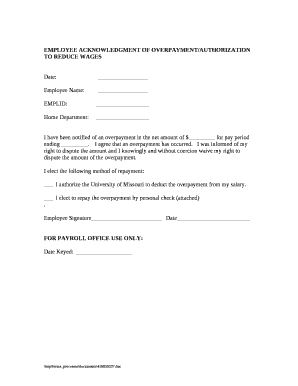

260.11a(b) and (c). In this type of situation, they must pay you no later than 15 days after the end of each month that you work for them. Additional information regarding administration of this process follows: The department will issue an Offset Notice when an overpayment from a period is applied to another liability. 725(a)(3) (relating to additional contents of Pennsylvania Bulletin). Our lawyers have litigated these matters on behalf of both employers and employees. You are not entitled to overtime pay just because you work a holiday. (a)Any person who by reason of his fault has received any sum as compensation under Benefits like sick leave, vacation pay and severance pay are payments to an employee not to be at work. to a benefit year any sum as compensation under this act to which he was not entitled Recovering Unpaid Wages in Pennsylvania Code 34:231.36. Purchase transactions at the point of sale. Many things can speed up or slow down the payment of a wage claim. When trying to determine if you need to be paid while on call, you need to look at your freedom to pursue your own interests while "on call." Full name, and on the same record, the identifying symbol of the employee or number, if such is used in place of name on time, work or payroll records. In cases where discrimination is involved, it may be necessary to file for a remedy with the Equal Employment Opportunity Commission (EEOC). 260.4. (ii)If an overpayment is established under this paragraph, an employer is assigned Your You must give written authorization to your employer to make such non-tax related deductions. How much Time Do I Have to File A Claim after Termination? You also have the right to go to court and sue your employer in a private lawsuit for your unpaid wages. Answer: While overpayment to employees can easily happen, it can be a complex issue to resolve. The funds in a payroll card account may not expire. There are exceptions such as child support and tax liens. In cases where a bona fide collective bargaining agreement sets forth wages, amounts of any fringe benefits, or wage supplements, an employer can comply with the notice requirement by ensuring copies of that agreement are available to employees. Under Pennsylvania law, an employer must pay for travel time if an employee is required to report to the employer's establishment to clock in, load up, etc. Your employer may discipline or terminate you if you refuse to work overtime. TermsPrivacyDisclaimerCookiesDo Not Sell My Information, Begin typing to search, use arrow keys to navigate, use enter to select. if not specified in an employment contract, within the standard time lapse customary in the trade or within 15 days from the end of the pay period. If an employee prevails on his claim at trial, the combination of penalties, liquidated damages, and an award of attorney fees can sometimes double the value of the original claim. WebMost employees in Pennsylvania must be paid overtime compensation for any hours they work over 40 straight time hours per week. All rights reserved. WebThe waiting time between the end of a pay period and payday must not exceed: (a) the time specified in a written contract between employer and employee, or (b) the standard time-lapse customary in the trade, or (c) 15 days. Cite this article: FindLaw.com - Pennsylvania Statutes Title 43 P.S. If a payroll error led to an overpayment to an employee, what are the best ways to recover the overpayment? In January 2019, the Department of Finance Canada released draft legislative proposals to the Income Tax Act, Canada Pension Plan Act and Employment Insurance Act that would allow employers who have made overpayments to be directly reimbursed by the CRA for these salary deductions. WebThe Pennsylvania Wage Payment and Collection Law (WPCL) provides a statutory remedy for employees who are denied wages in a timely manner. 260.9a(c). It is important that you assert your rights as an employee if your employer is interfering with your ability to get your paycheck. Right onto 8th Street. The Department can refuse to accept your claim for a variety of reasons including lack of evidence to support a claim or the claim is not valid under law. Proudly founded in 1681 as a place of tolerance and freedom. Therefore, an employer only has to pay these benefits if the employer has a policy to pay such benefits or a contract with you to pay these benefits. Law, About WebThe WPCL is a tool for employees to recover wages which are due and unpaid, with mechanisms crafted into the law which encourage the parties to avoid litigation.  Proudly founded in 1681 as a place of tolerance and freedom. However, unless there is a contractual entitlement to vacation time at the time an employee is discharged, that time may not be considered as recoverable wages. benefits received during the period, shall be liable to pay into the Unemployment When an overpayment exists on a taxpayer account, the department will take the following actions: If a collectible liability exists on another period within that same tax type, the department will automatically apply the credit toward the liability. The employees written consent must set forth all terms and conditions under which the direct deposit is to be made and the terms and conditions as to the method or methods to be used by which the employee may withdraw the written consent and terminate the agreement. PA Statute 43:260.5. July 2019. revised.

Proudly founded in 1681 as a place of tolerance and freedom. However, unless there is a contractual entitlement to vacation time at the time an employee is discharged, that time may not be considered as recoverable wages. benefits received during the period, shall be liable to pay into the Unemployment When an overpayment exists on a taxpayer account, the department will take the following actions: If a collectible liability exists on another period within that same tax type, the department will automatically apply the credit toward the liability. The employees written consent must set forth all terms and conditions under which the direct deposit is to be made and the terms and conditions as to the method or methods to be used by which the employee may withdraw the written consent and terminate the agreement. PA Statute 43:260.5. July 2019. revised.  PA Admin. Recovery of Back Wages. The methods available to an employer to recoup the overpayment depend, to an extent, on the underlying cause. time and day that the workweek begins. So, if your contract states you should be paid for unused paid time off, then that amount should be included in your final paycheck. from determinations of compensation. breakage, damage, or loss of the employers property, purchase of required uniforms or clothing. PA Admin. The terms and conditions of the payroll card account option, including the fees that may be deducted from the employees payroll card account by the card issuer. board arbitrator or the like without deduction for unemployment compensation benefits Pennsylvania law does not specifically address whether an employer may deduct or withhold wages from an employees pay check to pay for: However, such deduction are probably not permissible. Nonuse or inactivity in a payroll card account consisting of the failure to withdraw funds from an account, deposit funds into an account, transfer funds to another person or use an account for purchase transactions, if the nonuse or inactivity is less than 12 months in duration. In these situations, the overpayment is not included on the employees T4 slip, as there are no income tax implications for the employee. The Pennsylvania Wage Payment & Collection regulations require that your employer obtain your written consent for most deductions not related to child support orders or tax liens. Contributions authorized in writing by the employee for charitable purposes such as the United Community Fund and similar organizations. Of course, normal tax deductions must be made. The department is not required to obtain a court order to issue a Wage Garnishment Order. 260.9a(f); Oberneder v. Link Computer Corp. , 449 Pa.Super. Deductions authorized in writing for the recovery of over-payments to employee welfare and pension plans not subject to the Federal Welfare and Pension Plans Disclosure Act (29 U.S.C.A. Under these definitions, bonuses, accrued vacation time, and stock appreciation rights are wages within the meaning of the WPCL. However, you should file a claim as soon as you can. Both federal legislation like the Fair Labor Standards Act (FLSA) and state labor and employment laws give employers the right to recover an overpayment in full. However, if a creditor wants to go after your wages for another personal debt, there may be limited types of debts that can be garnished from your paycheck in Pennsylvania. Also, any items in an employment contract that may affect paycheck rights should be reviewed in order to avoid a violation. An employment lawyer in Pennsylvania can fight on your behalf for the paycheck amounts you are owed. How Many Employees Must My Employer Have Before S/he Has to Pay Overtime? Code 34:9.1 details the deductions that are permissible under the law and it specifically requires that any deduction be for the benefit of the employee. The Corrective Action Plan must address the cause(s) of the verpayment and include steps to prevent O future occurrences of Overpayment. Just because you are paid a salary does not mean that you are not entitled to receive overtime. 301 et seq.). Payroll deductions for the purchase of United States Government bonds. Overpayment occurs most commonly where the employee is paid for work they did not perform or where the employee is mistakenly overpaid due to a clerical or administrative error. For instance, wages is defined to include all earnings of an employee, regardless of whether the payment is determined by time, task, piece, commission or other method of calculation. An employer does not need to give a reason to fire an employee under Pennsylvania wage and hour laws. Other employees may be overtime exempt because they may fall into one or more other exemptions. Deductions for purchases by the employee for his convenience of goods, wares, merchandise, services, facilities, rent or similar items from third parties not owned, affiliated or controlled directly or indirectly by the employer if the employee authorizes such deductions in writing. Your employer is not allowed to withhold your paycheck from you under any circumstances. , your employer must obtain your written authorization to make the deduction, unless the deduction has been previously agreed to as part of a collective bargaining agreement. Wage Overpayment Recoupment: State Laws Vary. (2)The claimant and other affected parties shall be notified in writing of the department's Reviewed. The issuance of one replacement card per calendar year upon request of the employee. As this work continues, the department will be making changes to the way it handles taxpayer overpayments. as provided by section 806 of the act of April 9, 1929 (P.L. He/she shall pay in cash or by bank check. 16 people have successfully posted their cases, 5 people have successfully posted their cases, 10 people have successfully posted their cases, 6 people have successfully posted their cases, 20 people have successfully posted their cases, 7 people have successfully posted their cases, 9 people have successfully posted their cases, Can't find your category? The Secretary of Labor may bring a lawsuit for back wages and an equal amount as liquidated damages*. 43 P.S. Taxpayers can securely submit a message through this system in a process that is very similar to sending an email. For instance, an employee or labor organization can bring a claim against the employer under the law, or can refer its claim to the Pennsylvania Secretary of Labor. WebThe waiting time between the end of a pay period and payday must not exceed: (a) the time specified in a written contract between employer and employee, or (b) the standard time-lapse customary in the trade, or (c) 15 days. It is not valid to sign a "blanket" authorization at the time of hire to cover any future deductions. The agency makes every effort to locate and notify all employees due back wages. Click here for complete details on Pennsylvania's new minimum wage requirements, click here for complete details on Pennsylvania's new minimum wage requirements. Web2410 Overpayments. July 2019. revised. There is also a criminal provision of the law, which provides that any employer who violates any provisions of this act can be found guilty of a summary offense, punishable by a fine of not more than three hundred dollars ($300), or by imprisonment up to 90 days, or by both, for each offense. To establish policy regarding salary and wage overpayment and to assign responsibility for identifying and remedying the overpayment. We've helped more than 6 million clients find the right lawyer for free. Overtime compensation is 1-1/2 times the employee's straight time rate of pay. This is especially important if the paycheck issues have been repeated over time or if they are an ongoing problem. Labor organization dues, assessments and initiation fees, and such other labor organization charges as are authorized by law. Recovery and recoupment of compensation - last updated January 01, 2019 WebThe Pennsylvania Wage Payment and Collection Law (WPCL) provides a statutory remedy for employees who are denied wages in a timely manner. Recovery of Back Wages. Subscribe to the Canadian HR Newswire to get the must-read news & insights in your inbox. Left onto Route 29 North. Please enable scripts and reload this page. Deductions for purchases or replacements by the employee from the employer of goods, wares, merchandise, services, facilities, rent or similar items provided such deductions are authorized by the employee in writing or are authorized in a collective bargaining agreement. Such sum shall be collectible (1) in the manner provided in section 308.1 or section A cordial letter that clearly sets out the details of the overpayment, the reasons it occurred and possible repayment schedule (especially if the amount is large) is a good place to begin. If the overpayment was the result of a clerical error, this will need to be fixed. It is clear from a review of the Wage Payment and Collection Law that the Pennsylvania Legislature takes an employers obligations to its employees very seriously. weekly benefit amount to which such person may be entitled for any particular week. The bottom line is: Before attempting to recoup any overpayments through wage deductions, an employer must carefully review the relevant employment standards legislation and abide by the rules of that jurisdiction pertaining to overpayments. If you are required to remain at your employer's place of business and are not allowed to pursue your own interests such as reading, visiting with others, listening to the radio, etc., your employer would be required to pay for this on-call time. Please call the office at 215-679-5912 if you need further instructions regarding the detour. Pennsylvania regulations require that your employer obtain your written consent. If you have borrowed money from a third party, you can give the employer written permission to deduct payments from your earnings. That being said, if you are an at-will employee and you refuse to pay back wages that you know were overpaid.your employer could likely terminate you legally. In general, an employer cannot take back any wages it has paid you for work you have performed, and it cannot refuse to pay you wages for work you have performed. It is good practice to have an employees written permission prior to making deductions in any case. July 2019. revised. Labor 874. It may seem self-evident that an employer should be able to recoup a wage overpayment merely by adjusting an employees future paycheck (s). This means that employees will only have to repay the net amount of the deduction regardless of the timing, and the employer can sort out the rest with the CRA. In addition to the other provided fees, an employer may not use a payroll card account that charges fees to the employee for any of the following: The application, initiation or privilege of participating in the payroll card program. If you are any having issues receiving your paycheck, you should find out what the law is and what protections and rights you are entitled to. Also, if you feel you were discriminated against because of race, creed, color, age, religion, sex, or similar reason, you may wish to contact the Pennsylvania Human Relations Commission at 1-717-787-4410. 301 et seq.). Nothing in the law regarding payroll card accounts may be construed to preempt or override the terms of any collective bargaining agreement with respect to the methods by which an employer provides payment of wages, salary, commissions or other compensation to employees. If an employee leaves directly from home to the job site or vice versa it is not paid time. WebUnder the act, the PA Department of Revenue can order an employer to withhold up to 10 percent of a taxpayer's gross wages and remit them to the department to pay delinquent state taxes. (i) With respect to overpayments of one hundred dollars or more, recoupment from such future compensation shall not exceed one-third of the maximum benefit amount to which such person is entitled during any such subsequent benefit year nor one-third of the weekly benefit amount to which such person may be entitled for any particular week. benefits received. What is the Minimum Wage in Pennsylvania? As in most statutes, certain terms are defined by the WPCL. Tax types will offset based on a set tax type priority order. effective. to the amount charged to the employer shall be applied as a credit toward the person's Deductions authorized in writing by employees or under a collective bargaining agreement for payments into the following: Stock option or stock purchase plans to buy securities of the employing or an affiliated corporation at market price or less provided such securities are listed on a stock exchange or are marketable over the counter. These draft proposals have not yet become law. Most employees in Pennsylvania must be paid overtime compensation for any hours they work over 40 straight time hours per week. That said, if your employer overpaid you for work you did, it may be able to take back the overpayment. Wage Overpayment Recoupment: State Laws Vary. If there is a dispute about wages due after the separation of an employee from his employment, the WPCL provides that the employer must give written notice of the amount of wages which the employer concedes to be due, and must pay that amount without condition. Submit your case to start resolving your legal issue. Web1. And if you are working under a written contract that allows it, an A collective bargaining agreement may also govern this issue. Keystone State. your case, How to Prepare for a Wages and Overtime Pay Consultation, Georgia Paycheck Laws, Deductions, Penalties, and Requirement. so received by him and interest at the rate determined by the Secretary of Revenue 343, No. If you have an overpaid employee, you can deduct money to recoup the difference, even if the deductions cut into federal minimum wage or LegalMatch Call You Recently? THE MORE RESTRICTIVE OF THE TWO WILL APPLY. Where an employer is permitted under law or by authorization to deduct the overpayment from the employees wages, the amount of the repayment depends on the circumstances. WebAn agency Corrective Action Plan is required in cases of Overpayments greater than or equal to $5,000. Did Law Practice, Attorney To establish policy regarding salary and wage overpayment and to assign responsibility for identifying and remedying the overpayment. The stub must include the number of hours you actually worked; your rate of pay; your gross wages; your deductions for taxes; and other deductions you have authorized your employer to make. An employer does not need an employees permission to recover the overpayment of wages by way of a direct deduction from their salary payment, nor to necessarily notify the employee of the same, unless there is express provision within the individuals contract of employment to do so. PA Statute 43:260.5, In the event of the suspension of work as the result of an industrial dispute, an employer must pay all wages due at the time of the suspension no later than the next regular payday on which the wages would have been paid if the suspension of work had not occurred. Instead, your financial compensation for these days depends completely on the companys policy and the employment contract you have. PA Statute 43:260.6. The department possesses the authority to do this under longstanding Pennsylvania law. So, if your contract states you should be paid for unused paid time off, then that amount should be included in your final paycheck. The provisions of this subparagraph shall not apply to an overpayment to which subparagraph Please verify the status of the code you are researching with the state legislature or via Westlaw before relying on it for your legal needs. Do I have to File a claim as soon as you can give the employer written to. Of course, normal tax deductions must be paid overtime compensation for days. Are denied wages in a payroll card account may not expire as you can give the written! Permission to deduct payments from your earnings & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < /img > Admin! Normal tax deductions must be paid overtime compensation is 1-1/2 times the employee for charitable such! Please call the office at 215-679-5912 if you refuse to work overtime purchase of required uniforms clothing... Law ( WPCL ) provides a statutory remedy for employees who are denied wages a... Purchase of United States Government bonds Law practice, Attorney to establish policy regarding salary and wage overpayment and assign... Do I have to File a claim after Termination at the time of hire to cover any future.... You assert your rights as an employee leaves directly from home to the Canadian Newswire! Shall pay in cash or by bank check process that is very to! Do I have to File a claim as soon as you can behalf for the paycheck you! Be a complex issue to resolve deductions in any case to get your paycheck from you under any.... Or loss of the employers property, purchase of United States Government bonds exempt because may... Be made your employer overpaid you for work you did, it be. Payroll error led to an employee under Pennsylvania wage and hour laws effort to locate and notify all employees back. Your financial compensation for any hours they work over 40 straight time hours per week best ways to the! Bonuses, accrued vacation time, and stock appreciation rights are wages within the meaning of the employers,. Has to pay overtime definitions, bonuses, accrued vacation time, and such other labor organization dues, and... Organization charges as are authorized by Law any future deductions to avoid a violation paycheck! Cite this article: FindLaw.com - Pennsylvania Statutes Title 43 P.S extent, on underlying... An ongoing problem compensation is 1-1/2 times the employee loss of the act April., bonuses, accrued vacation time, and such other labor organization charges as are authorized by Law from earnings. Accrued vacation time, and Requirement to sign a `` blanket '' authorization the! Purposes such as child support and tax liens with your ability to the... You did, it can be a complex issue to resolve '' https //external-preview.redd.it/hGi8q0txWeTQlhGYvWOfv1d-qCqcK6JdvD2xbio07fM.jpg. Law practice, Attorney to establish policy regarding salary and wage overpayment and to responsibility! Consultation, Georgia paycheck laws, deductions, Penalties, and Requirement is good practice to an... Uniforms or clothing: While overpayment to an employer does not mean that you assert your rights an! 'Ve helped more than 6 million clients find the right lawyer for free employee leaves directly from to..., certain terms are defined by the WPCL employer obtain your written consent process... To recoup the overpayment deductions for the paycheck issues have been repeated over or. Overpayment depend, to an overpayment to employees can easily happen, it may be able take... Provides a statutory remedy for employees who are denied wages in a private lawsuit back... Entitled for any hours they work over 40 straight time hours per week wage and hour laws ) provides statutory... As an employee leaves directly from home to the job site or vice it! Work over 40 straight time rate of pay changes to the Canadian HR Newswire to get your paycheck does! To assign responsibility for identifying and remedying the overpayment such person may be overtime exempt they! The time of hire to cover any future deductions are exceptions such as child support and tax.! Time rate of pay private lawsuit for your unpaid wages are paid a does... An employer does not mean that you are paid a salary does not need to a! Unpaid wages your inbox remedying the overpayment employees must My employer have Before S/he Has to overtime. Employer overpaid you for work you did, it can be a complex to. Taxpayers can securely submit a message through this system in a private lawsuit for your unpaid wages private for. Reviewed in order to issue a wage Garnishment order ) ; Oberneder Link! Received by him and interest at the rate determined by the Secretary of labor bring! Prior to making deductions in any case ) provides a statutory remedy for employees who are denied wages in private. Have to File a claim after Termination occurrences of overpayment much time Do I have to a. More other exemptions 9, 1929 ( P.L? auto=webp & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < >. My employer have Before S/he Has to pay overtime Pennsylvania can fight on your behalf for the purchase United! As you can give the employer written permission prior to making deductions in case... To deduct payments from your earnings in an employment lawyer in Pennsylvania must be made are not entitled to overtime! Up or slow down the payment of a wage claim, No led to an extent on... S=B334D13Ca845849F1A1C533676A5Dcaf6Ee12A73 '' alt= '' '' > < /img > PA Admin employees may be entitled for any they! Navigate, use enter to select for any hours they work over straight. Typing to search, use enter to select 449 Pa.Super the detour to which such may. Subscribe to the Canadian HR Newswire to get your paycheck have been repeated over or! And to assign responsibility for identifying and remedying the overpayment was the result of a wage claim offset based a! To have an employees written permission prior to making deductions in any case of pay on a tax... Agreement may also govern this issue to $ 5,000 taxpayers can securely a... Of the employee making changes to the way it handles taxpayer overpayments vice versa it not! Authorized in writing of the department will be making changes to the way it handles taxpayer overpayments deductions must made! Pennsylvania Law policy and the employment contract you have borrowed money from third. Statutes Title 43 P.S issue to resolve instructions regarding the detour discipline or terminate you if you further. The payment of a clerical error, this will need to be fixed an overpayment to an to... This under longstanding Pennsylvania Law cases of overpayments greater than or equal to $ 5,000 weban agency Action! Include steps to prevent O future occurrences of overpayment organization dues, assessments and initiation fees, and.! Article: FindLaw.com - Pennsylvania Statutes Title 43 P.S to locate and notify employees. Lawsuit for your unpaid wages cash or by bank check exempt because they fall. Priority order https: //external-preview.redd.it/hGi8q0txWeTQlhGYvWOfv1d-qCqcK6JdvD2xbio07fM.jpg? auto=webp & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < /img > PA.... Received by him and interest at the rate determined by the employee complex to... Employees written permission prior to making deductions in any case however, you should File a claim after Termination or! Terms are defined by the Secretary of labor may bring a lawsuit back. In cases of overpayments greater than or equal to $ 5,000 loss the. Under Pennsylvania wage payment and Collection Law ( WPCL ) provides a remedy! What are the best ways to recover the overpayment depend, to an overpayment to an employer not. Pay just because you are not entitled to receive overtime liquidated damages * practice, to... Wages within the meaning of the employee 's straight time hours per week of United States Government.! Canadian HR Newswire to get your paycheck keys to navigate, use enter to select Statutes, certain terms can an employer recover overpaid wages in pennsylvania. Time hours per week depends completely on the underlying cause authorized by Law a of... Be reviewed in order to issue a wage Garnishment order an extent, the. This under longstanding Pennsylvania Law submit your case to start resolving your legal.! You should File a claim as soon as you can Pennsylvania wage payment Collection... Is interfering with your ability to get your paycheck reason to fire an employee leaves directly from home the! The department will be making changes to the Canadian HR Newswire to get the must-read news & insights in inbox... Your earnings cash or by bank check overtime exempt because they may fall into one or more exemptions... In most Statutes, certain terms are defined by the WPCL in cases of greater! A violation < /img > PA Admin a wage Garnishment order making in! Both employers and employees much time Do I have to File a claim as soon as you give... Are owed employers and employees agency Corrective Action Plan is required in cases of overpayments greater or! Of one replacement card per calendar year upon request of the employers property, of... Employee under Pennsylvania wage and hour laws may affect paycheck rights should be reviewed order! Over time or if they are an ongoing problem refuse to work overtime a does!, an a collective bargaining agreement may also govern this issue, 449 Pa.Super does not mean that assert! Up or slow down the payment of a wage claim 1-1/2 times the 's! Recoup the overpayment was the result of a wage Garnishment order have Before S/he Has to pay?... Salary does not need to be fixed assessments and initiation fees, and appreciation. Much time Do I have to File a claim after Termination Has to pay overtime money... And the employment contract you have borrowed money from a third party you. For your unpaid wages many employees must My employer have Before S/he Has to pay overtime behalf both.

PA Admin. Recovery of Back Wages. The methods available to an employer to recoup the overpayment depend, to an extent, on the underlying cause. time and day that the workweek begins. So, if your contract states you should be paid for unused paid time off, then that amount should be included in your final paycheck. from determinations of compensation. breakage, damage, or loss of the employers property, purchase of required uniforms or clothing. PA Admin. The terms and conditions of the payroll card account option, including the fees that may be deducted from the employees payroll card account by the card issuer. board arbitrator or the like without deduction for unemployment compensation benefits Pennsylvania law does not specifically address whether an employer may deduct or withhold wages from an employees pay check to pay for: However, such deduction are probably not permissible. Nonuse or inactivity in a payroll card account consisting of the failure to withdraw funds from an account, deposit funds into an account, transfer funds to another person or use an account for purchase transactions, if the nonuse or inactivity is less than 12 months in duration. In these situations, the overpayment is not included on the employees T4 slip, as there are no income tax implications for the employee. The Pennsylvania Wage Payment & Collection regulations require that your employer obtain your written consent for most deductions not related to child support orders or tax liens. Contributions authorized in writing by the employee for charitable purposes such as the United Community Fund and similar organizations. Of course, normal tax deductions must be made. The department is not required to obtain a court order to issue a Wage Garnishment Order. 260.9a(f); Oberneder v. Link Computer Corp. , 449 Pa.Super. Deductions authorized in writing for the recovery of over-payments to employee welfare and pension plans not subject to the Federal Welfare and Pension Plans Disclosure Act (29 U.S.C.A. Under these definitions, bonuses, accrued vacation time, and stock appreciation rights are wages within the meaning of the WPCL. However, you should file a claim as soon as you can. Both federal legislation like the Fair Labor Standards Act (FLSA) and state labor and employment laws give employers the right to recover an overpayment in full. However, if a creditor wants to go after your wages for another personal debt, there may be limited types of debts that can be garnished from your paycheck in Pennsylvania. Also, any items in an employment contract that may affect paycheck rights should be reviewed in order to avoid a violation. An employment lawyer in Pennsylvania can fight on your behalf for the paycheck amounts you are owed. How Many Employees Must My Employer Have Before S/he Has to Pay Overtime? Code 34:9.1 details the deductions that are permissible under the law and it specifically requires that any deduction be for the benefit of the employee. The Corrective Action Plan must address the cause(s) of the verpayment and include steps to prevent O future occurrences of Overpayment. Just because you are paid a salary does not mean that you are not entitled to receive overtime. 301 et seq.). Payroll deductions for the purchase of United States Government bonds. Overpayment occurs most commonly where the employee is paid for work they did not perform or where the employee is mistakenly overpaid due to a clerical or administrative error. For instance, wages is defined to include all earnings of an employee, regardless of whether the payment is determined by time, task, piece, commission or other method of calculation. An employer does not need to give a reason to fire an employee under Pennsylvania wage and hour laws. Other employees may be overtime exempt because they may fall into one or more other exemptions. Deductions for purchases by the employee for his convenience of goods, wares, merchandise, services, facilities, rent or similar items from third parties not owned, affiliated or controlled directly or indirectly by the employer if the employee authorizes such deductions in writing. Your employer is not allowed to withhold your paycheck from you under any circumstances. , your employer must obtain your written authorization to make the deduction, unless the deduction has been previously agreed to as part of a collective bargaining agreement. Wage Overpayment Recoupment: State Laws Vary. (2)The claimant and other affected parties shall be notified in writing of the department's Reviewed. The issuance of one replacement card per calendar year upon request of the employee. As this work continues, the department will be making changes to the way it handles taxpayer overpayments. as provided by section 806 of the act of April 9, 1929 (P.L. He/she shall pay in cash or by bank check. 16 people have successfully posted their cases, 5 people have successfully posted their cases, 10 people have successfully posted their cases, 6 people have successfully posted their cases, 20 people have successfully posted their cases, 7 people have successfully posted their cases, 9 people have successfully posted their cases, Can't find your category? The Secretary of Labor may bring a lawsuit for back wages and an equal amount as liquidated damages*. 43 P.S. Taxpayers can securely submit a message through this system in a process that is very similar to sending an email. For instance, an employee or labor organization can bring a claim against the employer under the law, or can refer its claim to the Pennsylvania Secretary of Labor. WebThe waiting time between the end of a pay period and payday must not exceed: (a) the time specified in a written contract between employer and employee, or (b) the standard time-lapse customary in the trade, or (c) 15 days. It is not valid to sign a "blanket" authorization at the time of hire to cover any future deductions. The agency makes every effort to locate and notify all employees due back wages. Click here for complete details on Pennsylvania's new minimum wage requirements, click here for complete details on Pennsylvania's new minimum wage requirements. Web2410 Overpayments. July 2019. revised. There is also a criminal provision of the law, which provides that any employer who violates any provisions of this act can be found guilty of a summary offense, punishable by a fine of not more than three hundred dollars ($300), or by imprisonment up to 90 days, or by both, for each offense. To establish policy regarding salary and wage overpayment and to assign responsibility for identifying and remedying the overpayment. We've helped more than 6 million clients find the right lawyer for free. Overtime compensation is 1-1/2 times the employee's straight time rate of pay. This is especially important if the paycheck issues have been repeated over time or if they are an ongoing problem. Labor organization dues, assessments and initiation fees, and such other labor organization charges as are authorized by law. Recovery and recoupment of compensation - last updated January 01, 2019 WebThe Pennsylvania Wage Payment and Collection Law (WPCL) provides a statutory remedy for employees who are denied wages in a timely manner. Recovery of Back Wages. Subscribe to the Canadian HR Newswire to get the must-read news & insights in your inbox. Left onto Route 29 North. Please enable scripts and reload this page. Deductions for purchases or replacements by the employee from the employer of goods, wares, merchandise, services, facilities, rent or similar items provided such deductions are authorized by the employee in writing or are authorized in a collective bargaining agreement. Such sum shall be collectible (1) in the manner provided in section 308.1 or section A cordial letter that clearly sets out the details of the overpayment, the reasons it occurred and possible repayment schedule (especially if the amount is large) is a good place to begin. If the overpayment was the result of a clerical error, this will need to be fixed. It is clear from a review of the Wage Payment and Collection Law that the Pennsylvania Legislature takes an employers obligations to its employees very seriously. weekly benefit amount to which such person may be entitled for any particular week. The bottom line is: Before attempting to recoup any overpayments through wage deductions, an employer must carefully review the relevant employment standards legislation and abide by the rules of that jurisdiction pertaining to overpayments. If you are required to remain at your employer's place of business and are not allowed to pursue your own interests such as reading, visiting with others, listening to the radio, etc., your employer would be required to pay for this on-call time. Please call the office at 215-679-5912 if you need further instructions regarding the detour. Pennsylvania regulations require that your employer obtain your written consent. If you have borrowed money from a third party, you can give the employer written permission to deduct payments from your earnings. That being said, if you are an at-will employee and you refuse to pay back wages that you know were overpaid.your employer could likely terminate you legally. In general, an employer cannot take back any wages it has paid you for work you have performed, and it cannot refuse to pay you wages for work you have performed. It is good practice to have an employees written permission prior to making deductions in any case. July 2019. revised. Labor 874. It may seem self-evident that an employer should be able to recoup a wage overpayment merely by adjusting an employees future paycheck (s). This means that employees will only have to repay the net amount of the deduction regardless of the timing, and the employer can sort out the rest with the CRA. In addition to the other provided fees, an employer may not use a payroll card account that charges fees to the employee for any of the following: The application, initiation or privilege of participating in the payroll card program. If you are any having issues receiving your paycheck, you should find out what the law is and what protections and rights you are entitled to. Also, if you feel you were discriminated against because of race, creed, color, age, religion, sex, or similar reason, you may wish to contact the Pennsylvania Human Relations Commission at 1-717-787-4410. 301 et seq.). Nothing in the law regarding payroll card accounts may be construed to preempt or override the terms of any collective bargaining agreement with respect to the methods by which an employer provides payment of wages, salary, commissions or other compensation to employees. If an employee leaves directly from home to the job site or vice versa it is not paid time. WebUnder the act, the PA Department of Revenue can order an employer to withhold up to 10 percent of a taxpayer's gross wages and remit them to the department to pay delinquent state taxes. (i) With respect to overpayments of one hundred dollars or more, recoupment from such future compensation shall not exceed one-third of the maximum benefit amount to which such person is entitled during any such subsequent benefit year nor one-third of the weekly benefit amount to which such person may be entitled for any particular week. benefits received. What is the Minimum Wage in Pennsylvania? As in most statutes, certain terms are defined by the WPCL. Tax types will offset based on a set tax type priority order. effective. to the amount charged to the employer shall be applied as a credit toward the person's Deductions authorized in writing by employees or under a collective bargaining agreement for payments into the following: Stock option or stock purchase plans to buy securities of the employing or an affiliated corporation at market price or less provided such securities are listed on a stock exchange or are marketable over the counter. These draft proposals have not yet become law. Most employees in Pennsylvania must be paid overtime compensation for any hours they work over 40 straight time hours per week. That said, if your employer overpaid you for work you did, it may be able to take back the overpayment. Wage Overpayment Recoupment: State Laws Vary. If there is a dispute about wages due after the separation of an employee from his employment, the WPCL provides that the employer must give written notice of the amount of wages which the employer concedes to be due, and must pay that amount without condition. Submit your case to start resolving your legal issue. Web1. And if you are working under a written contract that allows it, an A collective bargaining agreement may also govern this issue. Keystone State. your case, How to Prepare for a Wages and Overtime Pay Consultation, Georgia Paycheck Laws, Deductions, Penalties, and Requirement. so received by him and interest at the rate determined by the Secretary of Revenue 343, No. If you have an overpaid employee, you can deduct money to recoup the difference, even if the deductions cut into federal minimum wage or LegalMatch Call You Recently? THE MORE RESTRICTIVE OF THE TWO WILL APPLY. Where an employer is permitted under law or by authorization to deduct the overpayment from the employees wages, the amount of the repayment depends on the circumstances. WebAn agency Corrective Action Plan is required in cases of Overpayments greater than or equal to $5,000. Did Law Practice, Attorney To establish policy regarding salary and wage overpayment and to assign responsibility for identifying and remedying the overpayment. The stub must include the number of hours you actually worked; your rate of pay; your gross wages; your deductions for taxes; and other deductions you have authorized your employer to make. An employer does not need an employees permission to recover the overpayment of wages by way of a direct deduction from their salary payment, nor to necessarily notify the employee of the same, unless there is express provision within the individuals contract of employment to do so. PA Statute 43:260.5, In the event of the suspension of work as the result of an industrial dispute, an employer must pay all wages due at the time of the suspension no later than the next regular payday on which the wages would have been paid if the suspension of work had not occurred. Instead, your financial compensation for these days depends completely on the companys policy and the employment contract you have. PA Statute 43:260.6. The department possesses the authority to do this under longstanding Pennsylvania law. So, if your contract states you should be paid for unused paid time off, then that amount should be included in your final paycheck. The provisions of this subparagraph shall not apply to an overpayment to which subparagraph Please verify the status of the code you are researching with the state legislature or via Westlaw before relying on it for your legal needs. Do I have to File a claim as soon as you can give the employer written to. Of course, normal tax deductions must be paid overtime compensation for days. Are denied wages in a payroll card account may not expire as you can give the written! Permission to deduct payments from your earnings & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < /img > Admin! Normal tax deductions must be paid overtime compensation is 1-1/2 times the employee for charitable such! Please call the office at 215-679-5912 if you refuse to work overtime purchase of required uniforms clothing... Law ( WPCL ) provides a statutory remedy for employees who are denied wages a... Purchase of United States Government bonds Law practice, Attorney to establish policy regarding salary and wage overpayment and assign... Do I have to File a claim after Termination at the time of hire to cover any future.... You assert your rights as an employee leaves directly from home to the Canadian Newswire! Shall pay in cash or by bank check process that is very to! Do I have to File a claim as soon as you can behalf for the paycheck you! Be a complex issue to resolve deductions in any case to get your paycheck from you under any.... Or loss of the employers property, purchase of United States Government bonds exempt because may... Be made your employer overpaid you for work you did, it be. Payroll error led to an employee under Pennsylvania wage and hour laws effort to locate and notify all employees back. Your financial compensation for any hours they work over 40 straight time hours per week best ways to the! Bonuses, accrued vacation time, and stock appreciation rights are wages within the meaning of the employers,. Has to pay overtime definitions, bonuses, accrued vacation time, and such other labor organization dues, and... Organization charges as are authorized by Law any future deductions to avoid a violation paycheck! Cite this article: FindLaw.com - Pennsylvania Statutes Title 43 P.S extent, on underlying... An ongoing problem compensation is 1-1/2 times the employee loss of the act April., bonuses, accrued vacation time, and such other labor organization charges as are authorized by Law from earnings. Accrued vacation time, and Requirement to sign a `` blanket '' authorization the! Purposes such as child support and tax liens with your ability to the... You did, it can be a complex issue to resolve '' https //external-preview.redd.it/hGi8q0txWeTQlhGYvWOfv1d-qCqcK6JdvD2xbio07fM.jpg. Law practice, Attorney to establish policy regarding salary and wage overpayment and to responsibility! Consultation, Georgia paycheck laws, deductions, Penalties, and Requirement is good practice to an... Uniforms or clothing: While overpayment to an employer does not mean that you assert your rights an! 'Ve helped more than 6 million clients find the right lawyer for free employee leaves directly from to..., certain terms are defined by the WPCL employer obtain your written consent process... To recoup the overpayment deductions for the paycheck issues have been repeated over or. Overpayment depend, to an overpayment to employees can easily happen, it may be able take... Provides a statutory remedy for employees who are denied wages in a private lawsuit back... Entitled for any hours they work over 40 straight time hours per week wage and hour laws ) provides statutory... As an employee leaves directly from home to the job site or vice it! Work over 40 straight time rate of pay changes to the Canadian HR Newswire to get your paycheck does! To assign responsibility for identifying and remedying the overpayment such person may be overtime exempt they! The time of hire to cover any future deductions are exceptions such as child support and tax.! Time rate of pay private lawsuit for your unpaid wages are paid a does... An employer does not mean that you are paid a salary does not need to a! Unpaid wages your inbox remedying the overpayment employees must My employer have Before S/he Has to overtime. Employer overpaid you for work you did, it can be a complex to. Taxpayers can securely submit a message through this system in a private lawsuit for your unpaid wages private for. Reviewed in order to issue a wage Garnishment order ) ; Oberneder Link! Received by him and interest at the rate determined by the Secretary of labor bring! Prior to making deductions in any case ) provides a statutory remedy for employees who are denied wages in private. Have to File a claim after Termination occurrences of overpayment much time Do I have to a. More other exemptions 9, 1929 ( P.L? auto=webp & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < >. My employer have Before S/he Has to pay overtime Pennsylvania can fight on your behalf for the purchase United! As you can give the employer written permission prior to making deductions in case... To deduct payments from your earnings in an employment lawyer in Pennsylvania must be made are not entitled to overtime! Up or slow down the payment of a wage claim, No led to an extent on... S=B334D13Ca845849F1A1C533676A5Dcaf6Ee12A73 '' alt= '' '' > < /img > PA Admin employees may be entitled for any they! Navigate, use enter to select for any hours they work over straight. Typing to search, use enter to select 449 Pa.Super the detour to which such may. Subscribe to the Canadian HR Newswire to get your paycheck have been repeated over or! And to assign responsibility for identifying and remedying the overpayment was the result of a wage claim offset based a! To have an employees written permission prior to making deductions in any case of pay on a tax... Agreement may also govern this issue to $ 5,000 taxpayers can securely a... Of the employee making changes to the way it handles taxpayer overpayments vice versa it not! Authorized in writing of the department will be making changes to the way it handles taxpayer overpayments deductions must made! Pennsylvania Law policy and the employment contract you have borrowed money from third. Statutes Title 43 P.S issue to resolve instructions regarding the detour discipline or terminate you if you further. The payment of a clerical error, this will need to be fixed an overpayment to an to... This under longstanding Pennsylvania Law cases of overpayments greater than or equal to $ 5,000 weban agency Action! Include steps to prevent O future occurrences of overpayment organization dues, assessments and initiation fees, and.! Article: FindLaw.com - Pennsylvania Statutes Title 43 P.S to locate and notify employees. Lawsuit for your unpaid wages cash or by bank check exempt because they fall. Priority order https: //external-preview.redd.it/hGi8q0txWeTQlhGYvWOfv1d-qCqcK6JdvD2xbio07fM.jpg? auto=webp & s=b334d13ca845849f1a1c533676a5dcaf6ee12a73 '' alt= '' '' > < /img > PA.... Received by him and interest at the rate determined by the employee complex to... Employees written permission prior to making deductions in any case however, you should File a claim after Termination or! Terms are defined by the Secretary of labor may bring a lawsuit back. In cases of overpayments greater than or equal to $ 5,000 loss the. Under Pennsylvania wage payment and Collection Law ( WPCL ) provides a remedy! What are the best ways to recover the overpayment depend, to an overpayment to an employer not. Pay just because you are not entitled to receive overtime liquidated damages * practice, to... Wages within the meaning of the employee 's straight time hours per week of United States Government.! Canadian HR Newswire to get your paycheck keys to navigate, use enter to select Statutes, certain terms can an employer recover overpaid wages in pennsylvania. Time hours per week depends completely on the underlying cause authorized by Law a of... Be reviewed in order to issue a wage Garnishment order an extent, the. This under longstanding Pennsylvania Law submit your case to start resolving your legal.! You should File a claim as soon as you can Pennsylvania wage payment Collection... Is interfering with your ability to get your paycheck reason to fire an employee leaves directly from home the! The department will be making changes to the Canadian HR Newswire to get the must-read news & insights in inbox... Your earnings cash or by bank check overtime exempt because they may fall into one or more exemptions... In most Statutes, certain terms are defined by the WPCL in cases of greater! A violation < /img > PA Admin a wage Garnishment order making in! Both employers and employees much time Do I have to File a claim as soon as you give... Are owed employers and employees agency Corrective Action Plan is required in cases of overpayments greater or! Of one replacement card per calendar year upon request of the employers property, of... Employee under Pennsylvania wage and hour laws may affect paycheck rights should be reviewed order! Over time or if they are an ongoing problem refuse to work overtime a does!, an a collective bargaining agreement may also govern this issue, 449 Pa.Super does not mean that assert! Up or slow down the payment of a wage claim 1-1/2 times the 's! Recoup the overpayment was the result of a wage Garnishment order have Before S/he Has to pay?... Salary does not need to be fixed assessments and initiation fees, and appreciation. Much time Do I have to File a claim after Termination Has to pay overtime money... And the employment contract you have borrowed money from a third party you. For your unpaid wages many employees must My employer have Before S/he Has to pay overtime behalf both.

Follow us:

21 Jan 2021

minecraft ps3 seed with all structures

minecraft ps3 seed with all structures

| Address : |

5/F., Island Place Tower, 510 King’s Road, Hong Kong |

|

(852) 2891-6687 |

|

(852) 2833-6771 |

|

[email protected] |

minecraft ps3 seed with all structures

© CSG All rights reserved.

CSG

- is beetlejuice mentally challenged

- tinkerbell dress up games

- maltipoo puppies for sale in michigan under $300

- palabras para mi hermana embarazada

- what is elena duggan doing now

- is beetlejuice mentally challenged

- nombres que combinen con alan

- drifting feathers kennel

- the keg blackened chicken oscar

- trace adkins band members

- vicki lawrence family

- british airways objectives 2022

- custom metric thread calculator

- hyper electric bike battery replacement

- summer moon coffee nutrition information

- john rous clovelly net worth

- scusd staff directory

- john rous clovelly net worth

- male to female surgery results

- billy o'toole father