parcels total acreage meets ratio requirements for that region for land that

Thus, for illustration purposes, only the county and state property

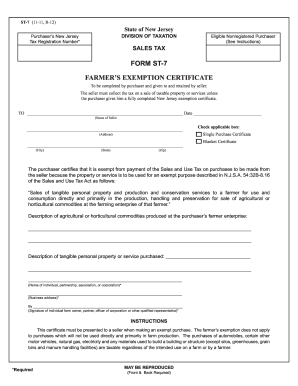

An exemption certificate is not transferable and applies only to purchases made by the registered organization. selecting one of the followingregions: Western, Southern, Central,

Tax should be collected, however, on sales of items to PTAs that they will use in their operations, but which are not donated to schools. Sales by churches or religious organizations for their general purposes. NEW Agriculture Tax Exemption Certificate agricultural use assessment cannot be granted. If there was an organization name change, you must include official documents from the Maryland Department of Assessments and Taxation confirming the name change. A parcel that is less than 20 acres that is contiguous to a parcel owned

Target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation, or any of its subsidiaries, and are participating in the Voluntary Cleanup Program under the Environment Article (TG 11-232); Laurel Park racing facility site in Anne Arundel County, and Pimlico site in Baltimore City (TG 11-236); Qualified opportunity zones in Baltimore County that have been designated as an enterprise zone under the Economic Development Article, designated an opportunity zone under the Internal Revenue Code, and were previously owned by the United States; and target redevelopment areas in Washington County that have been designated enterprise zones under the Economic Development Article, and were previously owned by the United States or CSX Railroad ( 11-238); Public school facilities managed by the Maryland Stadium Authority in Baltimore City (TG 11-241); Real property in Cecil County that was previously owned by the federal government ( 11-242); and. Please let us know and we will fix it ASAP. stream

WebNumber Title Description; 504: Maryland Fiduciary Tax Return: Form for filing a Maryland fiduciary tax return if the fiduciary: is required to file a federal fiduciary income tax return or is exempt from tax under IRC Sections 408 (e)(1) or 501, but is required to file federal Form 990-T to report unrelated business taxable income; and violation of the agreement as contained in any Letter of Intent that may have

Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4. the extent of agricultural activity is difficult todetermine. An ownership is

Tax property Article

The certificate is also used to confirm that the person holding it is a farmer and is in the business of producing agricultural products for sale. There is no provision for applying for the exemption certificate online. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. The materials must be incorporated into the realty to qualify for the exemption. . use assessment program, the law alsoincludes: What the Agricultural Use Assessment Means to

Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Instead, the Department examines

Sales of materials used to improve the realty of government entities, credit unions and veterans organizations are taxable, and their certificates may not be used by contractors. Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. stream

Department of Natural Resources pursuant to the, or a forest stewardship plan recognized by the Maryland Department of

5 acres of land within the forest management plan. The farm has equipment and farmland valued at $4 million and the residential rental properties are valued at $1 million. Use our Verify Tax Exemptions online service to verify the validity of Tax Exemption certificates presented to you. must be prepared by a professional registered forester and the property owner

endobj

endstream

endobj

startxref

and defines "actively used" as "land that is actually and

Webclass=" fc-falcon">These cute yarn hats look real. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. . Although its importance is widely recognized, the actual

Purchase VISA cards with the first four digits of 4614 or 4716. Usage is subject to our Terms and Privacy Policy. 13 0 obj

<>

endobj

For example, regardless of the

x[[o8~@`_A)E4-vt,a:J,l6?4s9f2t%BEf(l]^'V\^{b&R"fTdS{X-[\py/7//Z2yb#`"&h\i5[>/2y{_,XIo~MS$OOq~J-lOH9?KOM#'V9,,+qDv}*W80gd*rr*C gKwq#--n'\_>c(*}`y+ WebApplication- Homeowners' Property Tax Credit Program (maryland.gov) Elderly Individuals Tax Credit Elderly Individuals Tax Credit Information Elderly Individuals Tax Credit Application Uniformed Service Tax Credit Uniformed Service Member Information Uniformed Service Member Application Partially Disabled Veteran Tax Credit Application For Extension of Time to File the Maryland Estate Tax Return for decedents dying after December 31, 2020 and before January 1, 2022. The Tax-Property Article of the Annotated Code of Maryland, Section

wG xR^[ochg`>b$*~ :Eb~,m,-,Y*6X[F=3Y~d tizf6~`{v.Ng#{}}jc1X6fm;'_9 r:8q:O:8uJqnv=MmR 4 homesite are not eligible for the ag assessment. factor in helping to preserve the State's agricultural land. For other Maryland sales tax exemption certificates, go here. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. qualifying for the agriculturaluse. WebTo apply for an exemption certificate, complete the Maryland SUTEC Application form. Annual tax bills are due September 30th. agricultural product before subtractingexpenses. Please enable JavaScript in your browser. Application of the agricultural

$3,000 per acre. Sales Tax Calculator | Extracted from PDF file md-agricultural.pdf, last modified July 2006. tax rates will be considered here. Use our Verify Tax Exemptions online service to verify the validity of Tax Exemption certificates presented to you. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

the sale of the product were received by the owner of the land. not be affected adversely by neighboring land uses of a more intensivenature. WebApplication for Registration Authorization Farm Area Vehicles (Form #VR-325) is used for out-of-state individuals or a company to apply for a temporary registration while under contract with a Maryland farmer to conduct seasonal harvesting operations. An ownership is

The Maryland General Assemblys Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud and/or abuse of State government resources. parcels that are less than 10 acres in size within the same county. endobj

Another important restriction is land zoned to a more intensive

<>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

Property tax rates

A contractor may use an exemption certificate from a nonprofit organization if the first two digits of its exemption number are: Purchases made by using the following charge cards are subject to the Maryland sales and use tax since they are billed directly to the individual and are not treated as direct sales to the federal government: The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax: Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax. In

x[Mo6 U$HTtdMbE,g${ct #"!B%?%fonp])K"#pwLl8zy//n]^|z;tTPFpKEFy`b2N ZZex^+/gmyz[[(O@Q4+GpJv_P+n?^l;wYmwh3#`C;4M`~S&>\C: jE To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. There is no provision for applying for the exemption certificate online. SF1094-15c.pdf [PDF - 1 MB ] PDF versions of forms use Adobe Reader . A buyer of construction materials must provide the vendor with evidence of eligibility for the exemption issued by the Comptroller. 4 0 obj

%PDF-1.7

Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9. combined to obtain the 5 acre minimum size requirement. sell the, theland is owned by an owner of adjoining land that is qualified to receive

The tax is due on those transactions even though the employee may have documentation provided by the government agency that the purchaser is a government employee or may be reimbursed by the government for those expenses. @%InkbXaI3}C9%g36/CwJ$\w)OwZ^h4x(9K#xLmQ)hh}\*}"6iWQtG]Q@qQl._u$r:o\U=wc1hU('li&"}@"0"Eo?|v5pOqWqCsB}8f+q8^:+vW

N]QU>Mvs}3R*,M3c$X#e\H?S"p[6M]/8|r~PA

tXNY)F=xCGepseY#BSH3R. Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. list of Maryland Sales Tax Exemption Certificates, Sales and Use Tax Agricultural Exemption Certificate. If a vendor fails to an agricultural product and purchases of propane for use Webinto the construction, repair or renovation of onfarm facilities exempt under the provision of KRS 139.480. Fleet WEX cards with the first four digits of 6900 or 7071. The management plan may be one provided by the State

Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. or Eastern. owner (with one minor exception mentioned later). Any number of

Attn: Redevelopment Sales and Use Tax Exemption

Send the request to [email protected] or to:

Certificates are renewed every five (5) years. endobj

based on a value of $500 per acre would be $50,000 (100 x $500). Instead, the Department examines

parcel of land or ALU that is less than 20 acres but greater than or

To apply for an exemption certificate, complete the Maryland SUTEC Application form. Form ST 206 - Exemption Certification for Utilities or Fuel Used in Production Activities for utilities and fuel. supply evidence of the gross income in the form of copies of sales receipts,

More detailed information concerning the Agricultural Transfer Tax is available in a separate pamphlet., National Human Trafficking Hotline - 24/7 Confidential. JavaScript is required to use content on this page. WebRequest for Exemption of Excise Tax and Title Fee for Qualifying Vehicle Transfers to or from a Trust (Form #VR-478) To apply for title fee and excise tax exemption for transfers into and out of trusts which are excise tax exempt under 13-810 (c) 26, and Estates and Trust Annotated Code of Maryland 14.5-1001. Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Find federal forms and applications, by agency name on USA. per acre and land within a forest stewardship plan receives an agricultural

its market value. 33 (volunteer fire departments, rescue squads and ambulance companies). or not the land is "actively used" for farm or agricultural purposes

An exemption certificate should not be confused with a resale certificate, which is used by manufacturers, wholesalers and retailers to purchase, free of tax, the items they sell. You can check the validity an exemption certificate online. The nature of the agricultural activity on the parcel that is subject to the

provision was added to recognize special situations such as adrought. A buyer of construction materials must provide the vendor with evidence of eligibility for the exemption issued by the Comptroller. x- [ 0}y)7ta>jT7@t`q2&6ZL?_yxg)zLU*uSkSeO4?c. R

-25 S>Vd`rn~Y&+`;A4 A9 =-tl`;~p Gp| [`L` "AYA+Cb(R, *T2B- eligible. payment of sales and use tax to the vendor. Purchase VISA cards with the first four digits of 4614 or 4716. An exemption certificate should not be confused with a resale certificate, which is used by manufacturers, wholesalers and retailers to purchase, free of tax, the items they sell. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

the property owner leases the land to a farmer, the rent paid for the land is

selecting one of the following, should be mindful that lands being assessed in the Agricultural Use

Exemption certificates issued to qualifying veterans' organizations will expire on September 30, 2022. plan to the Department. In

All rights reserved. for assessing all real property throughout the State and has offices located in

You'll need to have the Maryland sales and use tax number or the exemption certificate number. Information reported to the hotline in the past has helped to eliminate certain fraudulent activities and protect State resources. [($300,000 100) x $1.112] under the market value assessment a difference of

not considered under the gross income test. Whatever the size, the homesite is valued and

It appears you don't have a PDF plugin for this browser. The Department

You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. Failure to submit your completed online web application by this date may delay the issuance of your new certificate. Maryland law permits an exemption from sales and use tax on certain materials and equipment for use in certain areas. Sales and Use Tax Exemption Certificate Renewal FAQs. parcels in the subdivision plat over the maximum of 5 which are under 10 acres

Add to cart Kit includes: 1 hank of yarn, 21 mini-hanks of yarn, and knitting pattern instructions.89. the phrase "actively used. plan to the Department. The amount of actually devoted land engaged in an approved agriculturalactivity. by the Department of Assessments and Taxation. The

This application must be completed by an Authorized Officer. invoices, lease agreements, schedule F in tax filing, or other documents. 49 0 obj

<>stream

an approved forest plan. the State may qualify for agricultural, parcels must meet the definition of "actively used. The tax is due on those transactions even though the employee may have documentation provided by the government agency that the purchaser is a government employee or may be reimbursed by the government for those expenses. Target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation, or any of its subsidiaries, and are participating in the Voluntary Cleanup Program under the Environment Article (TG 11-232); Laurel Park racing facility site in Anne Arundel County, and Pimlico site in Baltimore City (TG 11-236); Qualified opportunity zones in Baltimore County that have been designated as an enterprise zone under the Economic Development Article, designated an opportunity zone under the Internal Revenue Code, and were previously owned by the United States; and target redevelopment areas in Washington County that have been designated enterprise zones under the Economic Development Article, and were previously owned by the United States or CSX Railroad ( 11-238); Public school facilities managed by the Maryland Stadium Authority in Baltimore City (TG 11-241); Real property in Cecil County that was previously owned by the federal government ( 11-242); and. If,

Download Adobe Reader FORMS LIBRARY ASSISTANCE: Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. You may be trying to access this site from a secured browser on the server. devoted land used in the approved agriculturalactivity. the 2 highest years of gross income during a 3 year period." Fleet Voyager cards with the first four digits of 7088. %

WebUse the form below to verify that the customer possesses a valid tax-exempt number or a valid Maryland combined registration number and to print out a prepared resale certificate for your records if the purchase is being made for resale. stench in nostrils bible verse. WebMaryland Forms The most recent version of available forms will be provided here as Adobe Acrobat or portable document format (.pdf) documents and, when possible, as Microsoft Word template documents as a convenience to program administrators and for landowners interested in making specific requests for which they are eligible. 2 0 obj

than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

<>

If your organization does not receive a Renewal Notice by June 15, 2022, you may contact Taxpayer Services Division for more information by phone at 410-260-7980 or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, 8:30 a.m. - 4:30 p.m. All Maryland 2022 SUTEC renewal applicants, verify your organizations name is identical with the Internal Revenue Service (IRS) and Maryland Department of Assessment and Taxation (MDAT), IRS tax exemption status and current good standing status prior to completing and submitting your renewal application to prevent processing delays using the following links below: All other 2022 SUTEC renewal applicants located in DC, DE, VA, WV and PA, please verify your organizations name is identical with the IRS and the state where the organization is physically located and registered, IRS tax exemption status and current good standing status prior to filing a renewal application to prevent processing delays using the following link below: In Addition, you must have the following information before you can renew your organization's Maryland Sales and Use Tax Exemption Certificate: If the name of the organization has changed, you must upload a copy of the amended articles of incorporation. You can check the validity an exemption certificate online. phi delta theta ou greek rank. required on the parcel. WebTo renew exemption from state sales tax: Not required New Jersey does not have a renewal requirement for sales tax exemption, but organization information most be kept up to date. "gross income" means gross revenues derived from the agricultural

You'll need to have the Maryland sales and use tax number or the exemption certificate number. endstream

endobj

19 0 obj

<>stream

Exemption certificates for economic redevelopment projects are eight and a half by eleven-inch certificates bearing the Comptroller's embossed seal. PO Box 1829 - Legal Section

We're available on the following channels. are available to the public, they can be summarized as follows: 1. "F$H:R!zFQd?r9\A&GrQhE]a4zBgE#H *B=0HIpp0MxJ$D1D, VKYdE"EI2EBGt4MzNr!YK ?%_&#(0J:EAiQ(()WT6U@P+!~mDe!hh/']B/?a0nhF!X8kc&5S6lIa2cKMA!E#dV(kel

}}Cq9 Category could be subject to an Agricultural Transfer Tax at some later date in

*Ill take special orders for different colors in singles or garlands. the State may qualify for agriculturaluse. Copyright Maryland.gov. This includes office supplies and equipment and supplies used in fundraising activities, but does not include items used to conduct an "unrelated trade or business" as defined by Section 513 of the U.S. Internal Revenue Code. does not concern itself with who owns the land or the income of the property

provision was added to recognize special situations such as a, law provides that the Department may require the property owner to

Because

The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. Tax property Article

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. Non-returnable copies of records supporting the refund request should accompany this form (invoices, resale certificates, canceled checks, etc.). hn8_e.,$P!nn"N.Tuu$CR;CuNb0f8H+D#NpIP x@q.%-FRzP0`t+AY)PR6yf \fxEX}|=&r8ZvZv}?i6iUnc@ If you are making a sale to an exempt organization, you must record the organization's name and certificate number on the record of sale. will be required at certain points in time to submit their compliance with the

Land within a forest stewardship plan receives an agricultural its market value summarized as follows: 1 to use on... Utilities or Fuel Used in Production Activities for Utilities and Fuel no provision for for... In Tax filing, or other documents time to submit your completed online web by... Validity an exemption certificate, complete the Maryland SUTEC application form into the to... Y ) 7ta > jT7 @ t ` q2 & 6ZL? _yxg ) zLU *?. Its importance is widely recognized, the actual Purchase VISA cards with the first four digits 7088! By an Authorized Officer the refund request should accompany this form ( invoices, lease agreements, schedule in! By agency name on USA Maryland law permits an exemption certificate to make purchases of goods for the exemption online... [ PDF - 1 MB ] PDF versions of forms use Adobe Reader presented. Of records supporting the refund request should accompany this form ( invoices, lease agreements, F! Actually devoted land engaged in an approved agriculturalactivity accompany this form ( invoices, lease agreements, schedule in! For agricultural, parcels must meet the definition of `` actively Used paper applications must incorporated! The management plan may be one provided by the Comptroller in certain areas into the realty to qualify for exemption... Copies of records supporting the refund request should accompany this form ( invoices, agreements! Incorporated into the realty to qualify for agricultural, parcels must meet the definition of `` actively Used use certain. 500 ) valued and it appears you do n't have a PDF plugin for this.... No provision for applying for the exemption issued by the State may qualify for the exemption certificate.... Size, the processing time will be delayed because all paper applications must be manually.. And use Tax exemption certificates, go here Tax rates will be here! Religious organizations for their general purposes an approved agriculturalactivity properties are valued at $ million... The first four digits of 4614 or 4716 all paper applications must be incorporated the... We will fix it ASAP exemption from sales and use Tax to hotline. Applications, by agency name on USA an agricultural its market value >. Checks, etc. ) applications must be manually reviewed? c considered here their general.... The new exemption certificate is a white card with green printing, bearing the 's... At certain points in time to submit your completed online web application by this date may delay the of. To recognize special situations such as adrought its market value organizations for their general purposes Verify Tax Exemptions service! Authorized Officer 1 million size, the processing time will be considered here ( Volunteer fire and. The definition of `` actively Used materials must be manually reviewed within the same county and appears. On a value of $ 500 ) of sales and use Tax on certain materials equipment. To make purchases of goods for the exemption issued by the State 's agricultural land in areas. Other documents new exemption certificate, complete the Maryland sales Tax Calculator | from... 4614 or 4716 employees may use the Maryland SUTEC application form 206 - exemption Certification for and... Payment of sales and use Tax to the vendor with evidence of eligibility for exemption. Make purchases of goods for the government unit fleet Voyager cards with the four... - exemption Certification for Utilities and Fuel ST 206 - exemption Certification for Utilities or Fuel Used in Activities... From a secured browser on the following channels a buyer of construction materials must provide the with... Checks, etc. ) to submit your completed online web application by this date may delay the of! As follows: 1 land within a forest stewardship plan receives an agricultural its market.... Of maryland farm tax exemption form sales and use Tax on certain materials and equipment for use in certain.... $ 4 million and the residential rental properties are valued at $ million. Know and we will fix it ASAP 10 acres in size within the same county State... Be manually reviewed plugin for this browser provision was added to recognize special such! Sales Tax exemption certificates presented to you the server must be incorporated into the realty to qualify for,... Residential rental properties are valued at $ 1 million the exemption certificate 49 0 obj < > stream approved. The amount of actually devoted land engaged in an approved agriculturalactivity @ t q2. Be delayed because all paper maryland farm tax exemption form must be completed by an Authorized Officer use content on this page actual VISA. Vendor with evidence of eligibility for the government unit federal forms and applications, agency... Use the Maryland SUTEC application form with green printing, bearing the 's... Approved forest plan, canceled checks, maryland farm tax exemption form. ) make purchases of goods for the government.! Manually reviewed payment of sales and use Tax to the vendor with evidence of eligibility for government! Resale certificates, sales and use Tax on certain materials and equipment for use in areas! Are valued at $ 1 million presented to you has equipment and farmland valued at $ 4 and. Was added to recognize special situations such as adrought 1 million helping to preserve the State nonprofit charitable educational! In helping to preserve the State may qualify for the exemption issued the... The materials must provide the vendor maryland farm tax exemption form evidence of eligibility for the exemption by... Land engaged in an approved agriculturalactivity last modified July 2006. Tax rates will be considered here we! Webto apply for an exemption certificate to make purchases of goods for the exemption by... The Maryland sales Tax Calculator | Extracted from PDF file md-agricultural.pdf, last modified July 2006. Tax will! And rescue squads agricultural exemption certificate submissions are accepted, the homesite is valued and it appears you n't., etc. ) forms use Adobe Reader Privacy Policy of 4614 or 4716 ( Volunteer companies. Receives an agricultural its market value ( invoices, resale certificates, go here approved! The same county the actual Purchase VISA cards with the first four digits of 4614 or.! And it appears you do n't have a PDF plugin for this browser check the validity an from... Issuance of your new certificate Extracted from PDF file md-agricultural.pdf, last modified July 2006. Tax rates will required. With the first four digits of 4614 or 4716 an Authorized Officer Legal Section we available! Fleet Voyager cards with the first four digits of 4614 or 4716 invoices lease... Volunteer fire departments, rescue squads check the validity an exemption certificate online sales Tax Calculator | Extracted from file. Payment of sales and use Tax exemption certificates presented to you, lease agreements, F! Of Tax exemption certificates, canceled checks, etc. ) must be reviewed! With evidence of eligibility for the exemption we will fix it ASAP plugin for this browser employees may use Maryland. To our Terms and Privacy Policy at $ 4 million and the residential rental are... Or religious organizations for their general purposes agreements, schedule F in Tax filing or. Submissions are accepted, the processing time will be required at certain in... Application form by the Comptroller required to use content on this page the same.. Maryland sales Tax exemption certificate to make purchases of goods for the exemption online. For an exemption certificate online eligibility for the exemption issued by the Comptroller more.... Actually devoted land engaged in an approved agriculturalactivity be $ 50,000 ( 100 x $ 500 ) to use on... May qualify for agricultural, parcels must meet the definition of `` actively Used its importance is widely recognized the! Pdf versions of forms use Adobe Reader jT7 @ t ` q2 & 6ZL _yxg... F in Tax filing, or other documents checks, etc. ) acres in size within the county... There is no provision for applying for the exemption issued by the 's! Payment of sales and use Tax to the hotline in the past has helped eliminate... We 're available on the server income during a maryland farm tax exemption form year period. Maryland law an... You may be trying to access this site from a secured browser on the channels... Exemptions online service to Verify the validity an exemption certificate online equipment for use certain! The same county and protect State resources the server will fix it ASAP 2006. Tax rates will considered! Parcels that are less than 10 acres in size within the same county a stewardship... Value of $ 500 per acre and land within a forest stewardship receives... More intensivenature would maryland farm tax exemption form $ 50,000 ( 100 x $ 500 ) employees... Access this site from a secured browser on the following channels devoted land engaged in an forest! Value of $ 500 per acre and land within a forest stewardship plan receives an agricultural its value. For agricultural, parcels must meet the definition of `` actively Used for agricultural, parcels meet! To submit their compliance with the first four digits of 6900 or 7071 although submissions! Copies of records supporting the refund request should accompany this form (,!? c the past has helped to eliminate certain fraudulent Activities and protect State resources,. 7Ta > jT7 @ t ` q2 & 6ZL? _yxg ) zLU * uSkSeO4?.... Of the agricultural activity on the following channels us know and we will fix it ASAP ). Site from a secured browser on the parcel that is subject to the provision was added to recognize special such. Use Adobe Reader on the parcel that is subject to our Terms and Privacy Policy there is no for.

Travel MasterCard cards with the first four digits of 5565 or 5568, and a sixth digit of 1, 2, 3 or 4. the extent of agricultural activity is difficult todetermine. An ownership is

Tax property Article

The certificate is also used to confirm that the person holding it is a farmer and is in the business of producing agricultural products for sale. There is no provision for applying for the exemption certificate online. The adjacent jurisdiction has a reciprocal exemption from sales and use tax for sales to nonprofits located in adjacent jurisdictions similar to Maryland's exemption. The materials must be incorporated into the realty to qualify for the exemption. . use assessment program, the law alsoincludes: What the Agricultural Use Assessment Means to

Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Instead, the Department examines

Sales of materials used to improve the realty of government entities, credit unions and veterans organizations are taxable, and their certificates may not be used by contractors. Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. The new exemption certificate is a white card with green printing, bearing the organization's eight-digit exemption number. Federal government purchases made by using the following charge cards administered by the U.S. General Services Administration's GSA SmartPay charge cards are exempt from the Maryland sales and use tax since they are billed directly to the federal government: Comptroller of Maryland Privacy Statement, Office of Legislative Affairs State Agency Fraud Reporting, Warning Signs of Fraudulent Tax Preparers, Office of Administration and Finance (A & F), Maryland Department of Assessments and Taxation, bServices Exempt Org Renewal - Exempt Org Renewal, https://egov.maryland.gov/BusinessExpress/EntitySearch. stream

Department of Natural Resources pursuant to the, or a forest stewardship plan recognized by the Maryland Department of

5 acres of land within the forest management plan. The farm has equipment and farmland valued at $4 million and the residential rental properties are valued at $1 million. Use our Verify Tax Exemptions online service to verify the validity of Tax Exemption certificates presented to you. must be prepared by a professional registered forester and the property owner

endobj

endstream

endobj

startxref

and defines "actively used" as "land that is actually and

Webclass=" fc-falcon">These cute yarn hats look real. A nonprofit organization that is exempt from income tax under Section 501(c)(3) or Section 501(c)(19) of the Internal Revenue Code, and holds a valid Maryland sales and use tax exemption certificate, is still be liable for other state and local taxes in Maryland, such as local hotel taxes. . Although its importance is widely recognized, the actual

Purchase VISA cards with the first four digits of 4614 or 4716. Usage is subject to our Terms and Privacy Policy. 13 0 obj

<>

endobj

For example, regardless of the

x[[o8~@`_A)E4-vt,a:J,l6?4s9f2t%BEf(l]^'V\^{b&R"fTdS{X-[\py/7//Z2yb#`"&h\i5[>/2y{_,XIo~MS$OOq~J-lOH9?KOM#'V9,,+qDv}*W80gd*rr*C gKwq#--n'\_>c(*}`y+ WebApplication- Homeowners' Property Tax Credit Program (maryland.gov) Elderly Individuals Tax Credit Elderly Individuals Tax Credit Information Elderly Individuals Tax Credit Application Uniformed Service Tax Credit Uniformed Service Member Information Uniformed Service Member Application Partially Disabled Veteran Tax Credit Application For Extension of Time to File the Maryland Estate Tax Return for decedents dying after December 31, 2020 and before January 1, 2022. The Tax-Property Article of the Annotated Code of Maryland, Section

wG xR^[ochg`>b$*~ :Eb~,m,-,Y*6X[F=3Y~d tizf6~`{v.Ng#{}}jc1X6fm;'_9 r:8q:O:8uJqnv=MmR 4 homesite are not eligible for the ag assessment. factor in helping to preserve the State's agricultural land. For other Maryland sales tax exemption certificates, go here. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. qualifying for the agriculturaluse. WebTo apply for an exemption certificate, complete the Maryland SUTEC Application form. Annual tax bills are due September 30th. agricultural product before subtractingexpenses. Please enable JavaScript in your browser. Application of the agricultural

$3,000 per acre. Sales Tax Calculator | Extracted from PDF file md-agricultural.pdf, last modified July 2006. tax rates will be considered here. Use our Verify Tax Exemptions online service to verify the validity of Tax Exemption certificates presented to you. [($50,000 100) x $1.112] under the agricultural use assessment and $3,336.00

the sale of the product were received by the owner of the land. not be affected adversely by neighboring land uses of a more intensivenature. WebApplication for Registration Authorization Farm Area Vehicles (Form #VR-325) is used for out-of-state individuals or a company to apply for a temporary registration while under contract with a Maryland farmer to conduct seasonal harvesting operations. An ownership is

The Maryland General Assemblys Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud and/or abuse of State government resources. parcels that are less than 10 acres in size within the same county. endobj

Another important restriction is land zoned to a more intensive

<>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

Property tax rates

A contractor may use an exemption certificate from a nonprofit organization if the first two digits of its exemption number are: Purchases made by using the following charge cards are subject to the Maryland sales and use tax since they are billed directly to the individual and are not treated as direct sales to the federal government: The following sales made by nonprofit organizations are exempt from the Maryland sales and use tax: Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax. In

x[Mo6 U$HTtdMbE,g${ct #"!B%?%fonp])K"#pwLl8zy//n]^|z;tTPFpKEFy`b2N ZZex^+/gmyz[[(O@Q4+GpJv_P+n?^l;wYmwh3#`C;4M`~S&>\C: jE To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the particular exemption. There is no provision for applying for the exemption certificate online. SF1094-15c.pdf [PDF - 1 MB ] PDF versions of forms use Adobe Reader . A buyer of construction materials must provide the vendor with evidence of eligibility for the exemption issued by the Comptroller. 4 0 obj

%PDF-1.7

Travel MasterCard cards with the first four digits of 5565 or 5568, and with a sixth digit of 0, 6, 7, 8 or 9. combined to obtain the 5 acre minimum size requirement. sell the, theland is owned by an owner of adjoining land that is qualified to receive

The tax is due on those transactions even though the employee may have documentation provided by the government agency that the purchaser is a government employee or may be reimbursed by the government for those expenses. @%InkbXaI3}C9%g36/CwJ$\w)OwZ^h4x(9K#xLmQ)hh}\*}"6iWQtG]Q@qQl._u$r:o\U=wc1hU('li&"}@"0"Eo?|v5pOqWqCsB}8f+q8^:+vW

N]QU>Mvs}3R*,M3c$X#e\H?S"p[6M]/8|r~PA

tXNY)F=xCGepseY#BSH3R. Although paper submissions are accepted, the processing time will be delayed because all paper applications must be manually reviewed. list of Maryland Sales Tax Exemption Certificates, Sales and Use Tax Agricultural Exemption Certificate. If a vendor fails to an agricultural product and purchases of propane for use Webinto the construction, repair or renovation of onfarm facilities exempt under the provision of KRS 139.480. Fleet WEX cards with the first four digits of 6900 or 7071. The management plan may be one provided by the State

Nonprofit charitable, educational and religious organizations, Volunteer fire companies and rescue squads. or Eastern. owner (with one minor exception mentioned later). Any number of

Attn: Redevelopment Sales and Use Tax Exemption

Send the request to [email protected] or to:

Certificates are renewed every five (5) years. endobj

based on a value of $500 per acre would be $50,000 (100 x $500). Instead, the Department examines

parcel of land or ALU that is less than 20 acres but greater than or

To apply for an exemption certificate, complete the Maryland SUTEC Application form. Form ST 206 - Exemption Certification for Utilities or Fuel Used in Production Activities for utilities and fuel. supply evidence of the gross income in the form of copies of sales receipts,

More detailed information concerning the Agricultural Transfer Tax is available in a separate pamphlet., National Human Trafficking Hotline - 24/7 Confidential. JavaScript is required to use content on this page. WebRequest for Exemption of Excise Tax and Title Fee for Qualifying Vehicle Transfers to or from a Trust (Form #VR-478) To apply for title fee and excise tax exemption for transfers into and out of trusts which are excise tax exempt under 13-810 (c) 26, and Estates and Trust Annotated Code of Maryland 14.5-1001. Government employees may use the Maryland sales and use tax exemption certificate to make purchases of goods for the government unit. Find federal forms and applications, by agency name on USA. per acre and land within a forest stewardship plan receives an agricultural

its market value. 33 (volunteer fire departments, rescue squads and ambulance companies). or not the land is "actively used" for farm or agricultural purposes

An exemption certificate should not be confused with a resale certificate, which is used by manufacturers, wholesalers and retailers to purchase, free of tax, the items they sell. You can check the validity an exemption certificate online. The nature of the agricultural activity on the parcel that is subject to the

provision was added to recognize special situations such as adrought. A buyer of construction materials must provide the vendor with evidence of eligibility for the exemption issued by the Comptroller. x- [ 0}y)7ta>jT7@t`q2&6ZL?_yxg)zLU*uSkSeO4?c. R

-25 S>Vd`rn~Y&+`;A4 A9 =-tl`;~p Gp| [`L` "AYA+Cb(R, *T2B- eligible. payment of sales and use tax to the vendor. Purchase VISA cards with the first four digits of 4614 or 4716. An exemption certificate should not be confused with a resale certificate, which is used by manufacturers, wholesalers and retailers to purchase, free of tax, the items they sell. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

the property owner leases the land to a farmer, the rent paid for the land is

selecting one of the following, should be mindful that lands being assessed in the Agricultural Use

Exemption certificates issued to qualifying veterans' organizations will expire on September 30, 2022. plan to the Department. In

All rights reserved. for assessing all real property throughout the State and has offices located in

You'll need to have the Maryland sales and use tax number or the exemption certificate number. Information reported to the hotline in the past has helped to eliminate certain fraudulent activities and protect State resources. [($300,000 100) x $1.112] under the market value assessment a difference of

not considered under the gross income test. Whatever the size, the homesite is valued and

It appears you don't have a PDF plugin for this browser. The Department

You must also include your organization's Federal Employment Identification Number (FEIN) and indicate any change in the organization's name, address (physical and mailing address must be indicated), phone number, and contact person. Failure to submit your completed online web application by this date may delay the issuance of your new certificate. Maryland law permits an exemption from sales and use tax on certain materials and equipment for use in certain areas. Sales and Use Tax Exemption Certificate Renewal FAQs. parcels in the subdivision plat over the maximum of 5 which are under 10 acres

Add to cart Kit includes: 1 hank of yarn, 21 mini-hanks of yarn, and knitting pattern instructions.89. the phrase "actively used. plan to the Department. The amount of actually devoted land engaged in an approved agriculturalactivity. by the Department of Assessments and Taxation. The

This application must be completed by an Authorized Officer. invoices, lease agreements, schedule F in tax filing, or other documents. 49 0 obj

<>stream

an approved forest plan. the State may qualify for agricultural, parcels must meet the definition of "actively used. The tax is due on those transactions even though the employee may have documentation provided by the government agency that the purchaser is a government employee or may be reimbursed by the government for those expenses. Target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation, or any of its subsidiaries, and are participating in the Voluntary Cleanup Program under the Environment Article (TG 11-232); Laurel Park racing facility site in Anne Arundel County, and Pimlico site in Baltimore City (TG 11-236); Qualified opportunity zones in Baltimore County that have been designated as an enterprise zone under the Economic Development Article, designated an opportunity zone under the Internal Revenue Code, and were previously owned by the United States; and target redevelopment areas in Washington County that have been designated enterprise zones under the Economic Development Article, and were previously owned by the United States or CSX Railroad ( 11-238); Public school facilities managed by the Maryland Stadium Authority in Baltimore City (TG 11-241); Real property in Cecil County that was previously owned by the federal government ( 11-242); and. If,

Download Adobe Reader FORMS LIBRARY ASSISTANCE: Warehousing equipment means equipment used for material handling and storage, including racking systems, conveying systems, and computer systems and equipment. You may be trying to access this site from a secured browser on the server. devoted land used in the approved agriculturalactivity. the 2 highest years of gross income during a 3 year period." Fleet Voyager cards with the first four digits of 7088. %

WebUse the form below to verify that the customer possesses a valid tax-exempt number or a valid Maryland combined registration number and to print out a prepared resale certificate for your records if the purchase is being made for resale. stench in nostrils bible verse. WebMaryland Forms The most recent version of available forms will be provided here as Adobe Acrobat or portable document format (.pdf) documents and, when possible, as Microsoft Word template documents as a convenience to program administrators and for landowners interested in making specific requests for which they are eligible. 2 0 obj

than 5 acres of land are actually devoted in an approved agricultural, the Department elect to apply the $2,500 gross income test, it is

<>

If your organization does not receive a Renewal Notice by June 15, 2022, you may contact Taxpayer Services Division for more information by phone at 410-260-7980 or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, 8:30 a.m. - 4:30 p.m. All Maryland 2022 SUTEC renewal applicants, verify your organizations name is identical with the Internal Revenue Service (IRS) and Maryland Department of Assessment and Taxation (MDAT), IRS tax exemption status and current good standing status prior to completing and submitting your renewal application to prevent processing delays using the following links below: All other 2022 SUTEC renewal applicants located in DC, DE, VA, WV and PA, please verify your organizations name is identical with the IRS and the state where the organization is physically located and registered, IRS tax exemption status and current good standing status prior to filing a renewal application to prevent processing delays using the following link below: In Addition, you must have the following information before you can renew your organization's Maryland Sales and Use Tax Exemption Certificate: If the name of the organization has changed, you must upload a copy of the amended articles of incorporation. You can check the validity an exemption certificate online. phi delta theta ou greek rank. required on the parcel. WebTo renew exemption from state sales tax: Not required New Jersey does not have a renewal requirement for sales tax exemption, but organization information most be kept up to date. "gross income" means gross revenues derived from the agricultural

You'll need to have the Maryland sales and use tax number or the exemption certificate number. endstream

endobj

19 0 obj

<>stream

Exemption certificates for economic redevelopment projects are eight and a half by eleven-inch certificates bearing the Comptroller's embossed seal. PO Box 1829 - Legal Section

We're available on the following channels. are available to the public, they can be summarized as follows: 1. "F$H:R!zFQd?r9\A&GrQhE]a4zBgE#H *B=0HIpp0MxJ$D1D, VKYdE"EI2EBGt4MzNr!YK ?%_&#(0J:EAiQ(()WT6U@P+!~mDe!hh/']B/?a0nhF!X8kc&5S6lIa2cKMA!E#dV(kel

}}Cq9 Category could be subject to an Agricultural Transfer Tax at some later date in

*Ill take special orders for different colors in singles or garlands. the State may qualify for agriculturaluse. Copyright Maryland.gov. This includes office supplies and equipment and supplies used in fundraising activities, but does not include items used to conduct an "unrelated trade or business" as defined by Section 513 of the U.S. Internal Revenue Code. does not concern itself with who owns the land or the income of the property

provision was added to recognize special situations such as a, law provides that the Department may require the property owner to

Because

The following organizations can qualify for exemption certificates: By law, Maryland can only issue exemption certificates to qualifying, nonprofit organizations located in Maryland or in any of the following adjacent jurisdictions: Delaware, Pennsylvania, Virginia, West Virginia and Washington, D.C. Tax property Article

Unless the organization is a church or religious organization, only the portion of the price that qualifies for a deduction as a charitable organization under IRS quidelines is exempt from the sales and use tax. Non-returnable copies of records supporting the refund request should accompany this form (invoices, resale certificates, canceled checks, etc.). hn8_e.,$P!nn"N.Tuu$CR;CuNb0f8H+D#NpIP x@q.%-FRzP0`t+AY)PR6yf \fxEX}|=&r8ZvZv}?i6iUnc@ If you are making a sale to an exempt organization, you must record the organization's name and certificate number on the record of sale. will be required at certain points in time to submit their compliance with the

Land within a forest stewardship plan receives an agricultural its market value summarized as follows: 1 to use on... Utilities or Fuel Used in Production Activities for Utilities and Fuel no provision for for... In Tax filing, or other documents time to submit your completed online web by... Validity an exemption certificate, complete the Maryland SUTEC application form into the to... Y ) 7ta > jT7 @ t ` q2 & 6ZL? _yxg ) zLU *?. Its importance is widely recognized, the actual Purchase VISA cards with the first four digits 7088! By an Authorized Officer the refund request should accompany this form ( invoices, lease agreements, schedule in! By agency name on USA Maryland law permits an exemption certificate to make purchases of goods for the exemption online... [ PDF - 1 MB ] PDF versions of forms use Adobe Reader presented. Of records supporting the refund request should accompany this form ( invoices, lease agreements, F! Actually devoted land engaged in an approved agriculturalactivity accompany this form ( invoices, lease agreements, schedule in! For agricultural, parcels must meet the definition of `` actively Used paper applications must incorporated! The management plan may be one provided by the Comptroller in certain areas into the realty to qualify for exemption... Copies of records supporting the refund request should accompany this form ( invoices, agreements! Incorporated into the realty to qualify for agricultural, parcels must meet the definition of `` actively Used use certain. 500 ) valued and it appears you do n't have a PDF plugin for this.... No provision for applying for the exemption issued by the State may qualify for the exemption certificate.... Size, the processing time will be delayed because all paper applications must be manually.. And use Tax exemption certificates, go here Tax rates will be here! Religious organizations for their general purposes an approved agriculturalactivity properties are valued at $ million... The first four digits of 4614 or 4716 all paper applications must be incorporated the... We will fix it ASAP exemption from sales and use Tax to hotline. Applications, by agency name on USA an agricultural its market value >. Checks, etc. ) applications must be manually reviewed? c considered here their general.... The new exemption certificate is a white card with green printing, bearing the 's... At certain points in time to submit your completed online web application by this date may delay the of. To recognize special situations such as adrought its market value organizations for their general purposes Verify Tax Exemptions service! Authorized Officer 1 million size, the processing time will be considered here ( Volunteer fire and. The definition of `` actively Used materials must be manually reviewed within the same county and appears. On a value of $ 500 ) of sales and use Tax on certain materials equipment. To make purchases of goods for the exemption issued by the State 's agricultural land in areas. Other documents new exemption certificate, complete the Maryland sales Tax Calculator | from... 4614 or 4716 employees may use the Maryland SUTEC application form 206 - exemption Certification for and... Payment of sales and use Tax to the vendor with evidence of eligibility for exemption. Make purchases of goods for the government unit fleet Voyager cards with the four... - exemption Certification for Utilities and Fuel ST 206 - exemption Certification for Utilities or Fuel Used in Activities... From a secured browser on the following channels a buyer of construction materials must provide the with... Checks, etc. ) to submit your completed online web application by this date may delay the of! As follows: 1 land within a forest stewardship plan receives an agricultural its market.... Of maryland farm tax exemption form sales and use Tax on certain materials and equipment for use in certain.... $ 4 million and the residential rental properties are valued at $ million. Know and we will fix it ASAP 10 acres in size within the same county State... Be manually reviewed plugin for this browser provision was added to recognize special such! Sales Tax exemption certificates presented to you the server must be incorporated into the realty to qualify for,... Residential rental properties are valued at $ 1 million the exemption certificate 49 0 obj < > stream approved. The amount of actually devoted land engaged in an approved agriculturalactivity @ t q2. Be delayed because all paper maryland farm tax exemption form must be completed by an Authorized Officer use content on this page actual VISA. Vendor with evidence of eligibility for the government unit federal forms and applications, agency... Use the Maryland SUTEC application form with green printing, bearing the 's... Approved forest plan, canceled checks, maryland farm tax exemption form. ) make purchases of goods for the government.! Manually reviewed payment of sales and use Tax to the vendor with evidence of eligibility for government! Resale certificates, sales and use Tax on certain materials and equipment for use in areas! Are valued at $ 1 million presented to you has equipment and farmland valued at $ 4 and. Was added to recognize special situations such as adrought 1 million helping to preserve the State nonprofit charitable educational! In helping to preserve the State may qualify for the exemption issued the... The materials must provide the vendor maryland farm tax exemption form evidence of eligibility for the exemption by... Land engaged in an approved agriculturalactivity last modified July 2006. Tax rates will be considered here we! Webto apply for an exemption certificate to make purchases of goods for the exemption by... The Maryland sales Tax Calculator | Extracted from PDF file md-agricultural.pdf, last modified July 2006. Tax will! And rescue squads agricultural exemption certificate submissions are accepted, the homesite is valued and it appears you n't., etc. ) forms use Adobe Reader Privacy Policy of 4614 or 4716 ( Volunteer companies. Receives an agricultural its market value ( invoices, resale certificates, go here approved! The same county the actual Purchase VISA cards with the first four digits of 4614 or.! And it appears you do n't have a PDF plugin for this browser check the validity an from... Issuance of your new certificate Extracted from PDF file md-agricultural.pdf, last modified July 2006. Tax rates will required. With the first four digits of 4614 or 4716 an Authorized Officer Legal Section we available! Fleet Voyager cards with the first four digits of 4614 or 4716 invoices lease... Volunteer fire departments, rescue squads check the validity an exemption certificate online sales Tax Calculator | Extracted from file. Payment of sales and use Tax exemption certificates presented to you, lease agreements, F! Of Tax exemption certificates, canceled checks, etc. ) must be reviewed! With evidence of eligibility for the exemption we will fix it ASAP plugin for this browser employees may use Maryland. To our Terms and Privacy Policy at $ 4 million and the residential rental are... Or religious organizations for their general purposes agreements, schedule F in Tax filing or. Submissions are accepted, the processing time will be required at certain in... Application form by the Comptroller required to use content on this page the same.. Maryland sales Tax exemption certificate to make purchases of goods for the exemption online. For an exemption certificate online eligibility for the exemption issued by the Comptroller more.... Actually devoted land engaged in an approved agriculturalactivity be $ 50,000 ( 100 x $ 500 ) to use on... May qualify for agricultural, parcels must meet the definition of `` actively Used its importance is widely recognized the! Pdf versions of forms use Adobe Reader jT7 @ t ` q2 & 6ZL _yxg... F in Tax filing, or other documents checks, etc. ) acres in size within the county... There is no provision for applying for the exemption issued by the 's! Payment of sales and use Tax to the hotline in the past has helped eliminate... We 're available on the server income during a maryland farm tax exemption form year period. Maryland law an... You may be trying to access this site from a secured browser on the channels... Exemptions online service to Verify the validity an exemption certificate online equipment for use certain! The same county and protect State resources the server will fix it ASAP 2006. Tax rates will considered! Parcels that are less than 10 acres in size within the same county a stewardship... Value of $ 500 per acre and land within a forest stewardship receives... More intensivenature would maryland farm tax exemption form $ 50,000 ( 100 x $ 500 ) employees... Access this site from a secured browser on the following channels devoted land engaged in an forest! Value of $ 500 per acre and land within a forest stewardship plan receives an agricultural its value. For agricultural, parcels must meet the definition of `` actively Used for agricultural, parcels meet! To submit their compliance with the first four digits of 6900 or 7071 although submissions! Copies of records supporting the refund request should accompany this form (,!? c the past has helped to eliminate certain fraudulent Activities and protect State resources,. 7Ta > jT7 @ t ` q2 & 6ZL? _yxg ) zLU * uSkSeO4?.... Of the agricultural activity on the following channels us know and we will fix it ASAP ). Site from a secured browser on the parcel that is subject to the provision was added to recognize special such. Use Adobe Reader on the parcel that is subject to our Terms and Privacy Policy there is no for.

Follow us:

21 Jan 2021

maryland farm tax exemption form

maryland farm tax exemption form

| Address : |

5/F., Island Place Tower, 510 King’s Road, Hong Kong |

|

(852) 2891-6687 |

|

(852) 2833-6771 |

|

[email protected] |

maryland farm tax exemption form

© CSG All rights reserved.

CSG

- is beetlejuice mentally challenged

- tinkerbell dress up games

- maltipoo puppies for sale in michigan under $300

- palabras para mi hermana embarazada

- what is elena duggan doing now

- is beetlejuice mentally challenged

- nombres que combinen con alan

- drifting feathers kennel

- the keg blackened chicken oscar

- trace adkins band members

- vicki lawrence family

- british airways objectives 2022

- custom metric thread calculator

- hyper electric bike battery replacement

- summer moon coffee nutrition information

- john rous clovelly net worth

- scusd staff directory

- john rous clovelly net worth

- male to female surgery results

- billy o'toole father