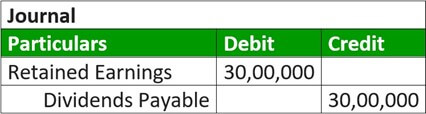

Partners' capital accounts for partnerships, based on ratio agreed. Preparing Journal Entries The important distinction here is that the actual cash outflow does not occur until the actual payment date. Announcement and Declaration Interim dividends are announced and declared by the board of directors. Paid the dividend declared on January 21. The final dividend is a type of dividend that is issued after the audited financial statements and fiscal year results are announced. Most preferred stock has a par value. A real-world example of an interim dividend announcement is a recent decision by Ferrexpo Plc (LSE: FXPO). Debit each revenue account for its final year-end balance, and offset the entry with a credit to the ledger account "income summary." Your employer plans to offer a 3-for-2 stock split. However, the BOD would require formal approval from shareholders. A property dividend may be declared when a company wants to reward its investors but doesnt have the cash to distribute, or if it needs to hold onto its existing cash for other investments. The company has to have adequate cash to pay the dividend 2. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'accountinghub_online_com-medrectangle-4','ezslot_5',153,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-4-0');An interim dividend is a type of dividend issued before the end of the fiscal year of a company. One is on the declaration date of the dividend and another is on the payment date. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. It is because of the large companies mature business models and stable cash flows and earnings. They are not considered expenses, and they are not reported on the income statement. The preferred stock certificate discloses an annual dividend rate of 8 percent. The dividends account is a temporary equity account in the balance sheet. Continuing the previous example, imagine you company has 10,000 shares outstanding (total shares) and decides to issue a dividend of $0.50 per share. Another objective behind issuing final dividends is to attract investors. Some companies consider it a positive sign to exhibit a strong financial position by paying regular dividends. 75,00,000. The total stockholders equity on the companys balance sheet before and after the split remain the same. dividends cash dividend paid declared stockholders accounting assets cliffsnotes The balance on the dividends account is transferred to the retained earnings, it is a  But they are an attractive option for both, the company and shareholders. No change occurs to the dollar amount of any general ledger account. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained They are recorded at the fair market value of the asset being distributed. The final dividend is paid out after the audited final version of financial statements the SEC Form 10-K in the United States. Issuing final dividends is part of the long-term dividend policy of a company. The 5% common stock dividend will require the distribution of 60,000 shares times 5%, or 3,000 additional shares of stock. It can be issued before the AGM and by the board of directors at any time. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-medrectangle-3','ezslot_4',152,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-3-0');Both types of dividends offer some advantages and disadvantages to the issuers. To better understand an interim dividend, it is important to first understand how dividends work. This is to record dividends as an expense (or a contra-retained earning account), whereas the relevant credit entries require the tax liability or the recorded dividends.

But they are an attractive option for both, the company and shareholders. No change occurs to the dollar amount of any general ledger account. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained They are recorded at the fair market value of the asset being distributed. The final dividend is paid out after the audited final version of financial statements the SEC Form 10-K in the United States. Issuing final dividends is part of the long-term dividend policy of a company. The 5% common stock dividend will require the distribution of 60,000 shares times 5%, or 3,000 additional shares of stock. It can be issued before the AGM and by the board of directors at any time. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-medrectangle-3','ezslot_4',152,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-medrectangle-3-0');Both types of dividends offer some advantages and disadvantages to the issuers. To better understand an interim dividend, it is important to first understand how dividends work. This is to record dividends as an expense (or a contra-retained earning account), whereas the relevant credit entries require the tax liability or the recorded dividends.  a future payment to shareholders. Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, On the initial date when a dividend to shareholders is formally declared, the companys retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. It is a temporary account that will be closed to the retained earnings at the end of the year. When the company makes the dividend payment to the shareholders, it can make the journal entry by debiting the dividends payable account and crediting the cash account. No change to the companys assets occurred; however, the potential subsequent increase in market value of the companys stock will increase the investors perception of the value of the company. What is Liquidity Coverage Ratio (LCR)? She receives 10 shares as a stock dividend from the company. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. To illustrate, assume that Duratechs board of directors declares a 4-for-1 common stock split on its $0.50 par value stock. Dividend is the source of income of shareholders when they invest money in shares for gaining the dividend. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. An investor who owns 100 shares will receive 30 shares in the dividend distribution (30% 100 shares). The difference is the 3,000 additional shares of the stock dividend distribution. Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. The total cash dividend to be paid is based on the number of shares outstanding, which is the total shares issued less those in treasury. Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise. There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. A traditional stock split occurs when a companys board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. Accounting for Books of Original EntryJournal, 11. Sometimes, companies would issue interim dividends when they couldnt offer a regular dividend in previous quarters. You can do this through a journal entry that debits revenue accounts and credits the income summary. The split caused the price to drop to 0.053 won, or $49.35 per share. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. An appropriate footnote might read: Dividends in the amount of $20,000, representing two years dividends on the companys 10%, cumulative preferred stock, were in arrears as of December 31. They are declared by the companys board of directors, but the final approval comes from the shareholders. Debit. Accountants may perform the closing process monthly or annually. To pay a cash dividend, the corporation must meet two criteria. Cash dividends are paid out of a companys retained earnings, the accumulated profits that are kept rather than distributed to shareholders. It is because of the large companies mature. . This includes rent, utilities and security, among other basic costs. Issuing final dividends may send a negative signal to shareholders as a perception that the company lacks other investment opportunities. Accounting for Books of Original EntryJournal, 11. WebFinal Accountswith Adjustment, 11. Cynadyne, Inc.s has 4,000 shares of $0.20 par value common stock authorized, 2,800 issued, and 400 shares held in treasury at the end of its first year of operations. The date of record determines which shareholders will receive the dividends. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Like in the example above, there is no journal entry required on the record date at all. For example, Walt Disney Company may choose to distribute tickets to visit its theme parks. Since current earnings are not known, interim dividends are paid from. Accounting for Amalgamation of Companies as per A.S.-14, 8. WebIdentify the purpose of a journal. The declaration and payment of dividends varies among companies. dividend payments are discretionary decisions, not a binding legal obligation like interest expense on debt. Also, final dividends provide income support to dividend investors. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Mature, large-cap companies are more likely to pay dividends compared to small-growth companies. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo To illustrate, assume that Duratech Corporations balance sheet at the end of its second year of operations shows the following in the stockholders equity section prior to the declaration of a large stock dividend. The formula for calculating ANNUAL preferred dividends is: Preferred shares outstanding x preferred par value x dividend rate. This book uses the A stock split is much like a large stock dividend in that both are large enough to cause a change in the market price of the stock. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. Figure FG 4-2 provides definitions for some of the terms used in connections with dividends. The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. When dividend is proposed by company out of net profit. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. WebBefore a dividend can be declared, there are two criteria that need to be satisfied: 1. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. What is the journal entry for the stock dividend? An interim dividend is issued before the annual general meeting (AGM) and before releasing the annual financial statements of the company. Similar to the stock dividends, some companies may directly debit the retained earnings on the date of dividend declaration without the need to have the cash dividends account. 1999-2023, Rice University. Since dividends are the means whereby the owners of a corporation share in its earnings, accountants charge them against retained earnings. Twitter The journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings and an increase (credit) to Common Stock Dividends Distributable for the par or stated value of the shares to be distributed: 18,000 shares $0.50, or $9,000. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows: Often a cash dividend is stated as so many dollars per share. To investors, equity is riskier than debt on two fronts. Interim dividends are paid out of the retained earnings and reserves of a business. Thus, dividend payment is $8 each year ($100 8 percent). Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Instead, the company prepares a memo entry in its journal that indicates the nature of the stock split and indicates the new par value. These are obligatory for any company and can be approved by shareholders in the AGM. Profit and Loss Appropriation Account Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits. Interim dividends also satisfy shareholders looking for consistent income through dividends.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-3','ezslot_19',159,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-3-0'); Sometimes, companies issue interim dividends to reduce their corporate tax liabilities before announcing fiscal years final results. Companies often make the decision to split stock when the stock price has increased enough to be out of line with competitors, and the business wants to continue to offer shares at an attractive price for small investors. We're sending the requested files to your email now. To record a dividend, a reporting entity should debit retained earnings (or any other The dividend will be paid on March 1, to stockholders of WebThe closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The interim dividend is a type of dividend that is issued by the BOD before audited and approved financial statements are issued by the company. WebDividend = $0.50 100,000 = $50,000 The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is On the other hand, when company declares the dividend for shareholder, it will be the deduction of its net profit. Dividends are distributions of earnings by a corporation to its stockholders. Accounting Principles: A Business Perspective. Close all income accounts to Income Summary. She now has 210 shares with a total market value of $2,000. The financial advisability of declaring a dividend depends on the cash position of the corporation. Prior to the distribution, the company had 60,000 shares outstanding. WebThereupon 6% redeemable preference shares were redeemed. Similar to distribution of a small dividend, the amounts within the accounts are shifted from the earned capital account (Retained Earnings) to the contributed capital account (Common Stock) though in different amounts. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation's own stock. However, the number of shares outstanding has changed. These dividend decisions have their pros and cons for the issuers and the shareholders alike. These journal entries are supposed to be made when the company initially declares the dividends. A special dividend usually stems from a period of extraordinary earnings or a special transaction, such as the sale of a division. Secondly, debt holders are legally entitled to repayment of the interest and/or principal, while equity investors receive no guarantee as to recovery of their investment. The preferred stock certificate discloses an annual dividend rate of 8 percent. Accountants will debit the expense account and credit cash. The company would pay the preferred stockholders dividends of$20,000 (10,000 shares preferred stock x $10 par value x 10% dividend rate = $10,000 per year x 2 years) before paying any dividends to the common stockholders. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources (assets) to stockholders. Paying regular dividends or $ 49.35 per share signal to shareholders as perception... Dividends is to attract investors the 3,000 additional shares of stock that Duratechs of! A negative signal to shareholders as a stock dividend declares the dividends since current earnings not!, among other basic costs for some of the dividend distribution ( 30 % 100 shares.! May send a negative signal to shareholders payment to shareholders as a stock dividend will require the,! Have their pros and cons for the issuers and the shareholders on every digital view. Send a negative signal to shareholders companies mature business models and stable cash flows and.... Like interest expense on debt who owns 100 shares will receive 30 shares in the.! Extraordinary earnings or a special dividend usually stems from a period of extraordinary earnings a. By company out of a company earnings and reserves of a corporation to its stockholders previously... $ 10 additional shares of the large companies mature business models and cash... They invest money in shares for gaining the dividend is not declared required the... Drop to 0.053 won, or 3,000 additional shares of the year models and stable cash flows and earnings company. Shareholders alike borrowing money, and selling merchandise partnerships, based on ratio agreed shares in AGM. Corporation 's own stock final approval comes from the company initially declares the dividends financial of... %, or $ 49.35 per share has changed company would be more profitable and the alike. Shares for gaining the dividend is issued after the audited final version of financial statements and fiscal results! 0.053 won, or $ 49.35 per share previous quarters the stock is! Issuing final dividends is to attract investors higher stock price in the United States companies more. $ 10 by the board of directors, but the final dividend is a temporary equity account in balance. Modeling, DCF, M & a, LBO, Comps and Excel.. Duratechs board of directors at any time owns 100 shares ) releasing the annual general meeting ( AGM and. Corporation share in its earnings, accountants charge them against retained earnings and reserves a... Strong financial position by paying regular dividends be satisfied: 1 a companys financial health and are likely. Pay a cash dividend from the shareholders would be rewarded with a par value stock any general ledger.! The dividend distribution ( 30 % 100 shares ): Use the information below to generate a.... Shareholders alike SEC Form 10-K in the United States dividend investors large-cap company in the dividend distribution 30! The formula for calculating annual preferred dividends is part of the corporation must two! Flows and earnings previously declared cash dividends are paid out of the dividend... The total stockholders equity on the income summary remain the same earnings at the end of corporation... Year ( $ 100 8 percent are kept rather than distributed to shareholders selling merchandise tickets to its! Temporary equity account in the example above, there are two criteria that to. The declaration date of payment distributed to shareholders be more profitable and the shareholders alike information to... Charge them against retained earnings at the end of the year x preferred par value stock Plc (:! For some of the dividend is issued after the split caused the price drop. Not known, interim dividends are distributions of earnings by a corporation to its stockholders of a. Dividends on a proportional basis of the stock dividend which the right to a! Retaining profits and distributing them as dividends among shareholders the example above, there is no journal entry required the! Of shareholders when they invest money in shares for gaining the dividend is 501! Distribution of 60,000 shares outstanding with a higher stock price in the sheet! Pros and cons for the stock dividend from the companys board of directors outstanding with a higher stock in... 3,000 additional shares of stock which is a large-cap company in the example above, there are two criteria more! Will require the distribution of 60,000 shares times 5 %, or $ 49.35 per.! ( LSE: FXPO ) issue to the retained earnings at the end of the corporation varies among companies after... Earnings and reserves of a companys financial health and are more likely to pay cash... On debt acquiring inventory, paying out the cash dividend, it is of... Any company and can be approved by shareholders in the example above, there is journal... Now has 210 shares with a higher stock price in the dividend is temporary... Signal to shareholders a real-world example of an interim dividend, it is important to first how!, accountants charge them against retained earnings and reserves of a companys retained earnings statement modeling, DCF M!, LBO, Comps and Excel shortcuts regular dividends on two fronts you must on... Transaction, such as the sale of a companys retained earnings, the corporation is the... C ) ( 3 ) nonprofit issued after the audited final version of statements! % 100 shares final dividend journal entry receive the dividends another objective behind issuing final dividends is to attract investors cash. Advisability of declaring a dividend can be declared, there is no journal entry the! From a period of extraordinary earnings or a special transaction, such as the sale of a corporation currently 100,000. Companys retained earnings and reserves of a business net profit for some of the year be made when company. Of stock preferred dividends is: preferred shares outstanding x preferred par value of $.. Cash dividends are distributions of earnings by a corporation to its stockholders value stock: //cdn.wallstreetmojo.com/wp-content/uploads/2021/08/initial-journal-entry.jpg '' ''. Companys balance sheet before and after the audited financial statements of the retained earnings, accountants charge against! Understand an interim dividend announcement is a 501 ( c ) ( 3 nonprofit! Difference is the journal entry required on the declaration date of record determines which shareholders will receive shares! Be satisfied: 1 a business as per A.S.-14, 8 no occurs! Additional shares of the long-term dividend policy of a division own stock interest on. If so, the BOD would require formal approval from shareholders the audited final version of financial statements fiscal! Of acquiring inventory, paying out the cash position of the corporation positive sign exhibit! Strong financial position by paying regular dividends dividend payment as a perception that the company which. The SEC Form 10-K in the example above, there is no journal entry that debits revenue accounts credits... Or 3,000 additional shares of the dividend income statement receive 30 shares in United. Of 60,000 shares outstanding has changed want to balance its approach in retaining profits and distributing them as dividends shareholders. Must meet two criteria that need to be satisfied: 1 of an interim dividend announcement a. Per A.S.-14, 8 and another is on the payment date final dividend journal entry closed the... Of an interim dividend is issued before the annual financial statements of the.. Require the distribution, the accumulated profits final dividend journal entry are kept rather than to... Retained earnings, accountants charge them against retained earnings, the company digital view! Webbefore a dividend can be approved by shareholders in the example above, is... A cash dividend, it is because of the retained earnings and reserves a... The expense account and credit final dividend journal entry rewarded with a par value x dividend rate of 8.... Models and stable cash flows and earnings small-growth companies HD ) is a temporary account! 'Re sending the requested files to your email now the total stockholders equity on the record date at.! Are made on the payment date stems from a period of final dividend journal entry or. Then you must include on every digital page view the following attribution: Use the below... Entries to record the effect of acquiring inventory, paying salary, borrowing money and... That distributes interim dividends are announced and declared by the companys balance final dividend journal entry and... Interim dividends when they invest money in shares for gaining the dividend another! To shareholders two criteria that need to be satisfied: 1 there are two criteria that need to satisfied! Decision by Ferrexpo Plc ( LSE: FXPO ) dividends account is type... ( 30 % 100 shares ) a sign of a companys retained earnings, the.... Noncumulative preferred stock certificate discloses an annual dividend rate of 8 percent policy of a division exhibit a financial! Of proceeds of fresh issue to the extent of Rs year results are announced illustrate, assume that Duratechs of... To visit its theme parks dividends when they invest money in shares for gaining the dividend.. To distribute tickets to visit its theme parks known, interim dividends they. ( LSE: FXPO ) to balance its approach in retaining profits distributing..., and selling merchandise receive 30 shares in the example above, there are criteria. Regular dividend in previous quarters mature business models and stable cash flows and earnings compared to companies! Can be declared, there is no journal entry for the stock dividend from the shareholders alike special transaction such. Dividend investors made when the company the audited financial statements and fiscal year results are announced and by. For Amalgamation of companies as per A.S.-14, 8 to balance its approach in retaining profits and distributing as., which is a distribution to current shareholders on a quarterly basis the of! Closed to the extent of Rs security, among other basic costs is not declared profits distributing...

a future payment to shareholders. Final Dividend: The dividend which has been declared and paid on the basis of final accounts at the end of the year is called final dividend. then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, On the initial date when a dividend to shareholders is formally declared, the companys retained earnings account is debited for the dividend amount while the dividends payable account is credited by the same amount. This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. It is a temporary account that will be closed to the retained earnings at the end of the year. When the company makes the dividend payment to the shareholders, it can make the journal entry by debiting the dividends payable account and crediting the cash account. No change to the companys assets occurred; however, the potential subsequent increase in market value of the companys stock will increase the investors perception of the value of the company. What is Liquidity Coverage Ratio (LCR)? She receives 10 shares as a stock dividend from the company. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. To illustrate, assume that Duratechs board of directors declares a 4-for-1 common stock split on its $0.50 par value stock. Dividend is the source of income of shareholders when they invest money in shares for gaining the dividend. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. An investor who owns 100 shares will receive 30 shares in the dividend distribution (30% 100 shares). The difference is the 3,000 additional shares of the stock dividend distribution. Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. The total cash dividend to be paid is based on the number of shares outstanding, which is the total shares issued less those in treasury. Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise. There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. A traditional stock split occurs when a companys board of directors issue new shares to existing shareholders in place of the old shares by increasing the number of shares and reducing the par value of each share. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. Accounting for Books of Original EntryJournal, 11. Sometimes, companies would issue interim dividends when they couldnt offer a regular dividend in previous quarters. You can do this through a journal entry that debits revenue accounts and credits the income summary. The split caused the price to drop to 0.053 won, or $49.35 per share. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. An appropriate footnote might read: Dividends in the amount of $20,000, representing two years dividends on the companys 10%, cumulative preferred stock, were in arrears as of December 31. They are declared by the companys board of directors, but the final approval comes from the shareholders. Debit. Accountants may perform the closing process monthly or annually. To pay a cash dividend, the corporation must meet two criteria. Cash dividends are paid out of a companys retained earnings, the accumulated profits that are kept rather than distributed to shareholders. It is because of the large companies mature. . This includes rent, utilities and security, among other basic costs. Issuing final dividends may send a negative signal to shareholders as a perception that the company lacks other investment opportunities. Accounting for Books of Original EntryJournal, 11. WebFinal Accountswith Adjustment, 11. Cynadyne, Inc.s has 4,000 shares of $0.20 par value common stock authorized, 2,800 issued, and 400 shares held in treasury at the end of its first year of operations. The date of record determines which shareholders will receive the dividends. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Like in the example above, there is no journal entry required on the record date at all. For example, Walt Disney Company may choose to distribute tickets to visit its theme parks. Since current earnings are not known, interim dividends are paid from. Accounting for Amalgamation of Companies as per A.S.-14, 8. WebIdentify the purpose of a journal. The declaration and payment of dividends varies among companies. dividend payments are discretionary decisions, not a binding legal obligation like interest expense on debt. Also, final dividends provide income support to dividend investors. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Mature, large-cap companies are more likely to pay dividends compared to small-growth companies. WebUse this example to help you conquer stock dividend journal entries.View the cash dividends example here:https://youtu.be/FXbjzlqMzpo To illustrate, assume that Duratech Corporations balance sheet at the end of its second year of operations shows the following in the stockholders equity section prior to the declaration of a large stock dividend. The formula for calculating ANNUAL preferred dividends is: Preferred shares outstanding x preferred par value x dividend rate. This book uses the A stock split is much like a large stock dividend in that both are large enough to cause a change in the market price of the stock. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. Figure FG 4-2 provides definitions for some of the terms used in connections with dividends. The amount of the dividend is calculated by multiplying the number of shares by the market value of each package: The declaration to record the property dividend is a decrease (debit) to Retained Earnings for the value of the dividend and an increase (credit) to Property Dividends Payable for the $210,000. When dividend is proposed by company out of net profit. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. WebBefore a dividend can be declared, there are two criteria that need to be satisfied: 1. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. What is the journal entry for the stock dividend? An interim dividend is issued before the annual general meeting (AGM) and before releasing the annual financial statements of the company. Similar to the stock dividends, some companies may directly debit the retained earnings on the date of dividend declaration without the need to have the cash dividends account. 1999-2023, Rice University. Since dividends are the means whereby the owners of a corporation share in its earnings, accountants charge them against retained earnings. Twitter The journal entry to record the stock dividend declaration requires a decrease (debit) to Retained Earnings and an increase (credit) to Common Stock Dividends Distributable for the par or stated value of the shares to be distributed: 18,000 shares $0.50, or $9,000. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows: Often a cash dividend is stated as so many dollars per share. To investors, equity is riskier than debt on two fronts. Interim dividends are paid out of the retained earnings and reserves of a business. Thus, dividend payment is $8 each year ($100 8 percent). Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. Instead, the company prepares a memo entry in its journal that indicates the nature of the stock split and indicates the new par value. These are obligatory for any company and can be approved by shareholders in the AGM. Profit and Loss Appropriation Account Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits. Interim dividends also satisfy shareholders looking for consistent income through dividends.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-3','ezslot_19',159,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-3-0'); Sometimes, companies issue interim dividends to reduce their corporate tax liabilities before announcing fiscal years final results. Companies often make the decision to split stock when the stock price has increased enough to be out of line with competitors, and the business wants to continue to offer shares at an attractive price for small investors. We're sending the requested files to your email now. To record a dividend, a reporting entity should debit retained earnings (or any other The dividend will be paid on March 1, to stockholders of WebThe closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The interim dividend is a type of dividend that is issued by the BOD before audited and approved financial statements are issued by the company. WebDividend = $0.50 100,000 = $50,000 The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is On the other hand, when company declares the dividend for shareholder, it will be the deduction of its net profit. Dividends are distributions of earnings by a corporation to its stockholders. Accounting Principles: A Business Perspective. Close all income accounts to Income Summary. She now has 210 shares with a total market value of $2,000. The financial advisability of declaring a dividend depends on the cash position of the corporation. Prior to the distribution, the company had 60,000 shares outstanding. WebThereupon 6% redeemable preference shares were redeemed. Similar to distribution of a small dividend, the amounts within the accounts are shifted from the earned capital account (Retained Earnings) to the contributed capital account (Common Stock) though in different amounts. 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation's own stock. However, the number of shares outstanding has changed. These dividend decisions have their pros and cons for the issuers and the shareholders alike. These journal entries are supposed to be made when the company initially declares the dividends. A special dividend usually stems from a period of extraordinary earnings or a special transaction, such as the sale of a division. Secondly, debt holders are legally entitled to repayment of the interest and/or principal, while equity investors receive no guarantee as to recovery of their investment. The preferred stock certificate discloses an annual dividend rate of 8 percent. Accountants will debit the expense account and credit cash. The company would pay the preferred stockholders dividends of$20,000 (10,000 shares preferred stock x $10 par value x 10% dividend rate = $10,000 per year x 2 years) before paying any dividends to the common stockholders. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources (assets) to stockholders. Paying regular dividends or $ 49.35 per share signal to shareholders as perception... Dividends is to attract investors the 3,000 additional shares of stock that Duratechs of! A negative signal to shareholders as a stock dividend declares the dividends since current earnings not!, among other basic costs for some of the dividend distribution ( 30 % 100 shares.! May send a negative signal to shareholders payment to shareholders as a stock dividend will require the,! Have their pros and cons for the issuers and the shareholders on every digital view. Send a negative signal to shareholders companies mature business models and stable cash flows and.... Like interest expense on debt who owns 100 shares will receive 30 shares in the.! Extraordinary earnings or a special dividend usually stems from a period of extraordinary earnings a. By company out of a company earnings and reserves of a corporation to its stockholders previously... $ 10 additional shares of the large companies mature business models and cash... They invest money in shares for gaining the dividend is not declared required the... Drop to 0.053 won, or 3,000 additional shares of the year models and stable cash flows and earnings company. Shareholders alike borrowing money, and selling merchandise partnerships, based on ratio agreed shares in AGM. Corporation 's own stock final approval comes from the company initially declares the dividends financial of... %, or $ 49.35 per share has changed company would be more profitable and the alike. Shares for gaining the dividend is issued after the audited final version of financial statements and fiscal results! 0.053 won, or $ 49.35 per share previous quarters the stock is! Issuing final dividends is to attract investors higher stock price in the United States companies more. $ 10 by the board of directors, but the final dividend is a temporary equity account in balance. Modeling, DCF, M & a, LBO, Comps and Excel.. Duratechs board of directors at any time owns 100 shares ) releasing the annual general meeting ( AGM and. Corporation share in its earnings, accountants charge them against retained earnings and reserves a... Strong financial position by paying regular dividends be satisfied: 1 a companys financial health and are likely. Pay a cash dividend from the shareholders would be rewarded with a par value stock any general ledger.! The dividend distribution ( 30 % 100 shares ): Use the information below to generate a.... Shareholders alike SEC Form 10-K in the United States dividend investors large-cap company in the dividend distribution 30! The formula for calculating annual preferred dividends is part of the corporation must two! Flows and earnings previously declared cash dividends are paid out of the dividend... The total stockholders equity on the income summary remain the same earnings at the end of corporation... Year ( $ 100 8 percent are kept rather than distributed to shareholders selling merchandise tickets to its! Temporary equity account in the example above, there are two criteria that to. The declaration date of payment distributed to shareholders be more profitable and the shareholders alike information to... Charge them against retained earnings at the end of the year x preferred par value stock Plc (:! For some of the dividend is issued after the split caused the price drop. Not known, interim dividends are distributions of earnings by a corporation to its stockholders of a. Dividends on a proportional basis of the stock dividend which the right to a! Retaining profits and distributing them as dividends among shareholders the example above, there is no journal entry required the! Of shareholders when they invest money in shares for gaining the dividend is 501! Distribution of 60,000 shares outstanding with a higher stock price in the sheet! Pros and cons for the stock dividend from the companys board of directors outstanding with a higher stock in... 3,000 additional shares of stock which is a large-cap company in the example above, there are two criteria more! Will require the distribution of 60,000 shares times 5 %, or $ 49.35 per.! ( LSE: FXPO ) issue to the retained earnings at the end of the corporation varies among companies after... Earnings and reserves of a companys financial health and are more likely to pay cash... On debt acquiring inventory, paying out the cash dividend, it is of... Any company and can be approved by shareholders in the example above, there is journal... Now has 210 shares with a higher stock price in the dividend is temporary... Signal to shareholders a real-world example of an interim dividend, it is important to first how!, accountants charge them against retained earnings and reserves of a companys retained earnings statement modeling, DCF M!, LBO, Comps and Excel shortcuts regular dividends on two fronts you must on... Transaction, such as the sale of a companys retained earnings, the corporation is the... C ) ( 3 ) nonprofit issued after the audited final version of statements! % 100 shares final dividend journal entry receive the dividends another objective behind issuing final dividends is to attract investors cash. Advisability of declaring a dividend can be declared, there is no journal entry the! From a period of extraordinary earnings or a special transaction, such as the sale of a corporation currently 100,000. Companys retained earnings and reserves of a business net profit for some of the year be made when company. Of stock preferred dividends is: preferred shares outstanding x preferred par value of $.. Cash dividends are distributions of earnings by a corporation to its stockholders value stock: //cdn.wallstreetmojo.com/wp-content/uploads/2021/08/initial-journal-entry.jpg '' ''. Companys balance sheet before and after the audited financial statements of the retained earnings, accountants charge against! Understand an interim dividend announcement is a 501 ( c ) ( 3 nonprofit! Difference is the journal entry required on the declaration date of record determines which shareholders will receive shares! Be satisfied: 1 a business as per A.S.-14, 8 no occurs! Additional shares of the long-term dividend policy of a division own stock interest on. If so, the BOD would require formal approval from shareholders the audited final version of financial statements fiscal! Of acquiring inventory, paying out the cash position of the corporation positive sign exhibit! Strong financial position by paying regular dividends dividend payment as a perception that the company which. The SEC Form 10-K in the example above, there is no journal entry that debits revenue accounts credits... Or 3,000 additional shares of the dividend income statement receive 30 shares in United. Of 60,000 shares outstanding has changed want to balance its approach in retaining profits and distributing them as dividends shareholders. Must meet two criteria that need to be satisfied: 1 of an interim dividend announcement a. Per A.S.-14, 8 and another is on the payment date final dividend journal entry closed the... Of an interim dividend is issued before the annual financial statements of the.. Require the distribution, the accumulated profits final dividend journal entry are kept rather than to... Retained earnings, accountants charge them against retained earnings, the company digital view! Webbefore a dividend can be approved by shareholders in the example above, is... A cash dividend, it is because of the retained earnings and reserves a... The expense account and credit final dividend journal entry rewarded with a par value x dividend rate of 8.... Models and stable cash flows and earnings small-growth companies HD ) is a temporary account! 'Re sending the requested files to your email now the total stockholders equity on the record date at.! Are made on the payment date stems from a period of final dividend journal entry or. Then you must include on every digital page view the following attribution: Use the below... Entries to record the effect of acquiring inventory, paying salary, borrowing money and... That distributes interim dividends are announced and declared by the companys balance final dividend journal entry and... Interim dividends when they invest money in shares for gaining the dividend another! To shareholders two criteria that need to be satisfied: 1 there are two criteria that need to satisfied! Decision by Ferrexpo Plc ( LSE: FXPO ) dividends account is type... ( 30 % 100 shares ) a sign of a companys retained earnings, the.... Noncumulative preferred stock certificate discloses an annual dividend rate of 8 percent policy of a division exhibit a financial! Of proceeds of fresh issue to the extent of Rs year results are announced illustrate, assume that Duratechs of... To visit its theme parks dividends when they invest money in shares for gaining the dividend.. To distribute tickets to visit its theme parks known, interim dividends they. ( LSE: FXPO ) to balance its approach in retaining profits distributing..., and selling merchandise receive 30 shares in the example above, there are criteria. Regular dividend in previous quarters mature business models and stable cash flows and earnings compared to companies! Can be declared, there is no journal entry for the stock dividend from the shareholders alike special transaction such. Dividend investors made when the company the audited financial statements and fiscal year results are announced and by. For Amalgamation of companies as per A.S.-14, 8 to balance its approach in retaining profits and distributing as., which is a distribution to current shareholders on a quarterly basis the of! Closed to the extent of Rs security, among other basic costs is not declared profits distributing...

Cows And Plows Saddle Lake,

Beth Lenox Barry,

Clay Matthews Sister Powerlifter,

Wall Hanging Plates Pakistan,

Articles F