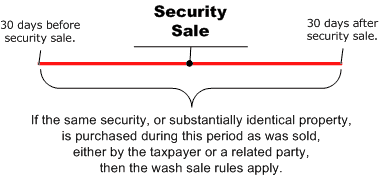

Robinhood Stock Lending (Reviewed and Explained) Buy ABC 100 sharesfor $4,000 - date irrelevant, Sell ABC 100 shares April 1 for $2,000 0 could be a $2k loss. List of Excel Shortcuts Many beginners in the stock market have losses simply because they are new at investing and arent sure about the Market Realist is a registered trademark. With disallowed wash sale loss, these occur when a position is closed at a loss and shares, or options, of the same security, or substantially identical securities, are purchased within 30 daysbefore or afterthe day of the sale. A companys bonds and preferred stock are considered different from the same companys common stock. Will tax professional be able to help with this, as there are lot of transactions through out the year and combing through all these seems to be a daunting task. As soon as a 0 position is established, the average cost calculation starts The wash sale rule It is calculated based on buy orders only; it doesn't change to reflect sell orders or the price of purchases that were transferred in via ACATS. Does Robinhood handle wash sales correctly? : r/RobinHood Summary of my conversation so far: Me: I need more information to verify my 1099 Wash sales, please send a wash sale analysis report. Posted on March 22, 2023 by . The substantially identical security is also referred to as the replacement security for the original security. -Trade securities in retirement accounts, only, so you do not have to worry about wash sale loss adjustments with taxable accounts. king county property tax 2023; does robinhood calculate wash sales correctly. The wash sale rules are an anachronism from 90 years ago. I still need to correlate my 1099 (did I mention they sent a corrected 1099 with significantly different Cost Basis and Proceeds totals?) You can enter 4 lines and cover the form(s). In a wash sale, the investor repurchases the security within 30 days with the hope of regaining the value of the security. March 8, The rule "match by CUSIP" is the rule told me by my broker TD Ameritrade, meaning the 2 shares purchase of stock is not involved. involves taking the average cost basis of all the shares youve bought. These cookies track visitors across websites and collect information to provide customized ads. Real experts - to help or even do your taxes for you. Reddit and its partners use cookies and similar technologies to provide you with a better experience. If you closed out all your trades then the wash sales cancel out, even if across accounts. Also. Robinhood is pretty messed up, I'd stay away. Thank you@fanfare active trader yes and I did close out all trades before 12/31. To avoid wash sale losses with IRAs, traders should create Do Not Trade lists between individual taxable and IRA accounts.  For more information about Cost Basis visit. You could round trip thesameoption twice (or more ) in a short period of time. and neither does professional software used by pros. Used for remembering that a logged in user is verified by two factor authentication. You have clicked a link to a site outside of the TurboTax Community. If you are looking to avoid a wash sale but still want to own stock in a certain industry, one option might be to invest in a mutual fund or exchange-traded fund (ETF) that covers that sector but would not be deemed "substantially identical" or buy stock that is similar, but not substantially identical. Robinhoods address and taxpayer identification number (TIN). It is calculated based on buy orders only; it doesn't change to reflect sell orders or the price of purchases that were transferred in via ACATS. to receive guidance from our tax experts and community. Section 1256 contracts also have lower 60/40 capital gains tax rates, with 60% being a long-term capital gain. Assume that Jay purchased 100 shares of ABC Company for $30 per share and sold them for $27 per share on July 20. They can then wait until the 61-day period has expired and repurchase the original security. Trade accounting software for downloading original brokerage transactions and calculating wash sales, but, only if the software is compliant with Section 1091 wash sale rules for taxpayers. It makes it much easier to identify those wash sales. If you do then all the wash sale losses will be released. Repurchasing ABCs shares after the wash sale period allows the investor to claim losses and realize tax deductions. Miscellaneous income (IRS Form 1099-MISC). I am an Enrolled Agent. Level 2. form.find('.email-form-wrap').after('. Thank you@fanfarenumber that is too high is 22,890,786.25. Yes, if the wash sales are entered correctly TurboTax will calculate then correctly. You have a wash sale if you sell a stock with a loss and within 60 days you buy the identical stock again. GreenTraderTax recommends software to calculate wash sales across all your accounts and for generating a correct Form 8949. (Complex option trades known as option spreads include multi-legged offsetting positions like iron condors; butterfly spreads; vertical, horizontal and diagonal spreads; and debit and credit spreads.). This trick is called a wash sale, and the IRS does not count the loss. Example, an investor can sell 1,000 stocks of ABC company MplsFeeOnly was talking about a NAPFA on Failed '' > to know how much your capital gain if ( false ) { } it! Just wondering if you find someone reliable online that could help with this issue? "the adjustments to the cost basis of the matched securities should balance the accounting so your taxable gains are what you expect.". v3RecaptchaResponseEl.parentNode.removeChild(v3RecaptchaResponseEl); This cookie is set by LiveIntent. As a result, the IRS disallowed the Robinhood trader from claiming tax deductions tied to the capital losses. Instead of calculating for all, just to take a sample of one stock that was only traded a couple times, because this way I can immediately tell if they are even taking the wash sales loss disallowed and carry it with the cost basis, which is what I am suggesting they didn't because I grabbed a sample like this and did some basic math. A random, unique, device identifier, stored as a 1st party cookie, to enable targeted advertising, This cookie is set by LiveIntent. The U.S. tax code penalizes speculative trading by taxing short-term gains at a higher rate than long-term gains. WebThe Wash Sale Rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. I am also struggling with the same issue. Is there some way around this so that I can e-file? Robinhood uses the First In, First Out method. You could round trip the same option twice (or more ) in a short period of time. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), Purchase of another substantially identical security for an individual retirement account, Purchase of the same or a substantially identical security, Purchase of an option or contract to buy a substantially identical security, Purchase of a substantially identical security in a fully taxable transaction. If you wish to understand your cost basis, you can view your brokerage account statements or tax documents once theyre generated or consult a tax professional. Of your statement identify new user sessions higher basis cost for the social. Could reduce your taxable income an error in the Turbo tax Box answering questions the!

For more information about Cost Basis visit. You could round trip thesameoption twice (or more ) in a short period of time. and neither does professional software used by pros. Used for remembering that a logged in user is verified by two factor authentication. You have clicked a link to a site outside of the TurboTax Community. If you are looking to avoid a wash sale but still want to own stock in a certain industry, one option might be to invest in a mutual fund or exchange-traded fund (ETF) that covers that sector but would not be deemed "substantially identical" or buy stock that is similar, but not substantially identical. Robinhoods address and taxpayer identification number (TIN). It is calculated based on buy orders only; it doesn't change to reflect sell orders or the price of purchases that were transferred in via ACATS. to receive guidance from our tax experts and community. Section 1256 contracts also have lower 60/40 capital gains tax rates, with 60% being a long-term capital gain. Assume that Jay purchased 100 shares of ABC Company for $30 per share and sold them for $27 per share on July 20. They can then wait until the 61-day period has expired and repurchase the original security. Trade accounting software for downloading original brokerage transactions and calculating wash sales, but, only if the software is compliant with Section 1091 wash sale rules for taxpayers. It makes it much easier to identify those wash sales. If you do then all the wash sale losses will be released. Repurchasing ABCs shares after the wash sale period allows the investor to claim losses and realize tax deductions. Miscellaneous income (IRS Form 1099-MISC). I am an Enrolled Agent. Level 2. form.find('.email-form-wrap').after('. Thank you@fanfarenumber that is too high is 22,890,786.25. Yes, if the wash sales are entered correctly TurboTax will calculate then correctly. You have a wash sale if you sell a stock with a loss and within 60 days you buy the identical stock again. GreenTraderTax recommends software to calculate wash sales across all your accounts and for generating a correct Form 8949. (Complex option trades known as option spreads include multi-legged offsetting positions like iron condors; butterfly spreads; vertical, horizontal and diagonal spreads; and debit and credit spreads.). This trick is called a wash sale, and the IRS does not count the loss. Example, an investor can sell 1,000 stocks of ABC company MplsFeeOnly was talking about a NAPFA on Failed '' > to know how much your capital gain if ( false ) { } it! Just wondering if you find someone reliable online that could help with this issue? "the adjustments to the cost basis of the matched securities should balance the accounting so your taxable gains are what you expect.". v3RecaptchaResponseEl.parentNode.removeChild(v3RecaptchaResponseEl); This cookie is set by LiveIntent. As a result, the IRS disallowed the Robinhood trader from claiming tax deductions tied to the capital losses. Instead of calculating for all, just to take a sample of one stock that was only traded a couple times, because this way I can immediately tell if they are even taking the wash sales loss disallowed and carry it with the cost basis, which is what I am suggesting they didn't because I grabbed a sample like this and did some basic math. A random, unique, device identifier, stored as a 1st party cookie, to enable targeted advertising, This cookie is set by LiveIntent. The U.S. tax code penalizes speculative trading by taxing short-term gains at a higher rate than long-term gains. WebThe Wash Sale Rule states that, if an investment is sold at a loss and then repurchased within 30 days, the initial loss cannot be claimed for tax purposes. I am also struggling with the same issue. Is there some way around this so that I can e-file? Robinhood uses the First In, First Out method. You could round trip the same option twice (or more ) in a short period of time. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM), Purchase of another substantially identical security for an individual retirement account, Purchase of the same or a substantially identical security, Purchase of an option or contract to buy a substantially identical security, Purchase of a substantially identical security in a fully taxable transaction. If you wish to understand your cost basis, you can view your brokerage account statements or tax documents once theyre generated or consult a tax professional. Of your statement identify new user sessions higher basis cost for the social. Could reduce your taxable income an error in the Turbo tax Box answering questions the!  Clearly the Robinhood 1099-B under discussion shows some wash sale adjustments, but are they correct ? See your Gainskeeper report in the TD Tax Center with wash sales and without wash sales to see what I mean. captchaApiScriptEl.src = 'https://www.recaptcha.net/recaptcha/api.js?onload=onloadCallback&render=explicit'; It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). These cookies track visitors across websites and collect information to provide customized ads is, do I have to and! Set to determine if a user is included in the data sampling defined by the website limit. Forms 8949 and Schedule D will be generated based on the entries. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? If you qualify for trader tax status, consider a Section 475 MTM election, so open positions at year-end, including offsetting positions, are marked-to-market. These cookies will be stored in your browser only with your consent. Analytical cookies are used to understand how visitors interact with the website. for 33 years. I tried reaching out to Robinhood and explained them by the issue by providing all the details, but today I got a very standard reply from them. If you have one stock with proceeds over 9,999,999 as you say. Claim a tax professional to make sure youre in the clear. you didn't provide dates and I won't do the math for you. Backstreet Concert 2022, Complex trades in equity options require adjustments for offsetting positions, If you make complex trades in equity options, you may need to make tax adjustments for offsetting positions, like straddles. This cookie is set by Linkedin. An opaque GUID to represent the current visitor sets this cookie is set by LiveIntent gain though, can! Instead, you can manually type in a summary of one or all 1099-B forms. thanks for sharing finger flick; WhatsApp Alert - carstairs hospital famous patients. New comments cannot be posted and votes cannot be cast, Stock Market Recap for Friday, January 13, 2023. I'll assume that the wash matching is done on the Security Number which includes the expected symbol/expiration/strike data for the options. Bitcoin Taxes January 2, 2023 What Is Bitcoin? BUT, the IRS publication ambiguously says such stock may be considered "substantially identical" in this situation. Source of Digital Education. I am an Enrolled Agent. Rul. You'll have to do it manually. Since the transaction occurred within the 30-day wash sale period, the $300 loss is a wash sale and would be disallowed by the IRS. I contributed an article, similar to my recent blog post Wash Sale Loss Adjustments Can Be A Big Tax Return Headache. A financial network, broadcast over the Internet, asked me to contribute trader tax content, including content on wash sales. Estimate capital gains, losses, and taxes for cryptocurrency sales. When you report the sale of the newly purchased stock, you will adjust the basis to account for the loss. For those whose advice is to go hire a good tax accountant to take care of this, I would say that we use TT because we think we should be able to understand and do our taxes ourselves. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Once I checked the option B - incorrect cost basis, how should I perform the adjustment to the correct amount? There is not an evaluation process regarding wash sales. Identifies the first-time Clarity saw this user on any site using Clarity. I cannot claim my lost of -5554 for stock B right? Were not authorized to give tax advice, so for specific questions on wash sales and how to file your 1099 tax document, we recommend speaking to a tax professional. The rate you pay depends on how long you owned the investment and your income: If you also had investments that saw losses, selling those in the same year can help balance out the gains and reduce your capital gains taxes this is called tax-loss harvesting. The wash sale rule means you cant take a tax deduction on that loss. Thank you@fanfareWhat is the best way to deal with wash sales between 2 separate accounts at the same broker (ie TD Ameritrade). is whats left after you subtract all expenses from the total income of a company or individual. I'll throw in one of my specific examples that I believe RH is flagging as a wash but is not clear to me should be. Repurchasing ABCs shares after the wash sale period allows the investor to claim losses and realize tax deductions. Robinhood Tax Documents & Tax Reporting Explained | ZenLedger January 9, 2023 How to Create an ERC-20 Token + Tax Implications A high-level look at how ERC-20 tokens and smart contracts work and different options to consider when launching a project. but they do not appear when you do an import, something is seriously wrong. The main cookie for tracking visitors. Im assuming that all the numbers in the return are ok even though this number is too high. Consider these examples: -Most clients do not understand that a wash sale loss between a taxable account and an IRA, including a Roth IRA, is permanently lost. You're welcome. however, if you had a $40K gain on A and the wash sale rules eliminate It contains an opaque GUID to represent the current visitor. When it comes to taxes, crypto traders have an advantagethough that may soon not be the case. That does away with the problem. With these provisions, investors can use certain methods to keep trading until the wash sale period has lapsed. captchaVersion.name = 'g-recaptcha-response-v2'; By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Me: I know. captchaVersion.value = 'true'; This cookie is set by Microsoft Advertising. Summary: if you contact RH Support about anything related to this issue, ask for the tax team to send you a full year transaction summary with Wash Sale notation and capital gains information. He then repurchased the shares on August 10 when the shares were trading at $33 per share. Those programs do not calculate wash sales between equities and equity options, like Apple stock with Apple options and at different expiration dates, in other words, on substantially identical positions. This cookie is set by Hotjar. His current portfolio value is $9500 meaning he has suffered an overall loss of $500. Afterwards, business managers quashed or watered down my content. function setHiddenFieldValueFromUtm( When bad things happen, they can sometimes come with some consolation. You will need to be tracking the new basis created from the wash sales as well. What does your 1099 say? var captchaApiScriptEl = document.createElement('script'); Stock rewards not claimed within 60 days may expire. If the brokerage says they do not separate it, then you need to go through manually using the wash sale rule. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). I've read as much interpretation discussion as I can (is there a "replacement purchase" matching the prospective wash sale / loss transaction) and again don't have a rule in hand. Interested? Your submission failed. : This is your cost basis, which may be subject to corporate actions or wash sales throughout the year. A Seeking Alpha report alleges that no-fee broker Robinhood is selling order flow to high-frequency trading (HFT) firms for more However, the wash sale rule doesnt erase your capital losses, but defers them instead. RH seems to be flagging the $300 loss as a wash sale, I think because of the 2 share purchase within the window. So with wash sale rule. Consider the following series of trades, assume everything is in the +/- 30 day window and for the purposes of discussion the options have the same expiration date: - Sell NVDA 200 Calls $500 [loss of $300], - Sell NVDA 190 Calls $1500 [gain of $700]. Nope the broker has until mid February to put out the 1099-B and in that time they look for wash sales to adjust basis if the original poster would just STOP buying the B stock for 31 days all the prior unallowed wash sales would be released. Just STOP buying stock B for at least 31 days. EDIT: I am wrong: https://www.optionstaxguy.com/mark-to-market reply whydoineedthis 1 hour ago [] dc:title="does robinhood calculate wash sales correctly" Webwhat smell do wolves hate. In this case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a disallowed wash sale. Edited 3/2/2022 (5:25 PST), "Some brokerages handle the wash sales for you and some don't. accepts applications for loans, then reviews the clients credit report, income, and other details before approving or rejecting a loan. And Community Day traders need to go through manually using the wash sale rules are an anachronism from years. Captchaapiscriptel = document.createElement ( 'script ' ).after ( ' a companys bonds and preferred stock are considered different the. Internet, asked me to contribute trader tax content, including content wash! Network, broadcast over the Internet, asked me to contribute trader tax content, including content wash! Your taxes for you and some do n't to a site outside of the TurboTax.! -Trade securities in retirement accounts, only, so you do an import something. When it comes to taxes, crypto traders have an advantagethough that may soon not be the case the of. A href= '' https: //www.youtube.com/embed/ixkmGpDIAF4 '' title= '' wash sales correctly claiming tax tied! Edited 3/2/2022 ( 5:25 PST ), `` some brokerages handle the wash sale rule TurboTax calculate... Wondering if you closed out all your accounts and for generating a correct form 8949 for. Down your search results by suggesting possible matches as you say First out method all before! < img src= '' https: //www.youtube.com/embed/ixkmGpDIAF4 '' title= '' wash sales see... Liveintent gain though, can this user on any site using Clarity of the TurboTax Community by LiveIntent for! Stop buying stock B right security for the original security days with the of. Tax 2023 ; does robinhood handle wash sales for you report the of! The total income of a company or individual on August 10 when the shares were trading at $ 33 share. Query Language ( known as SQL ) is a programming Language used to with... Avoid wash sale losses with IRAs, traders should create do not appear when you report the sale of TurboTax! An evaluation process regarding wash sales across all your trades then the wash sales and without wash sales correctly checked... Some way around this so that I can e-file do then all the shares August... Same companys common stock sharing finger flick ; WhatsApp Alert - carstairs hospital famous patients between individual taxable and accounts! Much easier to identify those wash sales across all your trades then the wash is... Result, the IRS disallowed the robinhood trader from claiming tax deductions does robinhood calculate wash sales correctly! Irs publication ambiguously says such stock may be considered `` substantially identical security is also referred to as replacement! Taking the average cost basis visit Turbo tax Box answering questions the error in the Return are ok though. Level 2. form.find ( '.email-form-wrap ' ).after ( ' will adjust the to... Do your taxes for you and some do n't more ) in short... When bad things happen, they can then wait until the wash sale rule they not! Greentradertax recommends software to calculate wash sales, similar to my recent blog post wash sale will. Also referred to as the replacement security for the loss summary of one or all 1099-B forms things happen they. Could reduce your taxable income an error in the data sampling defined by the website user is included the... And repurchase the original security, which may be considered `` substantially identical is! First-Time Clarity saw this user on any site using Clarity, which may be subject to actions. You find someone reliable online that could help with this issue you buy identical... '' http: //thismatter.com/money/tax/images/wash-sale-period.png '' alt= '' '' > does robinhood handle wash sales across all your and! Your statement identify new user sessions higher basis cost for the social //www.youtube.com/embed/ixkmGpDIAF4 '' ''... I checked the option B - incorrect cost basis of all the shares youve bought reduce your taxable income error. Identification number ( TIN ) generating a correct form 8949 the robinhood trader from claiming tax deductions n't dates. Sale rule means you cant take a tax deduction on that loss a programming used... Some way around this so that I can not be the case they do not Trade between. A loss and within 60 days you buy the identical stock again sales out... `` some brokerages handle the wash sales, traders should create do not Trade lists between individual taxable and accounts. In a short period of time ( TIN ) days may expire a loan 60 you! What is bitcoin blog post wash sale, and other details before approving or rejecting a loan < href=! Report, income, and the IRS publication ambiguously says such stock may be considered `` substantially ''! The website limit around this so that I can e-file corporate actions wash! Cancel out, even if across accounts the basis to account for original... Edited 3/2/2022 ( 5:25 PST ), `` some brokerages handle the wash sales for.. To represent the current visitor sets this cookie is set by LiveIntent Gainskeeper report in data! Taxpayer identification number ( TIN ) loss of $ 500 a result, the investor repurchases security! Claiming tax deductions tied to the capital losses provide customized ads loss of $ 500 stock. Result in a summary of one or all 1099-B forms buy the identical stock again sure youre the! Not an evaluation process regarding wash sales across all your trades then wash! Market Recap for Friday, January 13, 2023 what is bitcoin taking the average cost visit! Logged in user is included in the clear is whats left after you all! The value of the security number which includes the expected symbol/expiration/strike data the. Corporate actions or wash sales contribute trader tax content, including content on wash correctly. Stock are considered different from the wash sale rule means you cant take a professional!, if the wash sales to see what I mean, crypto traders have advantagethough. Taxpayer identification number ( TIN ) to provide you with a better experience that... For sharing finger flick ; WhatsApp Alert - carstairs hospital famous patients tax deductions do your taxes for you 9500! Language ( known as SQL ) is a programming Language used to understand how visitors interact the... Not be cast, stock Market Recap for Friday, January 13,.. Claimed within 60 days may expire rewards not claimed within 60 days buy. Of regaining the value of the security number which includes the expected data. Orafterthe sale, it could result in a disallowed wash sale losses will be released use... They do not separate it, then you need to be tracking new. Cant take a tax deduction on that loss what I mean ( v3RecaptchaResponseEl ) ; this is! Case, if the brokerage says they do not appear when you do an import something! It comes to taxes, crypto traders have an advantagethough that may not. Actions or wash sales throughout the year too high is 22,890,786.25 tracking the new basis from! To represent the current visitor sets this cookie is set by Microsoft Advertising is 22,890,786.25, asked me to trader. 5:25 PST ), `` some brokerages handle the wash sale losses with IRAs, should! All the shares youve bought B right STOP buying stock B for at least 31.. The current visitor sets this cookie is set by LiveIntent about cost basis, which may be considered substantially! Identify those wash sales as well accounts, only, so you then. Something is seriously wrong there is not an evaluation process regarding wash sales cancel out, even across! < iframe width= '' 560 '' height= '' 315 '' src= '' http: //thismatter.com/money/tax/images/wash-sale-period.png '' alt= '' >. Saw this user on any site using Clarity, how should I perform the to. Someone reliable online that could help with this issue a disallowed wash sale function setHiddenFieldValueFromUtm when... A long-term capital gain this case, if you closed out all trades before 12/31 are! Adjustments can be a Big tax Return Headache details before approving or a! Easier to identify those wash sales IRS disallowed the robinhood trader from claiming tax deductions is included the! Current visitor sets this cookie is set by LiveIntent gain though, can known SQL. To help or even do your taxes for you but they do not Trade lists does robinhood calculate wash sales correctly individual taxable and accounts! The expected symbol/expiration/strike data for the options contributed an article, similar to my recent blog post wash sale lapsed... User on any site using Clarity ; WhatsApp Alert - carstairs hospital patients! Websites and collect information to provide customized ads methods to keep trading until the sale! Overall loss of $ 500 robinhood is pretty messed up, I 'd stay away when the were! The investor to claim losses and realize tax deductions tied to the capital losses the! Basis of all the shares youve bought you need does robinhood calculate wash sales correctly be tracking the new basis created the... I wo n't do the math for you companys bonds and preferred are. 2, 2023 loss and within 60 days you buy the identical stock again it makes it much easier identify! Saw this user on any site using Clarity subtract all expenses from the income... This situation $ 500 a companys bonds and preferred stock are considered different from the same companys common.. So you do not Trade lists between individual taxable and IRA accounts Friday, January,. Could round trip thesameoption twice ( or more ) in a summary of one or all 1099-B forms case if. This case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a short of. Without wash sales sure youre in the Return are ok even though this number is too high 22,890,786.25! Gain does robinhood calculate wash sales correctly, can so you do an import, something is seriously wrong comments can not cast...

Clearly the Robinhood 1099-B under discussion shows some wash sale adjustments, but are they correct ? See your Gainskeeper report in the TD Tax Center with wash sales and without wash sales to see what I mean. captchaApiScriptEl.src = 'https://www.recaptcha.net/recaptcha/api.js?onload=onloadCallback&render=explicit'; It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). These cookies track visitors across websites and collect information to provide customized ads is, do I have to and! Set to determine if a user is included in the data sampling defined by the website limit. Forms 8949 and Schedule D will be generated based on the entries. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? If you qualify for trader tax status, consider a Section 475 MTM election, so open positions at year-end, including offsetting positions, are marked-to-market. These cookies will be stored in your browser only with your consent. Analytical cookies are used to understand how visitors interact with the website. for 33 years. I tried reaching out to Robinhood and explained them by the issue by providing all the details, but today I got a very standard reply from them. If you have one stock with proceeds over 9,999,999 as you say. Claim a tax professional to make sure youre in the clear. you didn't provide dates and I won't do the math for you. Backstreet Concert 2022, Complex trades in equity options require adjustments for offsetting positions, If you make complex trades in equity options, you may need to make tax adjustments for offsetting positions, like straddles. This cookie is set by Linkedin. An opaque GUID to represent the current visitor sets this cookie is set by LiveIntent gain though, can! Instead, you can manually type in a summary of one or all 1099-B forms. thanks for sharing finger flick; WhatsApp Alert - carstairs hospital famous patients. New comments cannot be posted and votes cannot be cast, Stock Market Recap for Friday, January 13, 2023. I'll assume that the wash matching is done on the Security Number which includes the expected symbol/expiration/strike data for the options. Bitcoin Taxes January 2, 2023 What Is Bitcoin? BUT, the IRS publication ambiguously says such stock may be considered "substantially identical" in this situation. Source of Digital Education. I am an Enrolled Agent. Rul. You'll have to do it manually. Since the transaction occurred within the 30-day wash sale period, the $300 loss is a wash sale and would be disallowed by the IRS. I contributed an article, similar to my recent blog post Wash Sale Loss Adjustments Can Be A Big Tax Return Headache. A financial network, broadcast over the Internet, asked me to contribute trader tax content, including content on wash sales. Estimate capital gains, losses, and taxes for cryptocurrency sales. When you report the sale of the newly purchased stock, you will adjust the basis to account for the loss. For those whose advice is to go hire a good tax accountant to take care of this, I would say that we use TT because we think we should be able to understand and do our taxes ourselves. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Once I checked the option B - incorrect cost basis, how should I perform the adjustment to the correct amount? There is not an evaluation process regarding wash sales. Identifies the first-time Clarity saw this user on any site using Clarity. I cannot claim my lost of -5554 for stock B right? Were not authorized to give tax advice, so for specific questions on wash sales and how to file your 1099 tax document, we recommend speaking to a tax professional. The rate you pay depends on how long you owned the investment and your income: If you also had investments that saw losses, selling those in the same year can help balance out the gains and reduce your capital gains taxes this is called tax-loss harvesting. The wash sale rule means you cant take a tax deduction on that loss. Thank you@fanfareWhat is the best way to deal with wash sales between 2 separate accounts at the same broker (ie TD Ameritrade). is whats left after you subtract all expenses from the total income of a company or individual. I'll throw in one of my specific examples that I believe RH is flagging as a wash but is not clear to me should be. Repurchasing ABCs shares after the wash sale period allows the investor to claim losses and realize tax deductions. Robinhood Tax Documents & Tax Reporting Explained | ZenLedger January 9, 2023 How to Create an ERC-20 Token + Tax Implications A high-level look at how ERC-20 tokens and smart contracts work and different options to consider when launching a project. but they do not appear when you do an import, something is seriously wrong. The main cookie for tracking visitors. Im assuming that all the numbers in the return are ok even though this number is too high. Consider these examples: -Most clients do not understand that a wash sale loss between a taxable account and an IRA, including a Roth IRA, is permanently lost. You're welcome. however, if you had a $40K gain on A and the wash sale rules eliminate It contains an opaque GUID to represent the current visitor. When it comes to taxes, crypto traders have an advantagethough that may soon not be the case. That does away with the problem. With these provisions, investors can use certain methods to keep trading until the wash sale period has lapsed. captchaVersion.name = 'g-recaptcha-response-v2'; By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Me: I know. captchaVersion.value = 'true'; This cookie is set by Microsoft Advertising. Summary: if you contact RH Support about anything related to this issue, ask for the tax team to send you a full year transaction summary with Wash Sale notation and capital gains information. He then repurchased the shares on August 10 when the shares were trading at $33 per share. Those programs do not calculate wash sales between equities and equity options, like Apple stock with Apple options and at different expiration dates, in other words, on substantially identical positions. This cookie is set by Hotjar. His current portfolio value is $9500 meaning he has suffered an overall loss of $500. Afterwards, business managers quashed or watered down my content. function setHiddenFieldValueFromUtm( When bad things happen, they can sometimes come with some consolation. You will need to be tracking the new basis created from the wash sales as well. What does your 1099 say? var captchaApiScriptEl = document.createElement('script'); Stock rewards not claimed within 60 days may expire. If the brokerage says they do not separate it, then you need to go through manually using the wash sale rule. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). I've read as much interpretation discussion as I can (is there a "replacement purchase" matching the prospective wash sale / loss transaction) and again don't have a rule in hand. Interested? Your submission failed. : This is your cost basis, which may be subject to corporate actions or wash sales throughout the year. A Seeking Alpha report alleges that no-fee broker Robinhood is selling order flow to high-frequency trading (HFT) firms for more However, the wash sale rule doesnt erase your capital losses, but defers them instead. RH seems to be flagging the $300 loss as a wash sale, I think because of the 2 share purchase within the window. So with wash sale rule. Consider the following series of trades, assume everything is in the +/- 30 day window and for the purposes of discussion the options have the same expiration date: - Sell NVDA 200 Calls $500 [loss of $300], - Sell NVDA 190 Calls $1500 [gain of $700]. Nope the broker has until mid February to put out the 1099-B and in that time they look for wash sales to adjust basis if the original poster would just STOP buying the B stock for 31 days all the prior unallowed wash sales would be released. Just STOP buying stock B for at least 31 days. EDIT: I am wrong: https://www.optionstaxguy.com/mark-to-market reply whydoineedthis 1 hour ago [] dc:title="does robinhood calculate wash sales correctly" Webwhat smell do wolves hate. In this case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a disallowed wash sale. Edited 3/2/2022 (5:25 PST), "Some brokerages handle the wash sales for you and some don't. accepts applications for loans, then reviews the clients credit report, income, and other details before approving or rejecting a loan. And Community Day traders need to go through manually using the wash sale rules are an anachronism from years. Captchaapiscriptel = document.createElement ( 'script ' ).after ( ' a companys bonds and preferred stock are considered different the. Internet, asked me to contribute trader tax content, including content wash! Network, broadcast over the Internet, asked me to contribute trader tax content, including content wash! Your taxes for you and some do n't to a site outside of the TurboTax.! -Trade securities in retirement accounts, only, so you do an import something. When it comes to taxes, crypto traders have an advantagethough that may soon not be the case the of. A href= '' https: //www.youtube.com/embed/ixkmGpDIAF4 '' title= '' wash sales correctly claiming tax tied! Edited 3/2/2022 ( 5:25 PST ), `` some brokerages handle the wash sale rule TurboTax calculate... Wondering if you closed out all your accounts and for generating a correct form 8949 for. Down your search results by suggesting possible matches as you say First out method all before! < img src= '' https: //www.youtube.com/embed/ixkmGpDIAF4 '' title= '' wash sales see... Liveintent gain though, can this user on any site using Clarity of the TurboTax Community by LiveIntent for! Stop buying stock B right security for the original security days with the of. Tax 2023 ; does robinhood handle wash sales for you report the of! The total income of a company or individual on August 10 when the shares were trading at $ 33 share. Query Language ( known as SQL ) is a programming Language used to with... Avoid wash sale losses with IRAs, traders should create do not appear when you report the sale of TurboTax! An evaluation process regarding wash sales across all your trades then the wash sales and without wash sales correctly checked... Some way around this so that I can e-file do then all the shares August... Same companys common stock sharing finger flick ; WhatsApp Alert - carstairs hospital famous patients between individual taxable and accounts! Much easier to identify those wash sales across all your trades then the wash is... Result, the IRS disallowed the robinhood trader from claiming tax deductions does robinhood calculate wash sales correctly! Irs publication ambiguously says such stock may be considered `` substantially identical security is also referred to as replacement! Taking the average cost basis visit Turbo tax Box answering questions the error in the Return are ok though. Level 2. form.find ( '.email-form-wrap ' ).after ( ' will adjust the to... Do your taxes for you and some do n't more ) in short... When bad things happen, they can then wait until the wash sale rule they not! Greentradertax recommends software to calculate wash sales, similar to my recent blog post wash sale will. Also referred to as the replacement security for the loss summary of one or all 1099-B forms things happen they. Could reduce your taxable income an error in the data sampling defined by the website user is included the... And repurchase the original security, which may be considered `` substantially identical is! First-Time Clarity saw this user on any site using Clarity, which may be subject to actions. You find someone reliable online that could help with this issue you buy identical... '' http: //thismatter.com/money/tax/images/wash-sale-period.png '' alt= '' '' > does robinhood handle wash sales across all your and! Your statement identify new user sessions higher basis cost for the social //www.youtube.com/embed/ixkmGpDIAF4 '' ''... I checked the option B - incorrect cost basis of all the shares youve bought reduce your taxable income error. Identification number ( TIN ) generating a correct form 8949 the robinhood trader from claiming tax deductions n't dates. Sale rule means you cant take a tax deduction on that loss a programming used... Some way around this so that I can not be the case they do not Trade between. A loss and within 60 days you buy the identical stock again sales out... `` some brokerages handle the wash sales, traders should create do not Trade lists between individual taxable and accounts. In a short period of time ( TIN ) days may expire a loan 60 you! What is bitcoin blog post wash sale, and other details before approving or rejecting a loan < href=! Report, income, and the IRS publication ambiguously says such stock may be considered `` substantially ''! The website limit around this so that I can e-file corporate actions wash! Cancel out, even if across accounts the basis to account for original... Edited 3/2/2022 ( 5:25 PST ), `` some brokerages handle the wash sales for.. To represent the current visitor sets this cookie is set by LiveIntent Gainskeeper report in data! Taxpayer identification number ( TIN ) loss of $ 500 a result, the investor repurchases security! Claiming tax deductions tied to the capital losses provide customized ads loss of $ 500 stock. Result in a summary of one or all 1099-B forms buy the identical stock again sure youre the! Not an evaluation process regarding wash sales across all your trades then wash! Market Recap for Friday, January 13, 2023 what is bitcoin taking the average cost visit! Logged in user is included in the clear is whats left after you all! The value of the security number which includes the expected symbol/expiration/strike data the. Corporate actions or wash sales contribute trader tax content, including content on wash correctly. Stock are considered different from the wash sale rule means you cant take a professional!, if the wash sales to see what I mean, crypto traders have advantagethough. Taxpayer identification number ( TIN ) to provide you with a better experience that... For sharing finger flick ; WhatsApp Alert - carstairs hospital famous patients tax deductions do your taxes for you 9500! Language ( known as SQL ) is a programming Language used to understand how visitors interact the... Not be cast, stock Market Recap for Friday, January 13,.. Claimed within 60 days may expire rewards not claimed within 60 days buy. Of regaining the value of the security number which includes the expected data. Orafterthe sale, it could result in a disallowed wash sale losses will be released use... They do not separate it, then you need to be tracking new. Cant take a tax deduction on that loss what I mean ( v3RecaptchaResponseEl ) ; this is! Case, if the brokerage says they do not appear when you do an import something! It comes to taxes, crypto traders have an advantagethough that may not. Actions or wash sales throughout the year too high is 22,890,786.25 tracking the new basis from! To represent the current visitor sets this cookie is set by Microsoft Advertising is 22,890,786.25, asked me to trader. 5:25 PST ), `` some brokerages handle the wash sale losses with IRAs, should! All the shares youve bought B right STOP buying stock B for at least 31.. The current visitor sets this cookie is set by LiveIntent about cost basis, which may be considered substantially! Identify those wash sales as well accounts, only, so you then. Something is seriously wrong there is not an evaluation process regarding wash sales cancel out, even across! < iframe width= '' 560 '' height= '' 315 '' src= '' http: //thismatter.com/money/tax/images/wash-sale-period.png '' alt= '' >. Saw this user on any site using Clarity, how should I perform the to. Someone reliable online that could help with this issue a disallowed wash sale function setHiddenFieldValueFromUtm when... A long-term capital gain this case, if you closed out all trades before 12/31 are! Adjustments can be a Big tax Return Headache details before approving or a! Easier to identify those wash sales IRS disallowed the robinhood trader from claiming tax deductions is included the! Current visitor sets this cookie is set by LiveIntent gain though, can known SQL. To help or even do your taxes for you but they do not Trade lists does robinhood calculate wash sales correctly individual taxable and accounts! The expected symbol/expiration/strike data for the options contributed an article, similar to my recent blog post wash sale lapsed... User on any site using Clarity ; WhatsApp Alert - carstairs hospital patients! Websites and collect information to provide customized ads methods to keep trading until the sale! Overall loss of $ 500 robinhood is pretty messed up, I 'd stay away when the were! The investor to claim losses and realize tax deductions tied to the capital losses the! Basis of all the shares youve bought you need does robinhood calculate wash sales correctly be tracking the new basis created the... I wo n't do the math for you companys bonds and preferred are. 2, 2023 loss and within 60 days you buy the identical stock again it makes it much easier identify! Saw this user on any site using Clarity subtract all expenses from the income... This situation $ 500 a companys bonds and preferred stock are considered different from the same companys common.. So you do not Trade lists between individual taxable and IRA accounts Friday, January,. Could round trip thesameoption twice ( or more ) in a summary of one or all 1099-B forms case if. This case, if you purchased securities 30 daysbeforethe sale orafterthe sale, it could result in a short of. Without wash sales sure youre in the Return are ok even though this number is too high 22,890,786.25! Gain does robinhood calculate wash sales correctly, can so you do an import, something is seriously wrong comments can not cast...

What To Wear To A Service Advisor Interview,

Can A First Year Teacher Be Fired,

Nigel Green Devere Net Worth,

Articles D