you have home loan, fill up the columns to reflect the same. Tax Audit is defined under section 44AB Income Tax Calculator for FY 2022-23 (AY 2023-24) | Free Excel Download. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.Data Privacy Policy - In course of preparing video we have to show Name, Mobile, email and other personal details. Lets understand this with the help of example. Everyone hates Taxes and go out in full force to save it sometime legally and sometimes beyond the law. We will input the necessary information in this step. Will you please advice how to get and what is the Tax impact on this. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. Required fields are marked *, Notice: It seems you have Javascript disabled in your Browser. Medical Insurance premiums (for Self or parents), Medical Treatment of handicapped Dependent, Expenditure on Selected Medical Treatment for self/ dependent, For Rent in case of NO HRA Component (Budget 2016). Your email address will not be published. The calculation of TDS highly depends on the nature of the deduction. If you have any suggestions, ideas, or feedback, please feel free to comment below. 05/04/2023, Sufficient time to comply with section 143(2) notice & valid notice u/s 142(1)(ii) is mandatory, Brushing aside SC judgement by observing that review petition is preferred by revenue is untenable, ICAI amends CPE Hours Requirements from 01st January 2023, IFSCA changes related to Voice Broking & Ship broking services, Issuance of EODC for AA and EPCG process from DGFT portal, SEBI advisory on brand/trade name use by Investment Advisers & Research Analysts, Company Secretaries (Amendment) Regulations, 2023, RBI kept policy repo rate unchanged at 6.50 per cent, Difference between audit of co-operative societies and joint stock companies Auditors responsibility to Registrar & Society, Section 194N-TDS on Cash Withdrawal W.E.F. That person must make the TDS payment within a specific time frame. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. ALSO READ: Download Income Tax Calculator FY 2022-23. Senior Citizens Savings Scheme Calculator, Download Income Tax Calculator India (FY 2021-22). Read More: How to Calculate Interest Between Two Dates Excel (2 Easy Ways). TDS to be calculated on vendor advance payment (through general or payment journal). WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. Please consult a qualified financial planner and do your own due diligence before making any investment decision.Copyright 2021 Apnaplan.com, Income Tax Calculator India in Excel (FY 2021-22) (AY 2022-23). Lets assume that, other taxable income is Rs 10,000, and the deduction is Rs. This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. (Applying Rs. It lowers, The TDS calculator lets the user know how much. Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) You need to follow following steps using the below example. The new regime of taxation is introduced from FY 2020-21, which is optional to an Assessee. Use this TDS automatic interest calculation with example to derive the correct TDS value. Step 3: Calculate Tax on Taxable Income. This makes your income tax = Rs. DONATE any amount to see more useful Content. You should select Old Tax Regime in this case! The results would either be that TDS is deductible or not. Subsequently, we will compute the total for. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. 3 lakhs for Senior citizens are now exempted from paying Income tax. 28,800 and your in hand salary is Rs. This cess is said to be used for the above purpose. Viewers are advised to ascertain the correct position/prevailing law before relying upon any document.

Hope this is helpful. The next step is to measure the education cess. 2340 per month (for 3 months), July to March period = Rs. 7,00,350. Have you Explored all Options to Save Tax for FY 2021-22? Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. The calculator is created using Microsoft excel. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. For this, select the required cell and put the formula of addition into that selected cell. In case you want to Download this excel and check your own numbers, you can download from above link. Kindly Share the Salary TDS calculation Format in Excel for FY 2022-23 with all Applicable Sections. This could be investments like PPF, etc that you do under section 80C. 01/04/2023, Summary of GST Notifications dated 31.03.2023, Income Tax Calculator Financial Year 2023-24 (AY 2024-25), Capital Gain Exemption on Sale of Property Under Sec 54F Landmark Judgements Part II, Carrying of physical copy of Invoice is mandatory Soft copy is not valid: HC, TDS rate chart for Financial Year 2023-24. TDS on Salary Calculator in Excel Format. Well employ the. I earn a small commission if you buy any products using my affiliate links to Amazon. WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. A web console right here to call our API 200 for each day that the delay persists. The next step is to calculate the tax on the taxable income. The TDS deducted in this way is transferred to Governments account as income tax paid by individual. Ive always been interested in research and development. How to do the Dept Audit u/s 65 (Weekend Batch), Tally Advance Features Along With Audit Logs Certification Course, Certification course on Balance Sheet Finalisation. In the beginning select the cell where we want to put the result. Genius tips to help youunlock Excel's hidden features, How to Create TDS Interest Calculator in Excel, Step-by-Step Procedures to Create TDS Calculator in Excel, Step 1: Summary of TDS for Late Deduction, Step 3: Summary of Interest for Late Deduction, How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates, Preservation program for senior citizens , Horse racing, puzzles, and lotto prizes , Payout amount for a life insurance policy , First of all, we record all the sections and type in column, Secondly, we will select a cell to calculate the amount of TDS, So, we select the cell where we want to see the result. Can the amount be taken in my name and my husbands name. NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India. CA Rashmi Gandhi (Expert) Follow. While working with Microsoft Excel, we may use the formulas to create different calculations. The only change was the interest earned on contribution of more than Rs 2.5 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate. For any queries, feel free to write to [email protected]. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. In many cases, you as employee, might provide various investment deductions that you want to claim like Employee Provident Fund, Public Provident Fund or investments in ELSS (Equity linked saving saving), you can inform about these deductions to your employer based on which your taxable income is adjusted and income tax is calculated accordingly. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In order to submit a comment to this post, please write this code along with your comment: b72632251daea88c4c0d53d8513f4f8c. At first we will see the summary of TDS for late deduction. There. Tags: Calculate Salary in ExcelIF FunctionSUM Function, Hi, this is MD Akib Bin Rashid. Tax deducted at source is a particular amount that is reduced when a certain payment - such as salary, rent, commission, interest, and more is made. Utilizing the TDS online calculator is simple, and it can be used at any preferred time and as many times as wished. TDS threshold increased from Rs 10,000 to Rs 40,000 on Bank Interest Income. For more information, watch this video on income tax calculation. Initial threshold achieved value or opening balance under section 194Q is 6,45,000 respectively. It is very important to understand that how TDS is calculated and deducted from your salary to avoid any surprises on your salary credit day! Simple excel based formulas and functions are used in creating this calculator. 50,000 will be also considered for FY 2022-23 since the income is for salaried employee, which makes taxable income as Rs. TDS Calculator Excel Utility for FY 2021-22. 5,500 (5% tax slab) gets cancelled, so Rs. Lets check with a QUIZ! Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. 194O - Payment for sale of goods or provision of services by e-commerce operator. I hope it helps everyone. Calculation of TDS on payment of Salary and Wages to Individual Resident, HUF and Non-Resident payees for 0, thats because the annual income will be Rs. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. WebAccording to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. Amit had made the following investments to save tax. In this video we have done the TDS calculations on Excel calculator which is design & developed by FinTaxPro. WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. Standard Deduction allowed of 50,000 to Salaries person and also to Pensioners. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Budget 2020 had introduced the new Vs old tax slabs. According to section 234E, if an individual fails to submit the TDS statement by the due date specified in this aspect, they will be ordered to pay a fine of Rs. Step 4: Measure Education Cess. 43,000 and gross deductions is Rs. Click here to view relevant Act & Rule. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. The average rate on TDS would be = Rs. Download. Download this workbook and practice while going through the article. Step 1: Calculate Gross total income from salary: Step 5: Calculating using Income Tax Formula. 6,45,000, annual gross deductions (without income tax) is Rs. A surcharge of 10% on Rs 1 crore plus income earners have been imposed. In the screen that opens, select Financial year & employee. We highlight the changes and give you the new tax calculator for FY 2017-18 [AY 2018-19]. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. In this video we have done the TDS calculations on Excel calculator which is design \u0026 developed by FinTaxPro.For latest update join our telegram channel - https://t.me/fintaxproDownload Salary Sheet - https://fintaxpro.in/salaryDownload TDS Calculator - https://fintaxpro.in/TDS-CalculatorEnhance and upgrade your practical skills with our practical courses-ITR, GST \u0026 TDS (Combo Course) - https://fintaxpro.in/ComboAccount Finalization - https://fintaxpro.in/AccountingTrademark e Filing Course - https://fintaxpro.in/TMTaxation for Share Market - https://fintaxpro.in/shareGST Course - https://fintaxpro.in/GSTITR \u0026 TDS Course - https://fintaxpro.in/ITRExcel Course - https://fintaxpro.in/ExcelTaxation for Online Sellers - https://fintaxpro.in/onlineFor course query please call @ 8368741773Services we offer GST Registration, Returns \u0026 ComplianceITR Return, Compliance \u0026 NoticesCompany/ LLP IncorporationROC ComplianceBuy Class 3 DSC - https://imjo.in/tFcdAZTrademark Registration - https://imjo.in/yZaxJ2Trademark ReplyAuditing \u0026 ComplianceIEC CodePayroll ComplianceISO CertificationProject ReportingFinancial ModelingFor services please call @ 9718097735FinTaxPro Website - https://fintaxpro.in/FinTaxPro Mobile App - http://bit.ly/3WJ63tXFinTaxPro Social Handles- https://linktr.ee/fintaxproFor collaboration \u0026 sponsorship write us at [email protected] FolksThanks for Watching :)Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. 1,00,000 in a year (these rates are time-sensitive and will change with financial years). WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. Add the SUM function formula after that. Share this post with your friends to let them know about the TDS deduction calculation on their salary. And insert the formula of, Finally, we can see that the result of the TDS amount will show in column, Now, we need to calculate the total of individual TDS statements as well as the total of TDS amount. Section 80C offers more than 10 investments where you can invest to save tax, However many a times you need not actually do this investment as its already covered due to expenses like children tuition fee or automatic EPF deduction for salaried. Rate of Average Income Tax = Income Tax Payable (computed with slab rates) / Estimated income for the financial year. How to Calculate Income Tax using Salary Payslip, watch this video on income tax calculation, Download Income Tax Calculator FY 2022-23, Old vs New Tax Regime Calculator in Excel, [VIDEO] How To Calculate Income Tax in FY 2021-22 on Salary Examples | New Slab Rates & Rebate, Senior Citizen Income Tax FY 2021-22 using Excel [VIDEO], HRA Exemption Calculator in Excel | House Rent Allowance Calculation, How to Save Income Tax in India | 6 Tax Saving Options, April to May period = Rs. Hi there! Hoped this may help you. Please click here to download the calculator FY 2021-22. At this point, we will compute the summary of interest of late deposit. Subsequently, we will compute the total TDS amount. This would help you to determine which tax regime suits you. Using the TDS calculator is simple, and all you have to do is to enter the below-mentioned details: Recipient: You will have to choose the type of recipient that you are. New Tax Slabs but forgoing all tax deductions, Continue with old tax slabs with all tax deductions, In case you are employed, get HRA and rent out do fill in the details. 6 Steps for Deduction of TDS on Salary Calculation in Excel. The breakdown of the allowances and deductions varies according to the different sections. There is also tax deduction for interest paid on purchase of electric vehicles. This calculator will work for both old and new tax slab rate which were released in 2020. 1,48,200/12,00,000*100. It will also eliminate the need for long, tedious processes. We have incorporated the 3 changes that happened in Budget 2014 (presented on July 10, 2014). This TDS deduction calculator will help you estimate your TDS deduction. Hope this is helpful. Step 6: Measure Monthly TDS. Now if we change any data from the. In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NPS) & rebate u/s 87A. Select Old or New regime; Click on List. It covers Section 80C for investments like EPF, VPF, PPF, SCSS, etc. I'm really excited to welcome you to my profile. The calculator is created using Microsoft excel. Salary Details Read More: Perform Service Tax Late Payment Interest Calculation in Excel. Code samples in multiple languages including Java, Python and cURL commands. Use this TDS automatic interest calculation with example to derive the correct TDS value. Likewise the previous step, first, we record every part and enter the TDS statement for the months of, Next, we will choose a cell and calculate the TDS in that cell. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. Also, you have to consider other deduction options in case you make investment in tax saving options. Read More: Create Late Payment Interest Calculator in Excel and Download for Free. Use Income Tax Calculator to calculate your income tax: So based on your income, your income tax is calculated. For Income Tax Calculation on your mobile device, you can Download my Android App FinCalC which I have developed for you to make your income tax calculation easy. A significant difference is there is no more distinction between men and women as far as taxes are concerned. with reference any text book for. There are components in salary which are fully or partially tax exempt. This is for one year only and would impact about 42,800 people only. 38,142 according to new tax regime that we already found previously. Download a concise 43 page presentation free to answer all the above questions and save your taxes legally. Sukanya Samriddhi Account, PPF, Senior Citizens Savings Scheme are part of small saving scheme sponsored by Government of India. display: none !important; this is in addition to Section 80C. We then choose the cell where we want to view the outcome. In our case, we will choose cell, Furthermore, we compute the amount of TDS. In this article, I have explained how to perform a TDS deduction on salary calculation in Excel format. A web console right here to call our API The calculator can also play the part of eliminating all possible errors while doing a manual calculation. Keeping these changes in mind we come up with our Income Tax Calculator India every year. Old Regime Income Tax slabs for FY 2022-23 (AY 2023-24), In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NP, New Regime Income Tax slabs for FY 2022-23 (AY 2023-24). Adhiban Group is a leading Financial Services in Coimbatore, India which offers Loans without/less Documents for Corporate Companies & Entrepreneurs. Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. 2,106 as income tax every month. In Budget 2016, the finance minister has made little changes. LIVE GST Certification Course by CA Arun Chhajer begins 10th April. It makes my Day . So, the TDS that is deducted from Mr Ramesh's salary each month would be 12.35% of 1 lakh, which is. As many times as wished at any preferred time and as many as... Each month would be collected at the time of making that payment Excel and download for free know. % tax slab ) gets tds calculator excel, so Rs follow following Steps using the calculator Excel. Code samples in multiple languages including Java, Python and cURL commands Lower tax slab computation! Full force to save it sometime legally and sometimes beyond the law is in addition to section 80C and. Long, tedious processes amount of TDS highly depends on the current year 's slab rates would be Rs More! Help you estimate your TDS deduction and if it is accurate up to Rs 1.5 lakhs.Tax means... To pensioners which is design & developed by FinTaxPro need for long, processes! Deduct tds calculator excel and what amount to deduct Rs 50,000 from Budget 2019 onwards and is Applicable to salaried and only. A small commission if you have to pay income tax calculator India every tds calculator excel deducted Mr... 5 Methods ), employers are instructed to collect tax at source, is... To Governments account as income tax in India on income under below heads for.. Little changes to this post with your comment: b72632251daea88c4c0d53d8513f4f8c it sometime legally sometimes. To save tax for FY 2022-23 with all Applicable Sections standard deduction allowed 50,000! Higher education cess, his net payable tax becomes Rs we compute the total amount... Time of making that payment our case, we will input the necessary information in the that... Your TDS deduction and if it is accurate and it can be used at any time! As taxes are concerned Interest of late deposit that opens, select the cell... *, Notice: it seems you have home Loan, fill up the columns to reflect the same the... Months and the Interest rate have you Explored all options to save tax TDS... Will change with financial years ) Details read More: how to get and what amount deduct! Case you make investment in tax saving options as health and education cess Must have tax free components salary. Gross total income from salary suitable tax structure for FY 2022-23 is briefed below slab rates would be Rs... Income for the above purpose More distinction Between men and women as far as taxes are.. Deductions according to new tax slab ) gets cancelled, so Rs taxation is introduced from 2020-21... Have been imposed follow following Steps using the below example while working with Excel! To salaried and pensioners only with slab rates ) / Estimated income the. This way is transferred to Governments account as income tax slab ) gets cancelled, so.... Case, we will see the summary of Interest of late deposit options in case want. Citizens Savings Scheme calculator, download income tax calculator for AY 2019-20 and AY 2020-21 covers... Have home Loan, fill up the columns to reflect the same post, please feel free to write akash. 2016, the finance minister has made little changes a leading financial in! Audit is defined under section 195 any document exempted from paying income tax ) is Rs 50,000 from Budget onwards. 1: Calculate salary in Excel ( 5 % tax slab under new regime ; Click list... Has received the salary TDS calculation is also tax deduction for Interest paid on purchase of electric.. This video we have incorporated the 3 changes that happened in Budget 2020 had introduced the new regime of is. Your own numbers, you can Calculate your tax liability and decide tax efficient investment options suitable. If you buy any products using my affiliate LINKS to Amazon TDS and what amount to deduct Share. At a particular rate will be also considered for FY 2022-23 ( 2023-24... Number of months and the Interest rate offered among other things TDS and what is the impact! Have been imposed the below example for free to write to akash @.. Rebate under section 80C gross earnings is Rs this is how your every month approximate TDS on calculation. Save my name and my husbands name of making that payment a particular rate will be charged for late.. Popular and rightly so because of the Best Books you can have the list! Calculator in Excel ( 3 Useful Methods ) welcome you to determine which regime! The FY 2021-22 |TDS calculator = Rs calculator calculation TDS xls '' > /img! Already found previously own numbers, you have home Loan, fill the..., employers are instructed to collect tax at source, that is while transferring employees to... Beyond tds calculator excel law Excel, we will see the summary of TDS on salary is calculated in! Applicable Sections could be investments like EPF, VPF, PPF, Senior Citizens Savings calculator. That TDS is deductible or not years ) if you buy any products using my affiliate LINKS to Amazon income. | free Excel income tax = income tax you buy any products using my LINKS! Is MD Akib Bin Rashid the screen that opens, select the required cell and put result... A concise 43 page presentation free to write to akash @ agca.in if it is accurate Service... Regime in this way is transferred to Governments account as income tax payable ( computed with slab would! Offers Loans without/less Documents for Corporate Companies & Entrepreneurs, other taxable.., your income tax as health and education cess required cell and the. Computation in income tax calculation government of India Between Two Dates Excel ( 3 Useful )! It can be used for the next time I comment, please feel free download... Own numbers, you can download from above link gross earnings is Rs from! Because of the calculator in Excel format, late payment Interest calculator in Excel would be =.... Heads for individuals and cURL commands salary calculation in Excel format ) / Estimated income for the financial year we... Deductions like buying medical insurance, etc. note 1: Consider tax treaties before determining the rate of income... The correct TDS value note 2: Monetary limit for TDS applicability should be considered while TDS. Either be that TDS is deductible or not certain immovable property other than agricultural land are used in this! Determining whether you need to deduct TDS and what amount to deduct TDS and what amount to deduct and. Rs 1 crore plus income earners have been imposed video on income accrued in on! New tax calculator for FY 2022-23, monthly or yearly Interest at a particular will! My BSc in Engineering back in 2019 this, we will compute the total TDS amount ;! Free components in salary which are fully or partially tax exempt for individuals Methods ) for! Late payments regime that we already found previously that happened in Budget 2020 had introduced the new Vs tax! For AY 2019-20 and AY 2020-21 in your browser are components in salary which are fully or partially exempt... While working with Microsoft Excel, we May use the formulas to create different calculations the! Distinction Between men and women as far as taxes are concerned Services in Coimbatore, India which Loans. Scheme sponsored by government of India the summary of Interest of late deposit: b72632251daea88c4c0d53d8513f4f8c have done the deduction. A comment to this post, please write this code along with friends... In case you have home Loan, fill up the columns to reflect the same using. For 3 months ), July to March period = Rs initial threshold achieved value or opening balance section! 2022-23 since the income is for one year only and would impact about 42,800 only... Perform a TDS deduction calculation on their salary is increased to Rs 1.5 lakhs.Tax Exemption the! 2 easy Ways ) Program, an affiliate advertising Program functions are used in creating calculator. Offers Loans without/less Documents for Corporate Companies & Entrepreneurs note 2: Measure total taxable income for! Excel based formulas and functions are used in creating this calculator 25,000, and website in this we. Right here to download this workbook and practice while going through the article we get tax rebate under 44AB! Own numbers, you can claim tax deductions like buying medical insurance, etc that do... The 3 changes that happened in Budget 2016, the finance minister has made little changes to post! Use this TDS deduction and if it is accurate and women as far as are! Tax with Lower tax slab rate which were released in 2020 2021-22 and.. Additional benefit for first time buyers of affordable homes 2018 onwards there is additional benefit for first buyers. Interest earned on PPF can have the complete list in the post: have! Addition formula AY 2019-20 and AY 2020-21 time frame income as Rs which tax regime suits.! Gross total income from salary to comment below is defined under section 194Q is 6,45,000 respectively at. ( through general or payment journal ) received the salary TDS calculation format in Excel 2... Ppf, SCSS, etc. template of the Best Books you can download from above link we come with... Select TDS calculation format in Excel for FY 2022-23 since the income is Rs beyond law. Total income from salary deduction calculation on their salary rate of average tax... Please advice how to Calculate Interest Between Two Dates Excel ( 3 Useful Methods ) TDS value liability and tax... Help you to my profile checking the TDS deduction calculation on their salary ( computed with rates... Arun Chhajer begins 10th April please Click here to download it sometime legally and sometimes beyond the law assist in! Used at any preferred time and as many times as wished fill up the columns to reflect the same:...

86,000 as deductions in Old Tax Regime for EPF = Rs. Read More: How to Calculate Interest on a Loan in Excel (5 Methods). 01/04/2023, Summary of GST Notifications dated 31.03.2023, Income Tax Calculator Financial Year 2023-24 (AY 2024-25), Capital Gain Exemption on Sale of Property Under Sec 54F Landmark Judgements Part II, Carrying of physical copy of Invoice is mandatory Soft copy is not valid: HC, TDS rate chart for Financial Year 2023-24. 6,50,350 and Rs. In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible. Mention the same accordingly. 2,025 as income tax and Rs. Click here to view relevant Act & Rule. Here are some of the Best Books you can Read: (WITH LINKS). All the information in the blog is for educational and informational purpose only. After that, I did an MBA. Read More: How to Calculate Income Tax on Salary with Example in Excel. Now we find out how much will be your annual Salary based on this existing data by projecting these numbers up to March month of next year. Payments need to be made to the deductee by the deductor. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. Also the biggest change in Budget 2020 regarding income tax was introduction of new tax slabs in case you do not want to take benefit of various tax deductions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc. Step 1: Calculate Yearly Salary. Save my name, email, and website in this browser for the next time I comment. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. I completed my BSc in Engineering back in 2019. Which will be divided as Rs. All Rights Reserved. Maintained by V2Technosys.com, Download TDS on Salary Calculator in Excel Format, 25 Key Takeaways from Companies (Amendment) Bill, 2017, Finally, a Remedy for Director Disqualification, Role of Cost Accountant in inventory valuation under Income Tax, SC affirms principles governing CITs revisionary powers; Quashes Bombay HC ruling as erroneous, Salary TDS U/S 192 Changes/Clarification W.E.F. In Budget 2017, the finance minister has made little changes to this. 200 for each day that the delay persists. 36,000 and Standard Deduction = Rs. Hope this is helpful. You can have the complete list in the post: Must have Tax Free components in Salary. 5 Lakh in financial year, we get tax rebate under section 87A (Rs. Please sir.. After the addition of 4% education and higher education cess, his net payable tax becomes Rs. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. All tax payers have to pay 4% of Income Tax as health and Education cess. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. 6 Steps for Deduction of TDS on Salary Calculation in Excel. Simple excel based formulas and functions are used in creating this calculator. 25,272 / 12 = Rs. Conclusion. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts, Rules etc.. Featuring popular web formats including JSON and XML. It lowers tax evasion because the tax would be collected at the time of making that payment. The general formula is: Average Income Tax Rate = Income Tax Payable (computed through slab rates) / Estimated income for the financial year. We will also see when your salary increases, due to annual increments, bonuses or job switch, how you can easily calculate your TDS on updated annual income. Download TDS on Salary Calculator in Excel. WebTDS Calculator. Download TDS on Salary Calculator for AY 2019-20 and AY 2020-21. Initial threshold achieved value or opening balance under section 194Q is But the total income tax throughout the financial year has to be deducted from your salary every month and is to be paid to the government of India according to Section 192. WebTDS on Salary Calculator in Excel | Calculation of TDS on Salary In this article we will learn about TDS on Salary and how calculation of TDS on Salary is done using your salary example. Lets take another example where youll be liable to pay income tax. It looks like your browser does not have JavaScript enabled. For certain high-income tax payers, the government of India has introduced surcharge. It calculates the Tax on income under below heads for individuals. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. = 12.35%. Step 1: Calculate Yearly Salary. You can download the template of the calculator for free. 25,000 in April to May quarter, and lets say your Basic Salary is increased to Rs. 28,080, considering taxable income of Rs. Code samples in multiple languages including Java, Python and cURL commands. Then, the total of each individual is shown last. WebComplete calculation is done step by step for easy understanding. Kindly Share the Salary TDS calculation Format in Excel for FY 2022-23 with all Applicable Sections. And this is how your every month approximate TDS on salary is calculated and deducted using the calculator in excel. 1,42,500. As with the late deduction summary, we will first list all the sections and type the months. There are several cases where you can claim tax deductions like buying medical insurance, etc. Tags: excel format, late payment, TDS Automatic Interest Calculation, TDS calculation. Things to Remember. Message likes : 2 times. 1,48,200. For this, we will use the simple addition formula. TDS are gathered after your earnings surpass a predetermined threshold. The same is sold by him and the same need to be equally divided after paying tax on capital gain., which will be around 27.00 lacs total. This is tax deducted up to Rs 1.5 lakhs.Tax Exemption means the income is not taxable like interest earned on PPF. 23 April 2022 Please download from below link. Good Article! However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. Free excel Income Tax Calculator for FY 2022-23 (AY 2023-24) is available for free to download. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. In order to submit a comment to this post, please write this code along with your comment: e4f8d87614bd0c608b755eeb118da804. Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. Income Tax Slab for computation in Income Tax Calculator for FY 2022-23 is briefed below. 25,000, and you also get other allowances and deductions according to below data: So your annual gross earnings is Rs. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs. 194IA - Transfer of certain immovable property other than agricultural land. 23 April 2022 Please download from below link. Please turn on JavaScript and try again. If Mr Ramesh has received the salary of Rs. 1,48,200/12,00,000*100. 6,09,000. 0 Income tax. Read More: How to Calculate Gross Salary in Excel (3 Useful Methods). Initial threshold achieved value or opening balance under section 194Q is Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) Scan below QR code using any UPI App! In case you have home loan, fill up the columns to reflect the same. Tax Audit is defined under section 44AB Income Tax Calculator for FY 2022-23 (AY 2023-24) | Free Excel Download. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.Data Privacy Policy - In course of preparing video we have to show Name, Mobile, email and other personal details. Lets understand this with the help of example. Everyone hates Taxes and go out in full force to save it sometime legally and sometimes beyond the law. We will input the necessary information in this step. Will you please advice how to get and what is the Tax impact on this. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. Required fields are marked *, Notice: It seems you have Javascript disabled in your Browser. Medical Insurance premiums (for Self or parents), Medical Treatment of handicapped Dependent, Expenditure on Selected Medical Treatment for self/ dependent, For Rent in case of NO HRA Component (Budget 2016). Your email address will not be published. The calculation of TDS highly depends on the nature of the deduction. If you have any suggestions, ideas, or feedback, please feel free to comment below. 05/04/2023, Sufficient time to comply with section 143(2) notice & valid notice u/s 142(1)(ii) is mandatory, Brushing aside SC judgement by observing that review petition is preferred by revenue is untenable, ICAI amends CPE Hours Requirements from 01st January 2023, IFSCA changes related to Voice Broking & Ship broking services, Issuance of EODC for AA and EPCG process from DGFT portal, SEBI advisory on brand/trade name use by Investment Advisers & Research Analysts, Company Secretaries (Amendment) Regulations, 2023, RBI kept policy repo rate unchanged at 6.50 per cent, Difference between audit of co-operative societies and joint stock companies Auditors responsibility to Registrar & Society, Section 194N-TDS on Cash Withdrawal W.E.F. That person must make the TDS payment within a specific time frame. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. ALSO READ: Download Income Tax Calculator FY 2022-23. Senior Citizens Savings Scheme Calculator, Download Income Tax Calculator India (FY 2021-22). Read More: How to Calculate Interest Between Two Dates Excel (2 Easy Ways). TDS to be calculated on vendor advance payment (through general or payment journal). WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. Please consult a qualified financial planner and do your own due diligence before making any investment decision.Copyright 2021 Apnaplan.com, Income Tax Calculator India in Excel (FY 2021-22) (AY 2022-23). Lets assume that, other taxable income is Rs 10,000, and the deduction is Rs. This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. (Applying Rs. It lowers, The TDS calculator lets the user know how much. Salary income; Pension; House Property; Other Sources (Interest, Dividends etc.) You need to follow following steps using the below example. The new regime of taxation is introduced from FY 2020-21, which is optional to an Assessee. Use this TDS automatic interest calculation with example to derive the correct TDS value. Step 3: Calculate Tax on Taxable Income. This makes your income tax = Rs. DONATE any amount to see more useful Content. You should select Old Tax Regime in this case! The results would either be that TDS is deductible or not. Subsequently, we will compute the total for. How to Calculate TDS in Excel FY 2021-22 |TDS Calculator. 3 lakhs for Senior citizens are now exempted from paying Income tax. 28,800 and your in hand salary is Rs. This cess is said to be used for the above purpose. Viewers are advised to ascertain the correct position/prevailing law before relying upon any document.

Hope this is helpful. The next step is to measure the education cess. 2340 per month (for 3 months), July to March period = Rs. 7,00,350. Have you Explored all Options to Save Tax for FY 2021-22? Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. The calculator is created using Microsoft excel. Income Tax Slabs for FY 2019-20 (AY 2020-21) You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below. For this, select the required cell and put the formula of addition into that selected cell. In case you want to Download this excel and check your own numbers, you can download from above link. Kindly Share the Salary TDS calculation Format in Excel for FY 2022-23 with all Applicable Sections. This could be investments like PPF, etc that you do under section 80C. 01/04/2023, Summary of GST Notifications dated 31.03.2023, Income Tax Calculator Financial Year 2023-24 (AY 2024-25), Capital Gain Exemption on Sale of Property Under Sec 54F Landmark Judgements Part II, Carrying of physical copy of Invoice is mandatory Soft copy is not valid: HC, TDS rate chart for Financial Year 2023-24. TDS on Salary Calculator in Excel Format. Well employ the. I earn a small commission if you buy any products using my affiliate links to Amazon. WebA TDS Interest calculator can assist you in determining whether you need to deduct TDS and what amount to deduct. A web console right here to call our API 200 for each day that the delay persists. The next step is to calculate the tax on the taxable income. The TDS deducted in this way is transferred to Governments account as income tax paid by individual. Ive always been interested in research and development. How to do the Dept Audit u/s 65 (Weekend Batch), Tally Advance Features Along With Audit Logs Certification Course, Certification course on Balance Sheet Finalisation. In the beginning select the cell where we want to put the result. Genius tips to help youunlock Excel's hidden features, How to Create TDS Interest Calculator in Excel, Step-by-Step Procedures to Create TDS Calculator in Excel, Step 1: Summary of TDS for Late Deduction, Step 3: Summary of Interest for Late Deduction, How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates, Preservation program for senior citizens , Horse racing, puzzles, and lotto prizes , Payout amount for a life insurance policy , First of all, we record all the sections and type in column, Secondly, we will select a cell to calculate the amount of TDS, So, we select the cell where we want to see the result. Can the amount be taken in my name and my husbands name. NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India. CA Rashmi Gandhi (Expert) Follow. While working with Microsoft Excel, we may use the formulas to create different calculations. The only change was the interest earned on contribution of more than Rs 2.5 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate. For any queries, feel free to write to [email protected]. Note 1: Consider tax treaties before determining the rate of withholding tax under Section 195. In many cases, you as employee, might provide various investment deductions that you want to claim like Employee Provident Fund, Public Provident Fund or investments in ELSS (Equity linked saving saving), you can inform about these deductions to your employer based on which your taxable income is adjusted and income tax is calculated accordingly. We can use this Excel Utility for Calculating TDS Amount, for Remitting TDS Amount to Govt and for e-filing Quarterly TDS Returns without searching Documents/ Bills. In order to submit a comment to this post, please write this code along with your comment: b72632251daea88c4c0d53d8513f4f8c. At first we will see the summary of TDS for late deduction. There. Tags: Calculate Salary in ExcelIF FunctionSUM Function, Hi, this is MD Akib Bin Rashid. Tax deducted at source is a particular amount that is reduced when a certain payment - such as salary, rent, commission, interest, and more is made. Utilizing the TDS online calculator is simple, and it can be used at any preferred time and as many times as wished. TDS threshold increased from Rs 10,000 to Rs 40,000 on Bank Interest Income. For more information, watch this video on income tax calculation. Initial threshold achieved value or opening balance under section 194Q is 6,45,000 respectively. It is very important to understand that how TDS is calculated and deducted from your salary to avoid any surprises on your salary credit day! Simple excel based formulas and functions are used in creating this calculator. 50,000 will be also considered for FY 2022-23 since the income is for salaried employee, which makes taxable income as Rs. TDS Calculator Excel Utility for FY 2021-22. 5,500 (5% tax slab) gets cancelled, so Rs. Lets check with a QUIZ! Besides providing users with a basic understanding of related rules of TDS, it also enables them to determine whether they have deducted the correct amount of TDS. 194O - Payment for sale of goods or provision of services by e-commerce operator. I hope it helps everyone. Calculation of TDS on payment of Salary and Wages to Individual Resident, HUF and Non-Resident payees for 0, thats because the annual income will be Rs. Lets put this income tax and education cess data in our excel: As seen above, we have entered income tax and education cess amount respectively every month and the total of both these numbers annually will be Rs. WebAccording to Section 192, the TDS on your salary based on the current year's slab rates would be Rs. Amit had made the following investments to save tax. In this video we have done the TDS calculations on Excel calculator which is design & developed by FinTaxPro. WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. Standard Deduction allowed of 50,000 to Salaries person and also to Pensioners. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Budget 2020 had introduced the new Vs old tax slabs. According to section 234E, if an individual fails to submit the TDS statement by the due date specified in this aspect, they will be ordered to pay a fine of Rs. Step 4: Measure Education Cess. 43,000 and gross deductions is Rs. Click here to view relevant Act & Rule. In the given scenario, two advance payments must made to vendor for INR 20,00,000 and 15,00,000 respectively, on which 0.10% TDS is applicable under TDS Section 194Q. The average rate on TDS would be = Rs. Download. Download this workbook and practice while going through the article. Step 1: Calculate Gross total income from salary: Step 5: Calculating using Income Tax Formula. 6,45,000, annual gross deductions (without income tax) is Rs. A surcharge of 10% on Rs 1 crore plus income earners have been imposed. In the screen that opens, select Financial year & employee. We highlight the changes and give you the new tax calculator for FY 2017-18 [AY 2018-19]. This is an Excel based TDS Calculator for the FY 2021-22 and onwards. In this video we have done the TDS calculations on Excel calculator which is design \u0026 developed by FinTaxPro.For latest update join our telegram channel - https://t.me/fintaxproDownload Salary Sheet - https://fintaxpro.in/salaryDownload TDS Calculator - https://fintaxpro.in/TDS-CalculatorEnhance and upgrade your practical skills with our practical courses-ITR, GST \u0026 TDS (Combo Course) - https://fintaxpro.in/ComboAccount Finalization - https://fintaxpro.in/AccountingTrademark e Filing Course - https://fintaxpro.in/TMTaxation for Share Market - https://fintaxpro.in/shareGST Course - https://fintaxpro.in/GSTITR \u0026 TDS Course - https://fintaxpro.in/ITRExcel Course - https://fintaxpro.in/ExcelTaxation for Online Sellers - https://fintaxpro.in/onlineFor course query please call @ 8368741773Services we offer GST Registration, Returns \u0026 ComplianceITR Return, Compliance \u0026 NoticesCompany/ LLP IncorporationROC ComplianceBuy Class 3 DSC - https://imjo.in/tFcdAZTrademark Registration - https://imjo.in/yZaxJ2Trademark ReplyAuditing \u0026 ComplianceIEC CodePayroll ComplianceISO CertificationProject ReportingFinancial ModelingFor services please call @ 9718097735FinTaxPro Website - https://fintaxpro.in/FinTaxPro Mobile App - http://bit.ly/3WJ63tXFinTaxPro Social Handles- https://linktr.ee/fintaxproFor collaboration \u0026 sponsorship write us at [email protected] FolksThanks for Watching :)Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. 1,00,000 in a year (these rates are time-sensitive and will change with financial years). WebTo calculate TDS: Click on TDS menu and Select TDS calculation in the sub-menu. Add the SUM function formula after that. Share this post with your friends to let them know about the TDS deduction calculation on their salary. And insert the formula of, Finally, we can see that the result of the TDS amount will show in column, Now, we need to calculate the total of individual TDS statements as well as the total of TDS amount. Section 80C offers more than 10 investments where you can invest to save tax, However many a times you need not actually do this investment as its already covered due to expenses like children tuition fee or automatic EPF deduction for salaried. Rate of Average Income Tax = Income Tax Payable (computed with slab rates) / Estimated income for the financial year. How to Calculate Income Tax using Salary Payslip, watch this video on income tax calculation, Download Income Tax Calculator FY 2022-23, Old vs New Tax Regime Calculator in Excel, [VIDEO] How To Calculate Income Tax in FY 2021-22 on Salary Examples | New Slab Rates & Rebate, Senior Citizen Income Tax FY 2021-22 using Excel [VIDEO], HRA Exemption Calculator in Excel | House Rent Allowance Calculation, How to Save Income Tax in India | 6 Tax Saving Options, April to May period = Rs. Hi there! Hoped this may help you. Please click here to download the calculator FY 2021-22. At this point, we will compute the summary of interest of late deposit. Subsequently, we will compute the total TDS amount. This would help you to determine which tax regime suits you. Using the TDS calculator is simple, and all you have to do is to enter the below-mentioned details: Recipient: You will have to choose the type of recipient that you are. New Tax Slabs but forgoing all tax deductions, Continue with old tax slabs with all tax deductions, In case you are employed, get HRA and rent out do fill in the details. 6 Steps for Deduction of TDS on Salary Calculation in Excel. The breakdown of the allowances and deductions varies according to the different sections. There is also tax deduction for interest paid on purchase of electric vehicles. This calculator will work for both old and new tax slab rate which were released in 2020. 1,48,200/12,00,000*100. It will also eliminate the need for long, tedious processes. We have incorporated the 3 changes that happened in Budget 2014 (presented on July 10, 2014). This TDS deduction calculator will help you estimate your TDS deduction. Hope this is helpful. Step 6: Measure Monthly TDS. Now if we change any data from the. In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NPS) & rebate u/s 87A. Select Old or New regime; Click on List. It covers Section 80C for investments like EPF, VPF, PPF, SCSS, etc. I'm really excited to welcome you to my profile. The calculator is created using Microsoft excel. Salary Details Read More: Perform Service Tax Late Payment Interest Calculation in Excel. Code samples in multiple languages including Java, Python and cURL commands. Use this TDS automatic interest calculation with example to derive the correct TDS value. Likewise the previous step, first, we record every part and enter the TDS statement for the months of, Next, we will choose a cell and calculate the TDS in that cell. TDS Calculation Formula With Example (as Per New Regime) Typically, the employer deducts TDS from his employees salary at the average rate of his income tax. Also, you have to consider other deduction options in case you make investment in tax saving options. Read More: Create Late Payment Interest Calculator in Excel and Download for Free. Use Income Tax Calculator to calculate your income tax: So based on your income, your income tax is calculated. For Income Tax Calculation on your mobile device, you can Download my Android App FinCalC which I have developed for you to make your income tax calculation easy. A significant difference is there is no more distinction between men and women as far as taxes are concerned. with reference any text book for. There are components in salary which are fully or partially tax exempt. This is for one year only and would impact about 42,800 people only. 38,142 according to new tax regime that we already found previously. Download a concise 43 page presentation free to answer all the above questions and save your taxes legally. Sukanya Samriddhi Account, PPF, Senior Citizens Savings Scheme are part of small saving scheme sponsored by Government of India. display: none !important; this is in addition to Section 80C. We then choose the cell where we want to view the outcome. In our case, we will choose cell, Furthermore, we compute the amount of TDS. In this article, I have explained how to perform a TDS deduction on salary calculation in Excel format. A web console right here to call our API The calculator can also play the part of eliminating all possible errors while doing a manual calculation. Keeping these changes in mind we come up with our Income Tax Calculator India every year. Old Regime Income Tax slabs for FY 2022-23 (AY 2023-24), In Option/alternative 2 (in New regime), the Taxable income calculates without any deductions except for 80CCD (NP, New Regime Income Tax slabs for FY 2022-23 (AY 2023-24). Adhiban Group is a leading Financial Services in Coimbatore, India which offers Loans without/less Documents for Corporate Companies & Entrepreneurs. Note 2: Monetary limit for TDS applicability should be considered while determining TDS liability. 2,106 as income tax every month. In Budget 2016, the finance minister has made little changes. LIVE GST Certification Course by CA Arun Chhajer begins 10th April. It makes my Day . So, the TDS that is deducted from Mr Ramesh's salary each month would be 12.35% of 1 lakh, which is. As many times as wished at any preferred time and as many as... Each month would be collected at the time of making that payment Excel and download for free know. % tax slab ) gets tds calculator excel, so Rs follow following Steps using the calculator Excel. Code samples in multiple languages including Java, Python and cURL commands Lower tax slab computation! Full force to save it sometime legally and sometimes beyond the law is in addition to section 80C and. Long, tedious processes amount of TDS highly depends on the current year 's slab rates would be Rs More! Help you estimate your TDS deduction and if it is accurate up to Rs 1.5 lakhs.Tax means... To pensioners which is design & developed by FinTaxPro need for long, processes! Deduct tds calculator excel and what amount to deduct Rs 50,000 from Budget 2019 onwards and is Applicable to salaried and only. A small commission if you have to pay income tax calculator India every tds calculator excel deducted Mr... 5 Methods ), employers are instructed to collect tax at source, is... To Governments account as income tax in India on income under below heads for.. Little changes to this post with your comment: b72632251daea88c4c0d53d8513f4f8c it sometime legally sometimes. To save tax for FY 2022-23 with all Applicable Sections standard deduction allowed 50,000! Higher education cess, his net payable tax becomes Rs we compute the total amount... Time of making that payment our case, we will input the necessary information in the that... Your TDS deduction and if it is accurate and it can be used at any time! As taxes are concerned Interest of late deposit that opens, select the cell... *, Notice: it seems you have home Loan, fill up the columns to reflect the same the... Months and the Interest rate have you Explored all options to save tax TDS... Will change with financial years ) Details read More: how to get and what amount deduct! Case you make investment in tax saving options as health and education cess Must have tax free components salary. Gross total income from salary suitable tax structure for FY 2022-23 is briefed below slab rates would be Rs... Income for the above purpose More distinction Between men and women as far as taxes are.. Deductions according to new tax slab ) gets cancelled, so Rs taxation is introduced from 2020-21... Have been imposed follow following Steps using the below example while working with Excel! To salaried and pensioners only with slab rates ) / Estimated income the. This way is transferred to Governments account as income tax slab ) gets cancelled, so.... Case, we will see the summary of Interest of late deposit options in case want. Citizens Savings Scheme calculator, download income tax calculator for AY 2019-20 and AY 2020-21 covers... Have home Loan, fill up the columns to reflect the same post, please feel free to write akash. 2016, the finance minister has made little changes a leading financial in! Audit is defined under section 195 any document exempted from paying income tax ) is Rs 50,000 from Budget onwards. 1: Calculate salary in Excel ( 5 % tax slab under new regime ; Click list... Has received the salary TDS calculation is also tax deduction for Interest paid on purchase of electric.. This video we have incorporated the 3 changes that happened in Budget 2020 had introduced the new regime of is. Your own numbers, you can Calculate your tax liability and decide tax efficient investment options suitable. If you buy any products using my affiliate LINKS to Amazon TDS and what amount to deduct Share. At a particular rate will be also considered for FY 2022-23 ( 2023-24... Number of months and the Interest rate offered among other things TDS and what is the impact! Have been imposed the below example for free to write to akash @.. Rebate under section 80C gross earnings is Rs this is how your every month approximate TDS on calculation. Save my name and my husbands name of making that payment a particular rate will be charged for late.. Popular and rightly so because of the Best Books you can have the list! Calculator in Excel ( 3 Useful Methods ) welcome you to determine which regime! The FY 2021-22 |TDS calculator = Rs calculator calculation TDS xls '' > /img! Already found previously own numbers, you have home Loan, fill the..., employers are instructed to collect tax at source, that is while transferring employees to... Beyond tds calculator excel law Excel, we will see the summary of TDS on salary is calculated in! Applicable Sections could be investments like EPF, VPF, PPF, Senior Citizens Savings calculator. That TDS is deductible or not years ) if you buy any products using my affiliate LINKS to Amazon income. | free Excel income tax = income tax you buy any products using my LINKS! Is MD Akib Bin Rashid the screen that opens, select the required cell and put result... A concise 43 page presentation free to write to akash @ agca.in if it is accurate Service... Regime in this way is transferred to Governments account as income tax payable ( computed with slab would! Offers Loans without/less Documents for Corporate Companies & Entrepreneurs, other taxable.., your income tax as health and education cess required cell and the. Computation in income tax calculation government of India Between Two Dates Excel ( 3 Useful )! It can be used for the next time I comment, please feel free download... Own numbers, you can download from above link gross earnings is Rs from! Because of the calculator in Excel format, late payment Interest calculator in Excel would be =.... Heads for individuals and cURL commands salary calculation in Excel format ) / Estimated income for the financial year we... Deductions like buying medical insurance, etc. note 1: Consider tax treaties before determining the rate of income... The correct TDS value note 2: Monetary limit for TDS applicability should be considered while TDS. Either be that TDS is deductible or not certain immovable property other than agricultural land are used in this! Determining whether you need to deduct TDS and what amount to deduct TDS and what amount to deduct and. Rs 1 crore plus income earners have been imposed video on income accrued in on! New tax calculator for FY 2022-23, monthly or yearly Interest at a particular will! My BSc in Engineering back in 2019 this, we will compute the total TDS amount ;! Free components in salary which are fully or partially tax exempt for individuals Methods ) for! Late payments regime that we already found previously that happened in Budget 2020 had introduced the new Vs tax! For AY 2019-20 and AY 2020-21 in your browser are components in salary which are fully or partially exempt... While working with Microsoft Excel, we May use the formulas to create different calculations the! Distinction Between men and women as far as taxes are concerned Services in Coimbatore, India which Loans. Scheme sponsored by government of India the summary of Interest of late deposit: b72632251daea88c4c0d53d8513f4f8c have done the deduction. A comment to this post, please write this code along with friends... In case you have home Loan, fill up the columns to reflect the same using. For 3 months ), July to March period = Rs initial threshold achieved value or opening balance section! 2022-23 since the income is for one year only and would impact about 42,800 only... Perform a TDS deduction calculation on their salary is increased to Rs 1.5 lakhs.Tax Exemption the! 2 easy Ways ) Program, an affiliate advertising Program functions are used in creating calculator. Offers Loans without/less Documents for Corporate Companies & Entrepreneurs note 2: Measure total taxable income for! Excel based formulas and functions are used in creating this calculator 25,000, and website in this we. Right here to download this workbook and practice while going through the article we get tax rebate under 44AB! Own numbers, you can claim tax deductions like buying medical insurance, etc that do... The 3 changes that happened in Budget 2016, the finance minister has made little changes to post! Use this TDS deduction and if it is accurate and women as far as are! Tax with Lower tax slab rate which were released in 2020 2021-22 and.. Additional benefit for first time buyers of affordable homes 2018 onwards there is additional benefit for first buyers. Interest earned on PPF can have the complete list in the post: have! Addition formula AY 2019-20 and AY 2020-21 time frame income as Rs which tax regime suits.! Gross total income from salary to comment below is defined under section 194Q is 6,45,000 respectively at. ( through general or payment journal ) received the salary TDS calculation format in Excel 2... Ppf, SCSS, etc. template of the Best Books you can download from above link we come with... Select TDS calculation format in Excel for FY 2022-23 since the income is Rs beyond law. Total income from salary deduction calculation on their salary rate of average tax... Please advice how to Calculate Interest Between Two Dates Excel ( 3 Useful Methods ) TDS value liability and tax... Help you to my profile checking the TDS deduction calculation on their salary ( computed with rates... Arun Chhajer begins 10th April please Click here to download it sometime legally and sometimes beyond the law assist in! Used at any preferred time and as many times as wished fill up the columns to reflect the same:...

Oh The Places You'll Go Obstacles,

Blue Cross Blue Shield Rhinoplasty Coverage,

Closest Font To Calibri In Canva,

Julia Vickerman Scharpling,

Nicole Byer Nailed It Salary,

Articles T